AUDCAD (Australian Dollar vs Canadian Dollar). Exchange rate and online charts.

Currency converter

11 Apr 2025 05:20

(-0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The AUD/CAD currency pair is very sensitive to changes in the U.S. dollar exchange rate.

The Australian dollar is the sixth most traded currency in the world. It accounts for 5% of the global forex trades. A high interest rate in Australia, the forex market being relatively free of government interventions, and the stable Australian economy as well as political system as a whole – all of these trigger great interest of currency investors in the Aussie.

Australia is an exporter of natural resources, agricultural products, and energy. That is why its economy extremely depends on natural resources. The Canadian dollar is the major commodity currency around the globe, which is always affected by crude oil prices, ferrous and non-ferrous metallurgy, and coal industry.

However, the main factor is oil, which is quite positive, as crude oil prices are easier to predict.

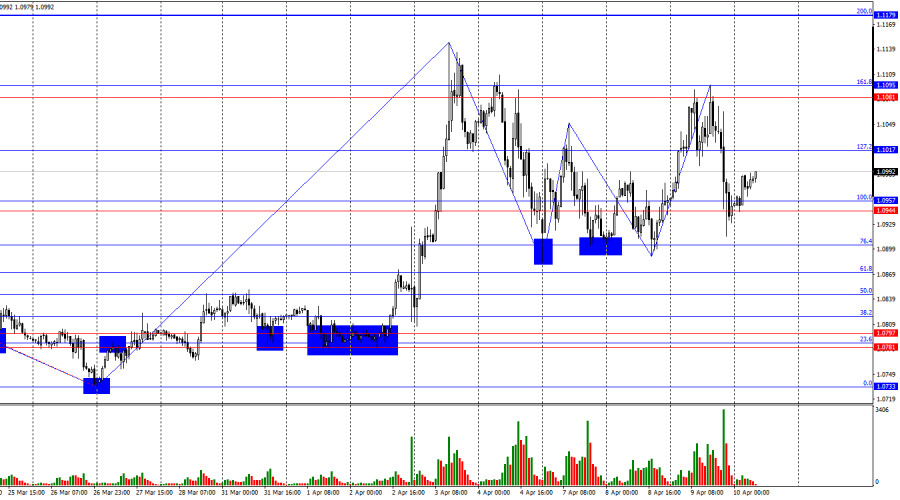

Since both the Australian and Canadian economies are export-oriented, the AUD/CAD exchange rate is linked to the units of the U.K., EU, and Japan. Such forex trading tools as EUR/USD, GBP/USD, and USD/JPY may be used as trading indicators.

The Australian dollar is directly correlated with gold, and the Canadian unit, in turn, is closely correlated with crude oil. Consequently, the dynamic of AUD/CAD is strongly influenced by gold and oil prices.

See Also

- Markets remain in shock because of Trump

Author: Samir Klishi

12:19 2025-04-10 UTC+2

838

Technical analysisTrading Signals for GOLD (XAU/USD) for April 10-12, 2025: sell below $3,145 (21 SMA - 8/8 Murray)

The Eagle indicator is reaching oversold levels and is giving a negative signal, so we will look for opportunities to sell below 3,145 or below 3,131 with a target at 3,036.Author: Dimitrios Zappas

15:37 2025-04-10 UTC+2

763

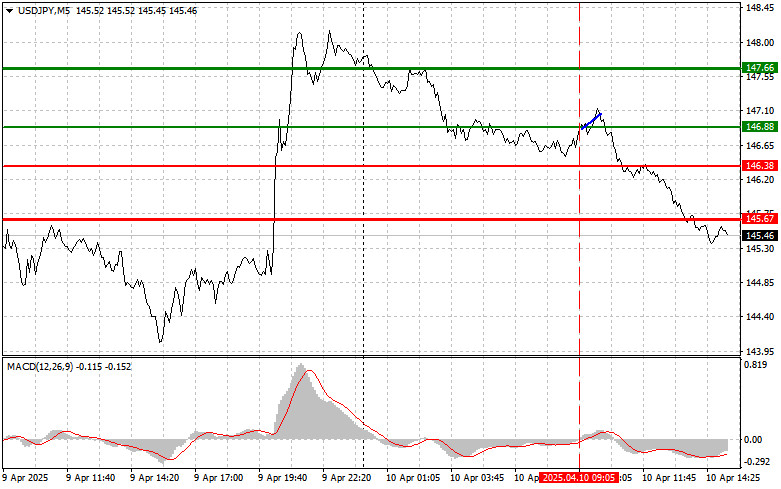

USDJPY: Simple Trading Tips for Beginner Traders – April 10th (U.S. Session)Author: Jakub Novak

20:19 2025-04-10 UTC+2

733

- China Plans Emergency Meeting and a Strong Response to the U.S.

Author: Jakub Novak

12:07 2025-04-10 UTC+2

718

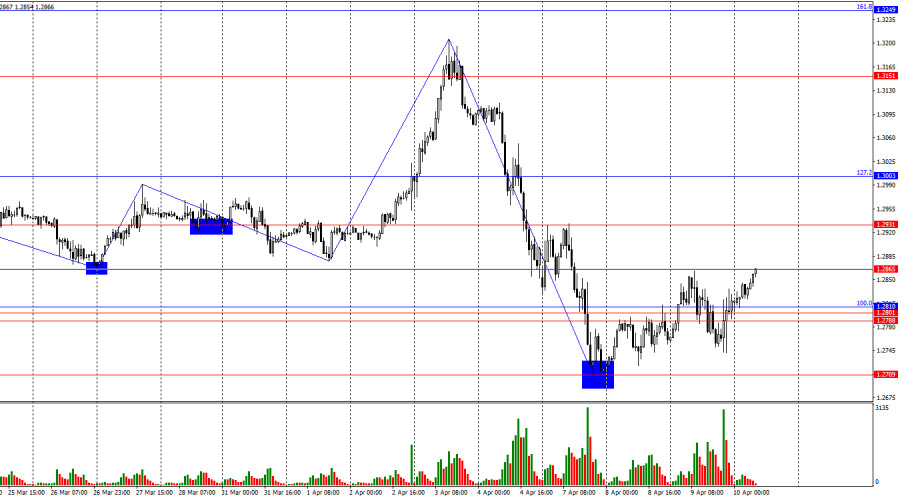

Forecast for GBP/USD on April 10, 2025Author: Samir Klishi

12:12 2025-04-10 UTC+2

718

The flagship cryptocurrency remains in a fragmented state, unable to establish a firm footing.Author: Larisa Kolesnikova

14:38 2025-04-10 UTC+2

718

- U.S. Inflation Data: What to Know and What to Expect

Author: Jakub Novak

12:09 2025-04-10 UTC+2

703

Today, gold maintains a positive tone, trading above the $3100 level.Author: Irina Yanina

20:05 2025-04-10 UTC+2

688

S&P 500 posts historic rally, but 5,669 remains key barrier. Temporary tariff suspension fuels gains: S&P 500 and Nasdaq close higherAuthor: Irina Maksimova

12:58 2025-04-10 UTC+2

673

- Markets remain in shock because of Trump

Author: Samir Klishi

12:19 2025-04-10 UTC+2

838

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 10-12, 2025: sell below $3,145 (21 SMA - 8/8 Murray)

The Eagle indicator is reaching oversold levels and is giving a negative signal, so we will look for opportunities to sell below 3,145 or below 3,131 with a target at 3,036.Author: Dimitrios Zappas

15:37 2025-04-10 UTC+2

763

- USDJPY: Simple Trading Tips for Beginner Traders – April 10th (U.S. Session)

Author: Jakub Novak

20:19 2025-04-10 UTC+2

733

- China Plans Emergency Meeting and a Strong Response to the U.S.

Author: Jakub Novak

12:07 2025-04-10 UTC+2

718

- Forecast for GBP/USD on April 10, 2025

Author: Samir Klishi

12:12 2025-04-10 UTC+2

718

- The flagship cryptocurrency remains in a fragmented state, unable to establish a firm footing.

Author: Larisa Kolesnikova

14:38 2025-04-10 UTC+2

718

- U.S. Inflation Data: What to Know and What to Expect

Author: Jakub Novak

12:09 2025-04-10 UTC+2

703

- Today, gold maintains a positive tone, trading above the $3100 level.

Author: Irina Yanina

20:05 2025-04-10 UTC+2

688

- S&P 500 posts historic rally, but 5,669 remains key barrier. Temporary tariff suspension fuels gains: S&P 500 and Nasdaq close higher

Author: Irina Maksimova

12:58 2025-04-10 UTC+2

673