CADHUF (Canadian Dollar vs Hungarian Forint). Exchange rate and online charts.

Currency converter

24 Mar 2025 16:00

(-0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The CAD/HUF pair is quite popular among some Forex traders. This trading instrument is a cross rate against the US dollar, which has a significant impact on the pair. So, when comparing the CAD/USD and USD/HUF charts, we can get an almost clear picture of CAD/HUF movements.

Features of CAD/HUF

The Canadian dollar is highly correlated with global oil prices. Canada is one of the largest oil-exporting countries. For this reason, the Canadian dollar strengthens when the value of the commodity rises and weakens when oil falls. Therefore, the CAD/HUF pair is dependent on the world price of this fuel.

Although Hungary is part of the European Union, it has its own national currency, the forint.

The Hungarian economy depends strongly on the organizations and countries that do business in its territory. The state is characterized by a high share of foreign capital in the economy.

A large part of Hungary's income is generated by tourism. In addition, such sectors of the economy as engineering, metallurgy, chemical industry, and agriculture are also flourishing in the country. Most of the production is exported abroad. Hungary's main trading partners are the EU countries and Russia. Therefore, when assessing the future exchange rate of the Hungarian forint, special attention should be paid to the economic indicators of these regions.

How to trade CAD/HUF

When trading cross rates, remember that brokers usually set a higher spread on such pairs than on more popular currency pairs. Therefore, before starting to work with cross-rate pairs, you should carefully study the trading conditions of the broker.

The CAD/HUF pair is a cross rate. Therefore, the US dollar has a significant impact on each of the currencies in this trading instrument. For this reason, when predicting the movement of the pair, it is necessary to take into account the major US economic indicators. These include the refinancing rate, GDP growth, unemployment, number of new jobs, and many others. Notably, the currencies mentioned above may react differently to changes taking place in the US economy. Therefore, CAD/HUF could be an indicator of fluctuations in these currencies.

See Also

- Today, gold prices remain low but are holding above the psychological level of $3000, which serves as an important support.

Author: Irina Yanina

11:25 2025-03-24 UTC+2

1153

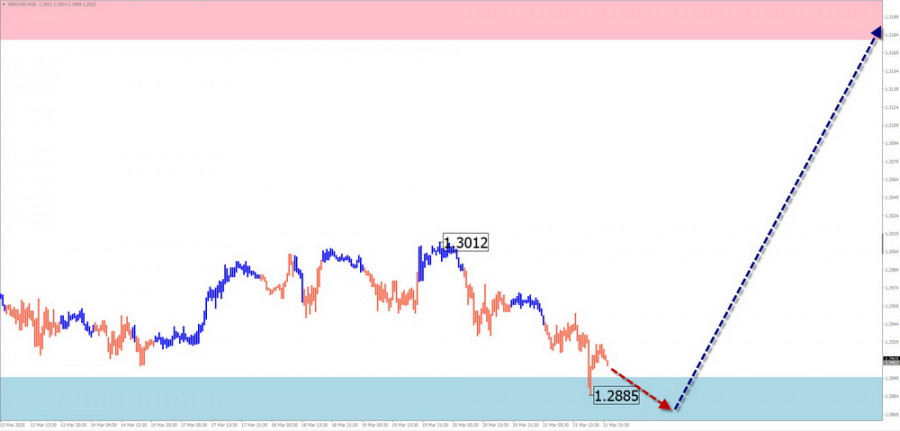

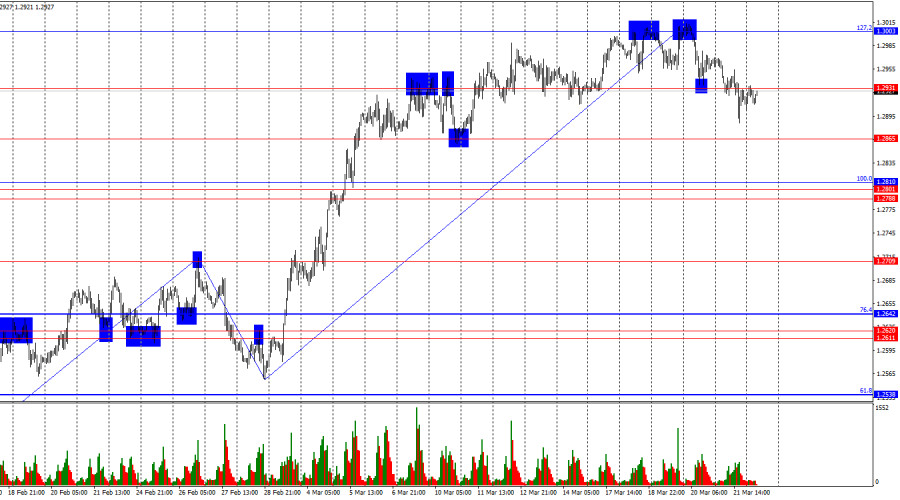

Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.Author: Stefan Doll

14:24 2025-03-24 UTC+2

1048

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

718

- The outcomes of the Bank of England and FOMC meetings contradicted each other.

Author: Samir Klishi

12:25 2025-03-24 UTC+2

718

Wave analysisWeekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

703

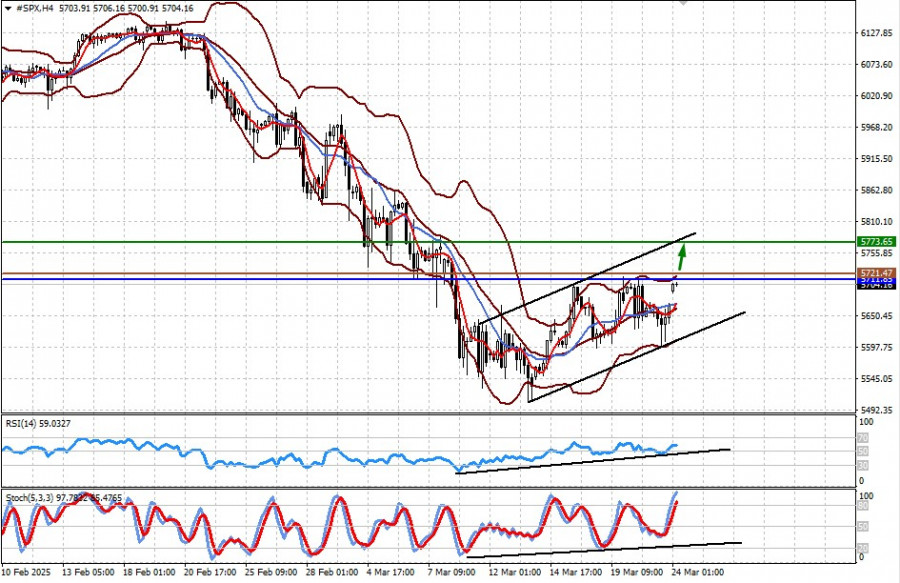

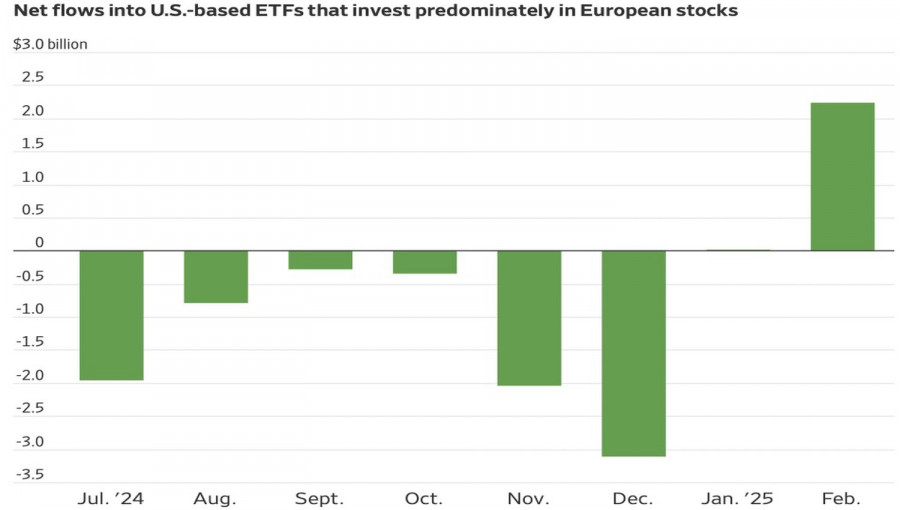

Fundamental analysisMarkets Are Tired of Falling. Investors Look for Growth Triggers (CFD contracts on #SPX and #NDX futures may rise on positive U.S. economic data)

Global financial markets continue to swing back and forth amid uncertainty over the actual impact on the economies of various countries targeted by Donald Trump's tariff hikes, which have prompted retaliatory measures in returnAuthor: Pati Gani

10:23 2025-03-24 UTC+2

643

- White House tariffs bring more pain to the U.S. than to other regions

Author: Marek Petkovich

10:23 2025-03-24 UTC+2

643

Trading Recommendations for the Cryptocurrency Market on March 24Author: Miroslaw Bawulski

09:54 2025-03-24 UTC+2

643

- Today, gold prices remain low but are holding above the psychological level of $3000, which serves as an important support.

Author: Irina Yanina

11:25 2025-03-24 UTC+2

1153

- Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:24 2025-03-24 UTC+2

1048

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

718

- The outcomes of the Bank of England and FOMC meetings contradicted each other.

Author: Samir Klishi

12:25 2025-03-24 UTC+2

718

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

703

- Fundamental analysis

Markets Are Tired of Falling. Investors Look for Growth Triggers (CFD contracts on #SPX and #NDX futures may rise on positive U.S. economic data)

Global financial markets continue to swing back and forth amid uncertainty over the actual impact on the economies of various countries targeted by Donald Trump's tariff hikes, which have prompted retaliatory measures in returnAuthor: Pati Gani

10:23 2025-03-24 UTC+2

643

- White House tariffs bring more pain to the U.S. than to other regions

Author: Marek Petkovich

10:23 2025-03-24 UTC+2

643

- Trading Recommendations for the Cryptocurrency Market on March 24

Author: Miroslaw Bawulski

09:54 2025-03-24 UTC+2

643