See also

23.12.2021 12:37 PM

23.12.2021 12:37 PMIn the UK, as in many countries of the world, the situation with the spread of a new strain of COVID-19 called Omicron also leaves much to be desired. So, on the eve of the United Kingdom, about 160,000 new cases of COVID infection were noted. This has become an anti-record since the beginning of the pandemic. The death toll on this day was about 140. In total, since the beginning of the coronavirus epidemic in the United Kingdom, more than 147.5 thousand people have died. In such a situation, British Prime Minister Boris Johnson will have no choice but to introduce another lockdown. As noted earlier, Johnson does not want to take such unpopular measures among the British until the last moment. And the economy of the United Kingdom, coupled with the costs of Brexit, will suffer significant damage. However, if the situation with the daily increase in the number of diseases cannot be normalized, whether you want it or not, restrictions cannot be avoided. And all this can happen on the eve of the Christmas holidays.

If we touch on macroeconomic statistics, it is not expected from the UK today. But a large block of data will be received from the United States of America at 13:30 London time, which was discussed in more detail in today's article on the euro/dollar. I can only add that at 15:00 (London time) there will be data on sales of new buildings, as well as the consumer sentiment index from the University of Michigan. Thus, it can be assumed that today's trading on GBP/USD will be influenced by macroeconomic indicators from the United States, as well as market sentiment, which has not been stable lately and is very changeable.

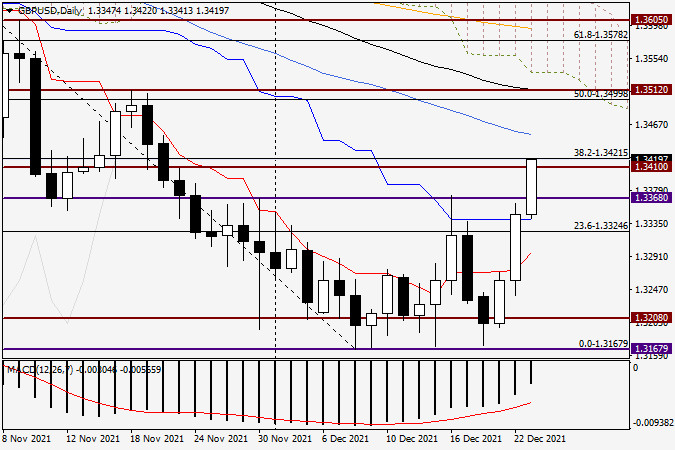

Daily

For example, we can cite the fact that, despite the positive US GDP reports for the third quarter, as well as the consumer confidence index, the US dollar did not receive the necessary support and showed a weakening in pair with the British pound. The GBP/USD pair ended yesterday with steady growth at 1.3347, and today continues to strengthen even more impressively. The blue Kijun line of the Ichimoku indicator turned out to be broken, the resistance level is 1.3370, and right now the bulls on the pound are testing a very significant technical level of 1.3400 for a breakdown. Looking at the already pretty impressive bullish candle, purchases may turn out to be a belated trading decision, but there are no clear signals for opening short positions yet. If the pair rises to 1.3452, it may meet resistance there in the form of a 50-simple moving average. This is quite realistic, especially after such impressive growth. Based on this, I suggest looking for candlestick signals for sales near 1.3450/60, which will appear on smaller timeframes, and if available, try selling with small targets in the area of 1.3420-1.3400. There are no other trading recommendations yet. Let's see how the pair will behave after the publication of American statistics. Do not forget about it.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

From what is seen on the 4-hour chart, the EUR/GBP cross currency pair appears to be moving above the EMA (100), which indicates that Buyers dominate the currency pair

With the appearance of Convergence between the price movement of the main currency pair USD/JPY with the Stochastic Oscillator indicator and the position of the EMA (100) which is above

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

From what we see on the 4-hour chart of the Nasdaq 100 index, there are several interesting things, namely, first, the price movement is moving below the MA (100), second

Early in the American session, gold is trading around 3,312 with a bullish bias after breaking out of the symmetrical triangle. Gold is now likely to continue rising

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.