AUDNZD (Australian Dollar vs New Zealand Dollar). Exchange rate and online charts.

Currency converter

11 Apr 2025 05:20

(-0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

AUD/NZD is a cross rate of the Australian dollar to the New Zealand dollar that has a high liquidity.

Australia and New Zealand have tight economic interrelation and are situated rather close to each other. That is why the AUD/NZD pair is sought-after by many traders. The most intense trade between these currencies happens during the Asian session.

When trading the AUD/NZD currency pair, a market participant has to take into account lots of economic factors of New Zealand such us GDP level, business activities, trading volume with other countries, discount rate, and other. It is crucial to remember that the New Zealand economy highly depends on exports of wool and its products. Moreover, the country’s economy is influenced by the United States, Australia and Asia-Pacific countries because they are the main partners of New Zealand. So, one should also allow for their economic indicators while trading AUD/NZD.

In order to forecast the price movement of this financial instrument correctly, it is important to consider the influence of the US dollar on each of the currencies of the pair. Therefore, you should keep in mind main US economic indicators that are GDP level, unemployment rate, interest rates and number of new vacancies.

See Also

- Markets remain in shock because of Trump

Author: Samir Klishi

12:19 2025-04-10 UTC+2

838

Technical analysisTrading Signals for GOLD (XAU/USD) for April 10-12, 2025: sell below $3,145 (21 SMA - 8/8 Murray)

The Eagle indicator is reaching oversold levels and is giving a negative signal, so we will look for opportunities to sell below 3,145 or below 3,131 with a target at 3,036.Author: Dimitrios Zappas

15:37 2025-04-10 UTC+2

763

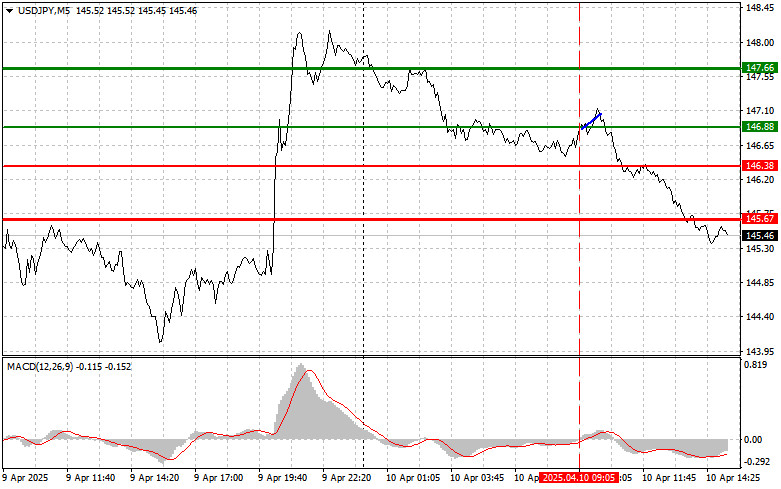

USDJPY: Simple Trading Tips for Beginner Traders – April 10th (U.S. Session)Author: Jakub Novak

20:19 2025-04-10 UTC+2

733

- China Plans Emergency Meeting and a Strong Response to the U.S.

Author: Jakub Novak

12:07 2025-04-10 UTC+2

718

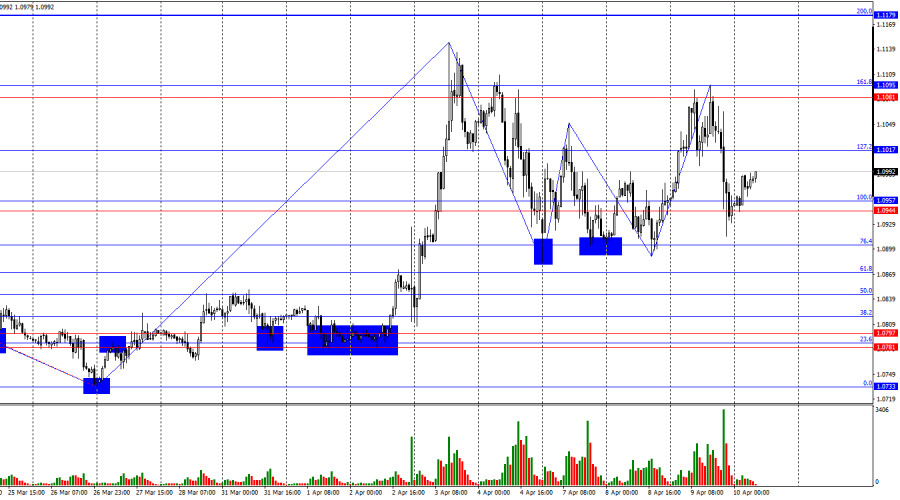

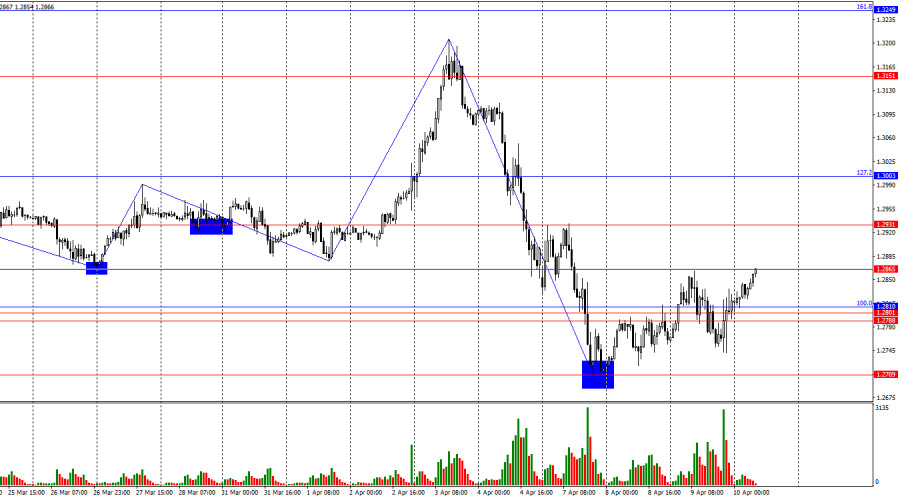

Forecast for GBP/USD on April 10, 2025Author: Samir Klishi

12:12 2025-04-10 UTC+2

718

The flagship cryptocurrency remains in a fragmented state, unable to establish a firm footing.Author: Larisa Kolesnikova

14:38 2025-04-10 UTC+2

718

- U.S. Inflation Data: What to Know and What to Expect

Author: Jakub Novak

12:09 2025-04-10 UTC+2

703

Today, gold maintains a positive tone, trading above the $3100 level.Author: Irina Yanina

20:05 2025-04-10 UTC+2

688

S&P 500 posts historic rally, but 5,669 remains key barrier. Temporary tariff suspension fuels gains: S&P 500 and Nasdaq close higherAuthor: Irina Maksimova

12:58 2025-04-10 UTC+2

673

- Markets remain in shock because of Trump

Author: Samir Klishi

12:19 2025-04-10 UTC+2

838

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 10-12, 2025: sell below $3,145 (21 SMA - 8/8 Murray)

The Eagle indicator is reaching oversold levels and is giving a negative signal, so we will look for opportunities to sell below 3,145 or below 3,131 with a target at 3,036.Author: Dimitrios Zappas

15:37 2025-04-10 UTC+2

763

- USDJPY: Simple Trading Tips for Beginner Traders – April 10th (U.S. Session)

Author: Jakub Novak

20:19 2025-04-10 UTC+2

733

- China Plans Emergency Meeting and a Strong Response to the U.S.

Author: Jakub Novak

12:07 2025-04-10 UTC+2

718

- Forecast for GBP/USD on April 10, 2025

Author: Samir Klishi

12:12 2025-04-10 UTC+2

718

- The flagship cryptocurrency remains in a fragmented state, unable to establish a firm footing.

Author: Larisa Kolesnikova

14:38 2025-04-10 UTC+2

718

- U.S. Inflation Data: What to Know and What to Expect

Author: Jakub Novak

12:09 2025-04-10 UTC+2

703

- Today, gold maintains a positive tone, trading above the $3100 level.

Author: Irina Yanina

20:05 2025-04-10 UTC+2

688

- S&P 500 posts historic rally, but 5,669 remains key barrier. Temporary tariff suspension fuels gains: S&P 500 and Nasdaq close higher

Author: Irina Maksimova

12:58 2025-04-10 UTC+2

673