12.03.2025 01:35 PM

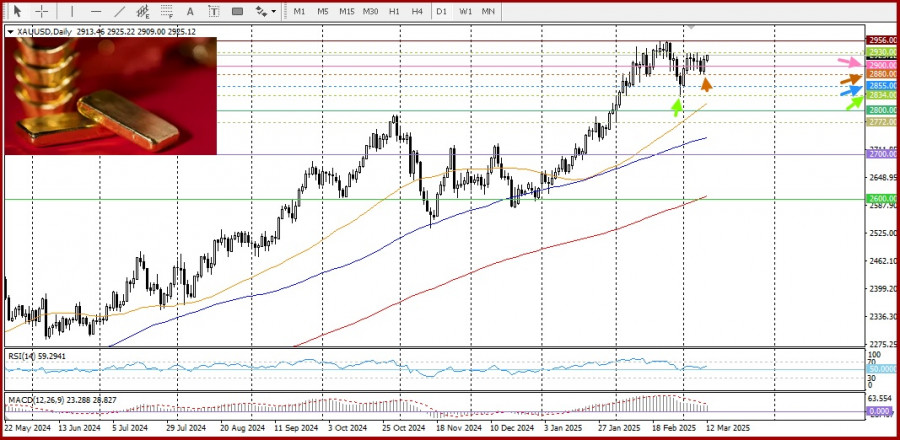

12.03.2025 01:35 PM黃金繼續橫向波動,處於盤整階段,交易員在等待美國消費者通脹數據,該數據預計將於今日稍晚的北美時段發布。這份報告可能對聯邦儲備局的未來政策產生重大影響,並因此影響美元需求。如果通脹超出預期,可能會為XAU/USD帶來新的看漲推動力。

美國美元指數在關鍵經濟數據發布前暫時穩定,而全球股票市場的廣泛情緒也影響了黃金的價格走勢。股市的正面變化正給黃金帶來壓力,但對關稅及其對全球經濟影響的持續擔憂,仍然支持其避險吸引力。此外,對聯儲局降息的預期也幫助黃金維持在高位附近。

對於多頭而言,突破2928–2930美元的水平是確認進一步上行的必要條件。如果出現這種情況,黃金可能會再次測試其在二月份達到的歷史高點2956美元。持續突破這一水平將引發更多的買盤動能,尤其是在日線圖上的正面振盪指標暗示上升趨勢的延續。

另一方面,跌破心理關口2900美元可能會導致初步支撐在2880美元或上周低點附近。跌破2855美元可能引發更深的拋售壓力,向2834–2832美元區域下滑,而最壞的情況是跌至關鍵的2800美元水平。

當1.3322的價格測試發生時,MACD指標已經顯著地移動到零線之上,這限制了該貨幣對的上行潛力。因此,我沒有買入英鎊。

日元交易分析與策略提示 第一次測試142.66的水平時,MACD指標已經顯著跌破零線,這限制了該貨幣對的下行潛力。因此,我選擇不賣出美元。

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.