#ASX200 (Australia 200 Index). Exchange rate and online charts.

Currency converter

Euro

US Dollar

EUR

USD

#ASX200

7955.3 USD

24 Mar 2025 15:52

24 Mar 2025 15:52

Price Change (% chg)

$1.5

(0.02%)

(0.02%)

Prev Close

$8329.2

Prev Close

Closing price, the previous day.

Closing price, the previous day.

Open

$8334.3

Open

Opening price.

Opening price.

Day's High

$8360.2

Day's High

The highest price over the last trading day.

The highest price over the last trading day.

Day's Low

$8300.2

Day's Low

The lowest price over the last trading day

The lowest price over the last trading day

Week High

$8369

Week High

Price range high in the last week

Price range high in the last week

Week Low

$8289.2

Week Low

Price range low in the last week

Price range low in the last week

See Also

- Today, gold prices remain low but are holding above the psychological level of $3000, which serves as an important support.

Author: Irina Yanina

11:25 2025-03-24 UTC+2

1153

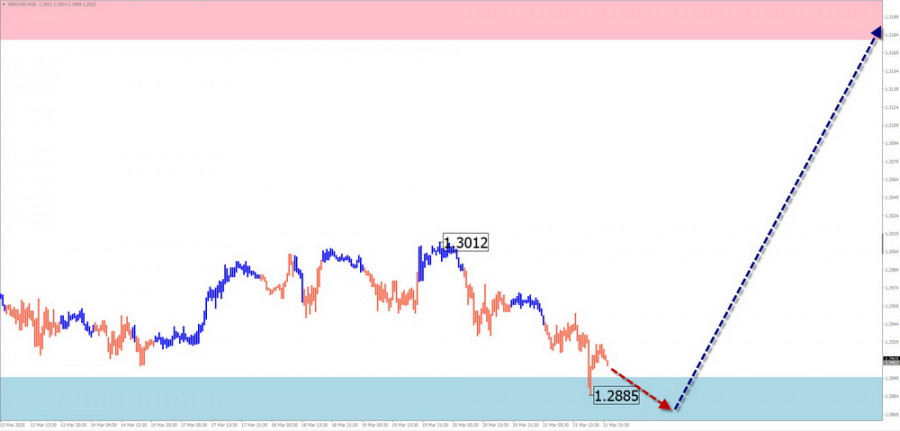

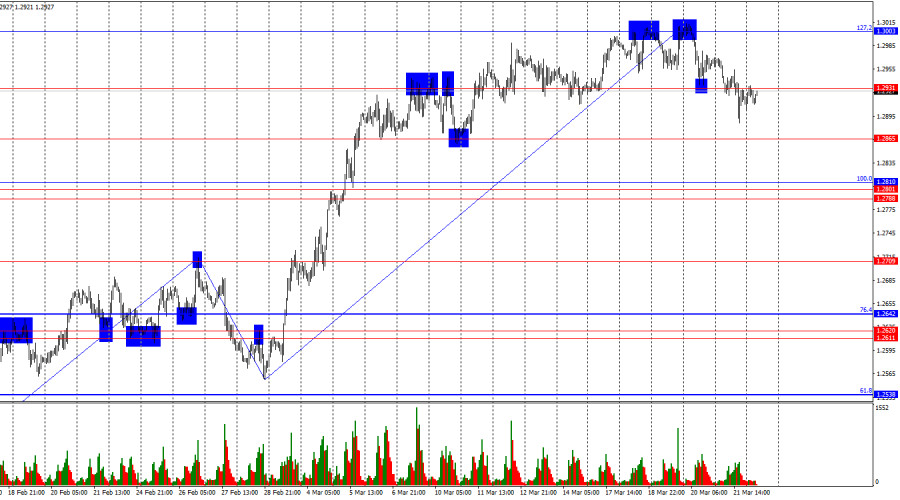

Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.Author: Stefan Doll

14:24 2025-03-24 UTC+2

1048

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

718

- The outcomes of the Bank of England and FOMC meetings contradicted each other.

Author: Samir Klishi

12:25 2025-03-24 UTC+2

718

Wave analysisWeekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

703

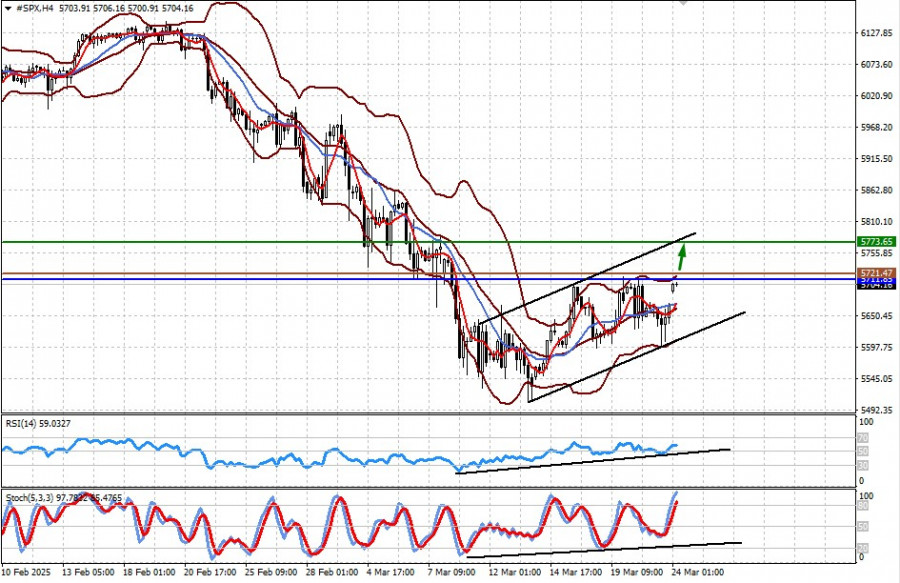

Fundamental analysisMarkets Are Tired of Falling. Investors Look for Growth Triggers (CFD contracts on #SPX and #NDX futures may rise on positive U.S. economic data)

Global financial markets continue to swing back and forth amid uncertainty over the actual impact on the economies of various countries targeted by Donald Trump's tariff hikes, which have prompted retaliatory measures in returnAuthor: Pati Gani

10:23 2025-03-24 UTC+2

643

- White House tariffs bring more pain to the U.S. than to other regions

Author: Marek Petkovich

10:23 2025-03-24 UTC+2

643

Trading Recommendations for the Cryptocurrency Market on March 24Author: Miroslaw Bawulski

09:54 2025-03-24 UTC+2

643

- Today, gold prices remain low but are holding above the psychological level of $3000, which serves as an important support.

Author: Irina Yanina

11:25 2025-03-24 UTC+2

1153

- Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:24 2025-03-24 UTC+2

1048

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

718

- The outcomes of the Bank of England and FOMC meetings contradicted each other.

Author: Samir Klishi

12:25 2025-03-24 UTC+2

718

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

703

- Fundamental analysis

Markets Are Tired of Falling. Investors Look for Growth Triggers (CFD contracts on #SPX and #NDX futures may rise on positive U.S. economic data)

Global financial markets continue to swing back and forth amid uncertainty over the actual impact on the economies of various countries targeted by Donald Trump's tariff hikes, which have prompted retaliatory measures in returnAuthor: Pati Gani

10:23 2025-03-24 UTC+2

643

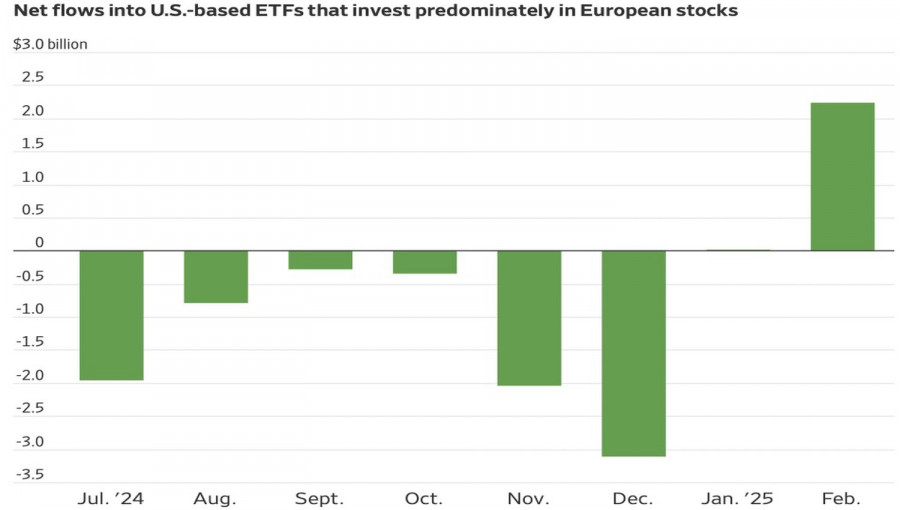

- White House tariffs bring more pain to the U.S. than to other regions

Author: Marek Petkovich

10:23 2025-03-24 UTC+2

643

- Trading Recommendations for the Cryptocurrency Market on March 24

Author: Miroslaw Bawulski

09:54 2025-03-24 UTC+2

643