CADDKK (Canadian Dollar vs Danish Krone). Exchange rate and online charts.

Currency converter

24 Mar 2025 16:00

(0.02%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The CAD/DKK currency pair is not really popular among the traders of Forex market. This pair is the cross rate against the U.S. dollar. Although there is no U.S. Dollar in this currency pair, the CAD/DKK pair is under considerable influence of it. To make it clear, just combine two charts (CAD/USD and USD/DKK) in the same price chart and you will get an approximate the CAD/DKK chart.

The U.S. dollar affects both currencies deeply. That is why for better forecasting the future CAD/DKK rate, it is necessary to pay attention to the main economic indicators of the U.S. There are some indicators such as the interest rate, GDP, unemployment, new workplaces indicator and many others. These two currencies can react differently to the U.S. economy changes.

The world oil prices have a great influence on the Canadian dollar. As you know, Canada has the status of one of the largest world exporters of oil. So when the oil price is getting higher, the Canadian dollar value is also increasing, and vice versa. The fact speaks for itself: the CAD/DKK currency pair is directly dependent on the world oil prices.

Denmark is known as prosperous country with developed industrial and agricultural sectors. Its economic indicators are one of the highest in the world. Despite of the Danish large oil and gas reserves (in Jutland and in the North Sea), it is still dependent on export of other mineral resources. Denmark has stable economic and trade relationships with all the developed countries, mostly with the EU ones. They lead the active trade in machinery, electronics, agriculture, mining, etc.

That fact that the economy of Denmark is one of the strongest in the world allows the Danish krone to be stable in pairs with other major currencies on Forex market. There are some factors strengthening the Denmark economy such as low inflation and unemployment rates, large oil and gas reserves, high technology and highly qualified specialists in economic fields.

The economy of Denmark has one of the highest levels, but there are still some factors that make it weaker, such as high taxes and deterioration of the competitiveness on the world market. Traders working with this currency pair should take into account some economic indicators like prices for oil and for other minerals that can influence Denmark production.

Keep in mind that the spread for cross currency pairs can be higher than for popular ones. So before you start dealing with the cross rates, learn carefully broker’s conditions of trading with specified trade instrument.

See Also

- Today, gold prices remain low but are holding above the psychological level of $3000, which serves as an important support.

Author: Irina Yanina

11:25 2025-03-24 UTC+2

1153

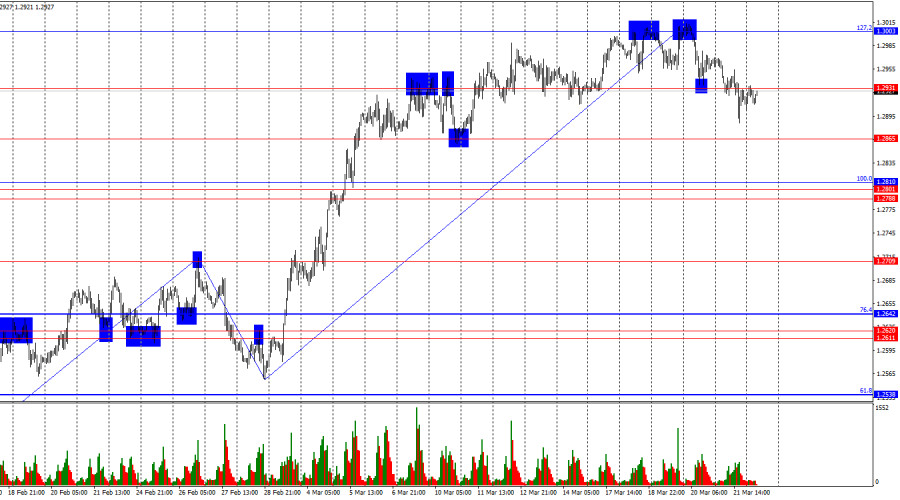

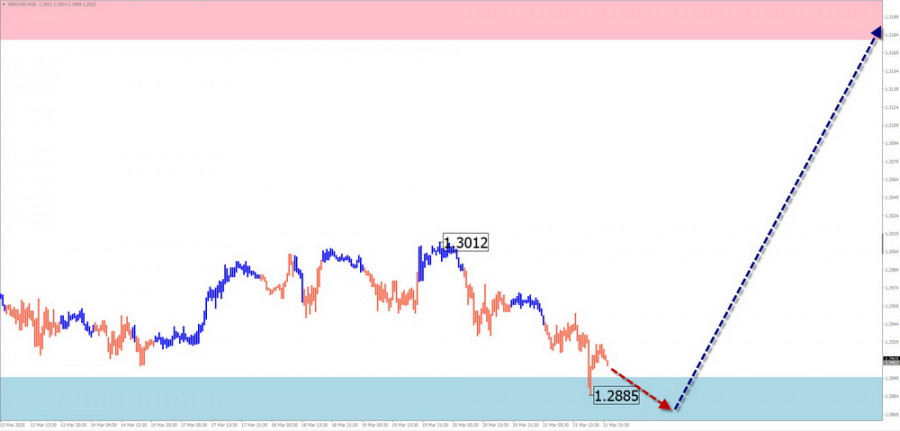

Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.Author: Stefan Doll

14:24 2025-03-24 UTC+2

1048

The outcomes of the Bank of England and FOMC meetings contradicted each other.Author: Samir Klishi

12:25 2025-03-24 UTC+2

718

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

718

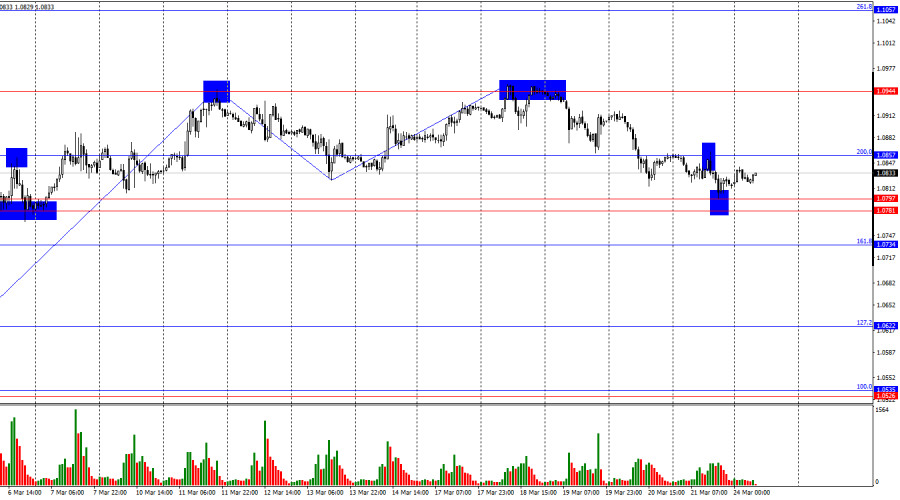

Wave analysisWeekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

718

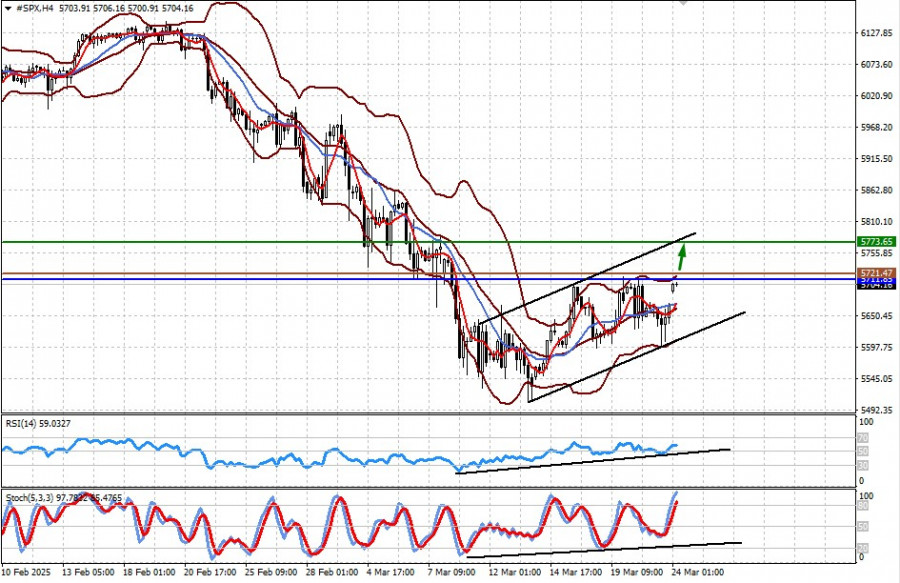

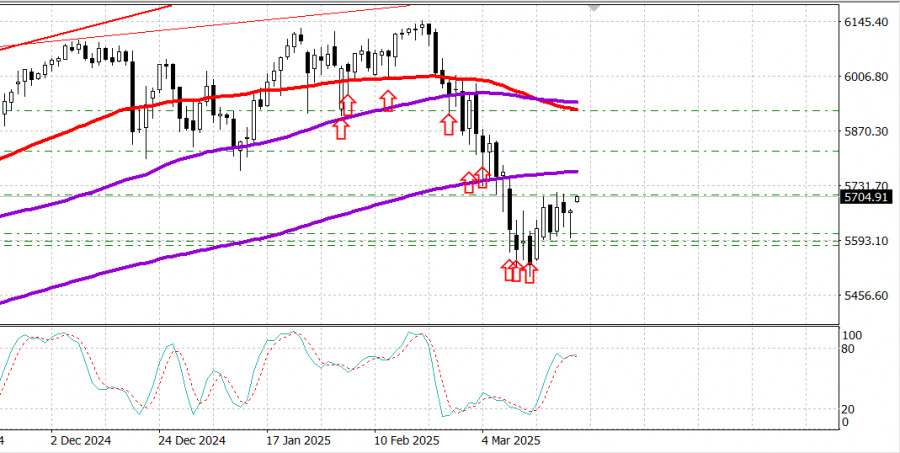

Fundamental analysisMarkets Are Tired of Falling. Investors Look for Growth Triggers (CFD contracts on #SPX and #NDX futures may rise on positive U.S. economic data)

Global financial markets continue to swing back and forth amid uncertainty over the actual impact on the economies of various countries targeted by Donald Trump's tariff hikes, which have prompted retaliatory measures in returnAuthor: Pati Gani

10:23 2025-03-24 UTC+2

643

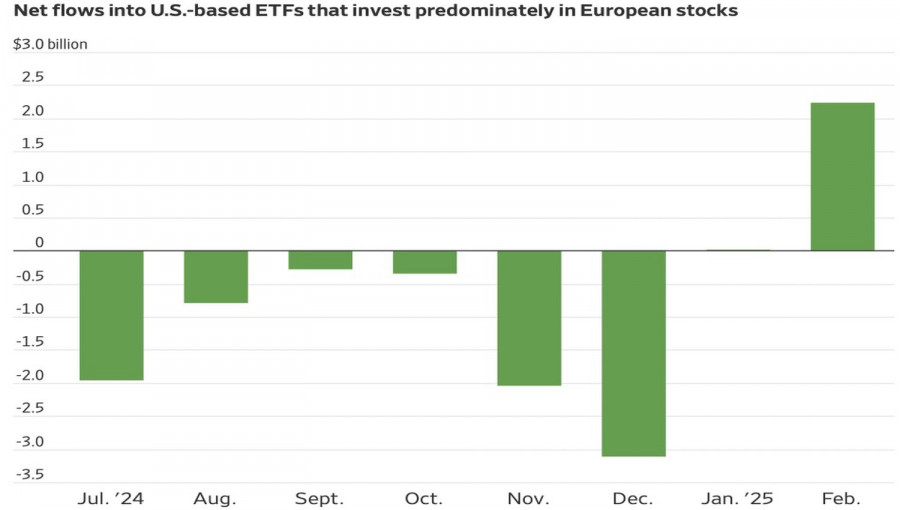

- White House tariffs bring more pain to the U.S. than to other regions

Author: Marek Petkovich

10:23 2025-03-24 UTC+2

643

The bulls attacked for two weeks, but now it's time for a pause.Author: Samir Klishi

13:55 2025-03-24 UTC+2

628

- Today, gold prices remain low but are holding above the psychological level of $3000, which serves as an important support.

Author: Irina Yanina

11:25 2025-03-24 UTC+2

1153

- Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:24 2025-03-24 UTC+2

1048

- The outcomes of the Bank of England and FOMC meetings contradicted each other.

Author: Samir Klishi

12:25 2025-03-24 UTC+2

718

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

718

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

718

- Fundamental analysis

Markets Are Tired of Falling. Investors Look for Growth Triggers (CFD contracts on #SPX and #NDX futures may rise on positive U.S. economic data)

Global financial markets continue to swing back and forth amid uncertainty over the actual impact on the economies of various countries targeted by Donald Trump's tariff hikes, which have prompted retaliatory measures in returnAuthor: Pati Gani

10:23 2025-03-24 UTC+2

643

- White House tariffs bring more pain to the U.S. than to other regions

Author: Marek Petkovich

10:23 2025-03-24 UTC+2

643

- The bulls attacked for two weeks, but now it's time for a pause.

Author: Samir Klishi

13:55 2025-03-24 UTC+2

628