CHFPLN (Swiss Franc vs Polish Zloty). Exchange rate and online charts.

Currency converter

25 Mar 2025 15:22

(-0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

CHF/PLN is not very popular currency pair on the Forex market. It the cross currency pair as it does not include the U.S. dollar. However, the U.S. currency has a significant influence on it. This can be seen if you combine two price charts: the USD/CHF and USD/PLN. Thus, you can get an approximate CHF/PLN chart.

The U.S. dollar has a significant influence on both currencies. So, a CHF/PLN trader should take into account the major U.S. economic indicators in order to make a correct prediction of a future trend of this financial asset. The indicators which are important to keep track of: the Federal Reserve discount rate, GDP, unemployment rate, new jobs, etc. It is also worth noting that the currencies comprising the pair can respond at a different rate on changes in the U.S. economy. Therefore, the CHF/PLN may be considered as a specific indicator reflecting changes of these currencies.

The Swiss economy remains strong for several centuries. For this reason, its national currency enjoys a great confidence all over the world as one of the most reliable and stable currencies. The Swiss franc is also a safe haven for capital investment during the crisis. Therefore, in times of crisis, when capital is urgently forwarded to Switzerland, the Swiss franc rises sharply against other currencies. This feature of Swiss economy should be taken into account when you trade this financial asset.

Poland plans to introduce the euro in the near future. At the same time, many of the domestic problems (the budget deficit, high public debt, etc.), as well as the global economic crisis prevented Poland from adopting the single European currency in the planned terms. The European Central Bank proposed to the country strict conditions to euro adoption. However, Poland will introduce the euro until 2014, having met all requirements.

Poland is a developed industrial country with high living standards. The main economic sectors are engineering, metallurgy, chemical and coal industry. Poland has robust automotive industry and shipbuilding yards on the Baltic Sea. The country is rich in mineral resources: coal, copper, lead, natural gas, etc. Due to the large number of hydrocarbons, Poland's economy is able to cover most of its electricity needs. International sovereign credit rating, the state of the leading sectors of the economy of Poland and the European Union are considered to be the factors that have a significant influence on the rate of the national currency.

This trading instrument is relatively illiquid compared with major currency pairs such as the EUR/USD, USD/CHF, GBP/USD, and USD/JPY. Therefore, when you forecast its further movement, you should primarily focus on the pairs with the Swiss franc and Polish zloty quoted against the U.S. dollar.

If you trade cross rates, it is necessary to remember that brokers usually set a higher spread for crosses than for more popular currency pairs, so you should carefully read the conditions the broker offers for trading this type of currency pairs.

See Also

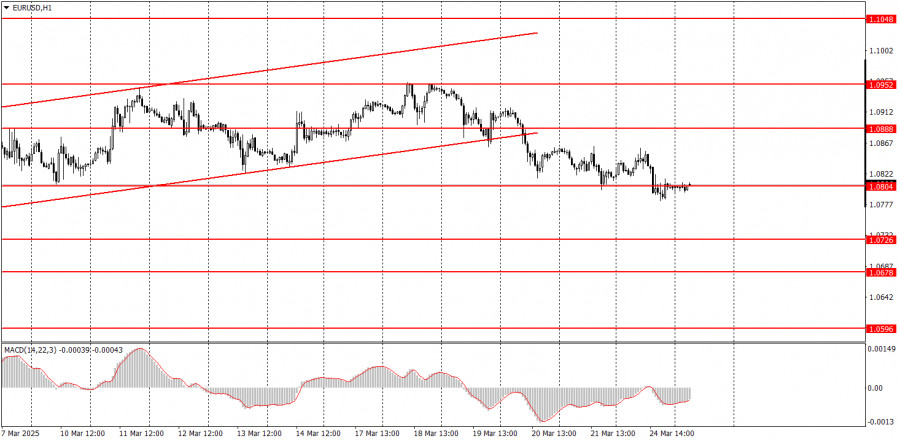

- The Euro is Searching for a Foothold for Reversal

Author: Laurie Bailey

05:59 2025-03-25 UTC+2

1123

Will money return to North America?Author: Marek Petkovich

09:18 2025-03-25 UTC+2

1093

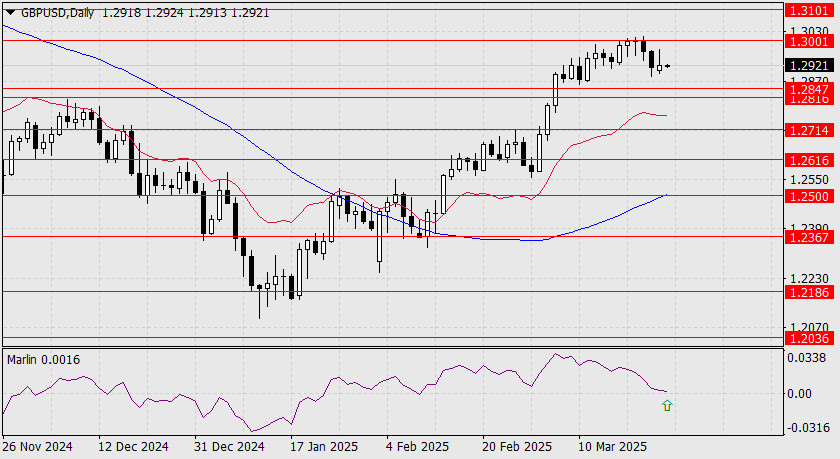

The Pound is Ready to Resume GrowthAuthor: Laurie Bailey

05:59 2025-03-25 UTC+2

1003

- Intraday Strategies for Beginner Traders on March 25

Author: Miroslaw Bawulski

08:49 2025-03-25 UTC+2

883

AUD/USD Eyes the Upside AgainAuthor: Laurie Bailey

05:59 2025-03-25 UTC+2

868

Fundamental analysisWhat to Pay Attention to on March 25? A Breakdown of Fundamental Events for Beginners

Very few macroeconomic events are scheduled for Tuesday, and none are of significant importanceAuthor: Paolo Greco

07:30 2025-03-25 UTC+2

823

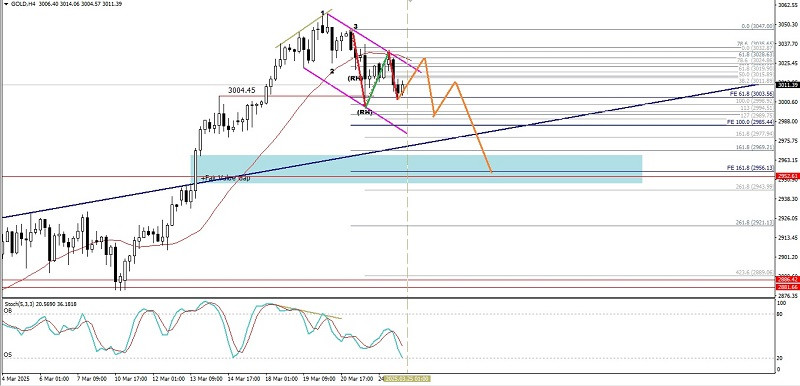

- Technical analysis

Technical Analysis of Intraday Price Movement of Gold Commodity Instrument, Tuesday March 25,2025.

If we look at the 4-hour chart of the Gold commodity instrument, a Bearish 123 pattern appearsAuthor: Arief Makmur

08:19 2025-03-25 UTC+2

823

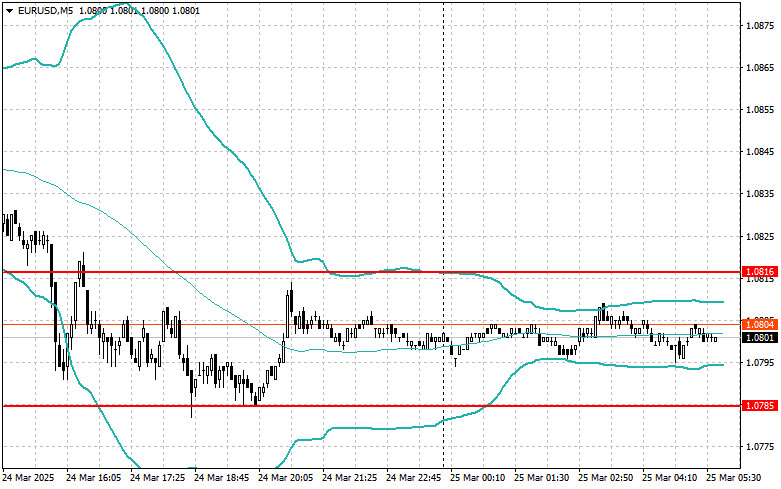

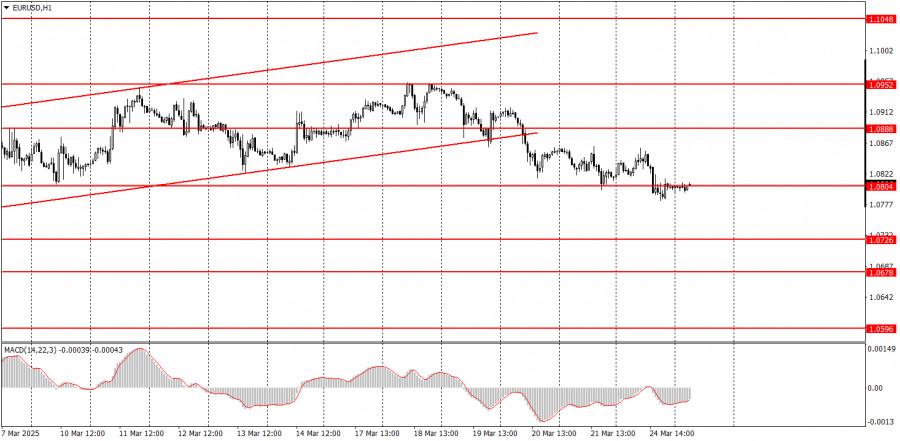

Trading planHow to Trade the EUR/USD Pair on March 25? Simple Tips and Trade Analysis for Beginners

The EUR/USD currency pair continued its weak downward movement on MondayAuthor: Paolo Greco

07:29 2025-03-25 UTC+2

808

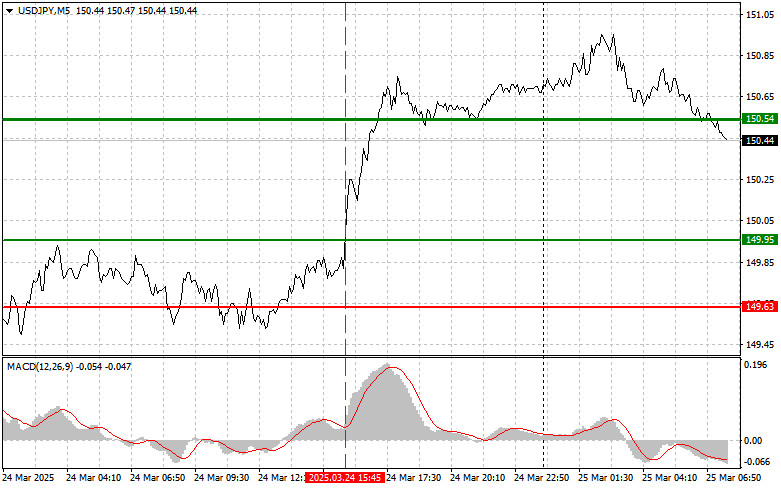

Type of analysisUSD/JPY: Simple Trading Tips for Beginner Traders on March 25. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on March 25. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:15 2025-03-25 UTC+2

793

- The Euro is Searching for a Foothold for Reversal

Author: Laurie Bailey

05:59 2025-03-25 UTC+2

1123

- Will money return to North America?

Author: Marek Petkovich

09:18 2025-03-25 UTC+2

1093

- The Pound is Ready to Resume Growth

Author: Laurie Bailey

05:59 2025-03-25 UTC+2

1003

- Intraday Strategies for Beginner Traders on March 25

Author: Miroslaw Bawulski

08:49 2025-03-25 UTC+2

883

- AUD/USD Eyes the Upside Again

Author: Laurie Bailey

05:59 2025-03-25 UTC+2

868

- Fundamental analysis

What to Pay Attention to on March 25? A Breakdown of Fundamental Events for Beginners

Very few macroeconomic events are scheduled for Tuesday, and none are of significant importanceAuthor: Paolo Greco

07:30 2025-03-25 UTC+2

823

- Technical analysis

Technical Analysis of Intraday Price Movement of Gold Commodity Instrument, Tuesday March 25,2025.

If we look at the 4-hour chart of the Gold commodity instrument, a Bearish 123 pattern appearsAuthor: Arief Makmur

08:19 2025-03-25 UTC+2

823

- Trading plan

How to Trade the EUR/USD Pair on March 25? Simple Tips and Trade Analysis for Beginners

The EUR/USD currency pair continued its weak downward movement on MondayAuthor: Paolo Greco

07:29 2025-03-25 UTC+2

808

- Type of analysis

USD/JPY: Simple Trading Tips for Beginner Traders on March 25. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on March 25. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:15 2025-03-25 UTC+2

793