See also

20.07.2022 11:37 PM

20.07.2022 11:37 PMAmong all the currencies included in the US dollar basket, the yen is the biggest underdog. The fundamental discrepancy between the US Federal Reserve's aggressive monetary policy and the Bank of Japan's ultra-soft monetary policy pushed the USD/JPY to 139 last week (139.9 high in September 1998). At the same time, the Japanese authorities have repeatedly expressed concern about the sharp depreciation of the yen, but there has never been any talk of any foreign exchange interventions, except for verbal ones. Meanwhile, in Japan itself, "enyasu" (weak yen) is beginning to be regarded as public enemy number one.

In addition to the policy of the BOJ, the movement of the yen is influenced by the yield of US government bonds. The safe-haven Japanese currency gets some tailwind even if the markets are risk-averse. Perhaps the recent strengthening of the yen is also due to the fact that speculation about a 100% rate hike by the US Federal Reserve has lost some supporters. Especially after several FOMC members at once made it clear that they would most likely prefer a 75 bp rate hike at the upcoming policy meeting on July 26-27. However, investors appear to be convinced that the recent spike in US inflation to a 40-year high will force the Fed to raise rates even further later this year.

With such conflicting prospects, and on elevated US Treasury yields, the dollar may try to reverse its recent corrective decline. And traders - to refrain from bearish rates on the yen. Especially amid expectations of the BOJ's decision. It is noteworthy that inflation data (consumer price index, CPI) will be published on July 22. That is, the decision of the central bank on the key rate will be released the day before.

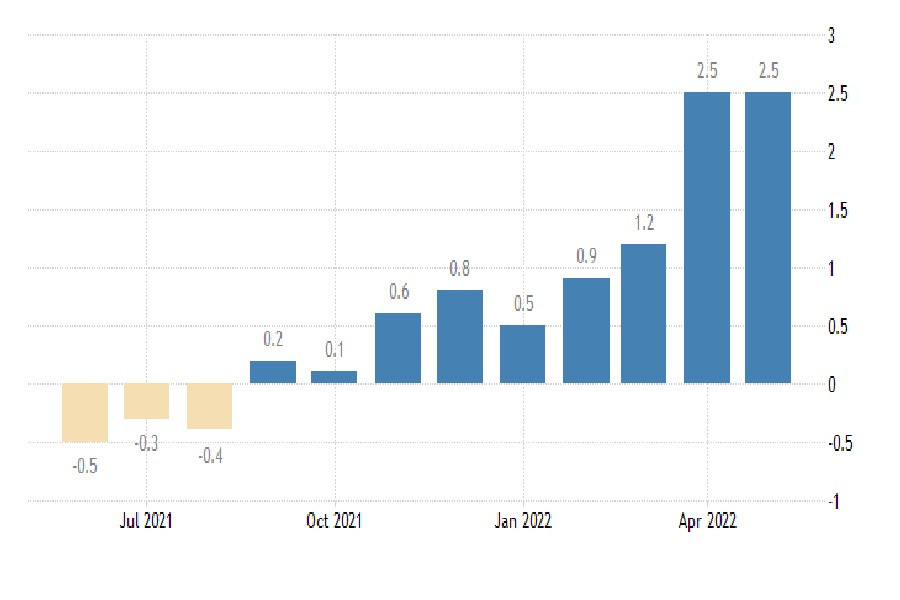

Consumer prices in Japan rise for the 10th consecutive month. In May 2022, the annual inflation rate was 2.5%, repeating the April data (7.5-year high).

Japanese Consumer Prices (May)

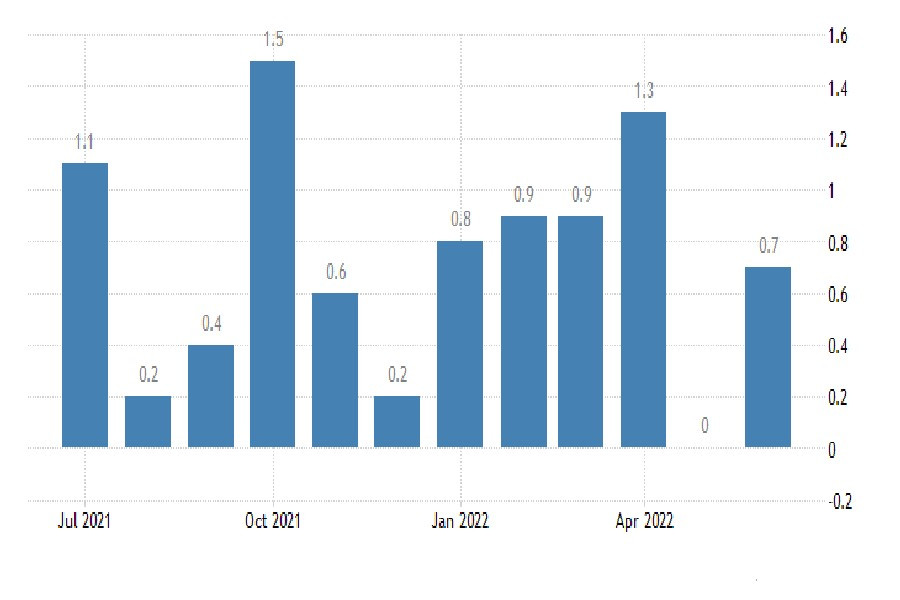

It is clear that those who will determine Japan's monetary policy in the near future have a certain idea of the state of prices. And they know that the inflationary background in the country is rising. So, for a month - from May to June - the producer price index increased from 0% to 0.70%.

Japanese Producer Price Change (M/M)

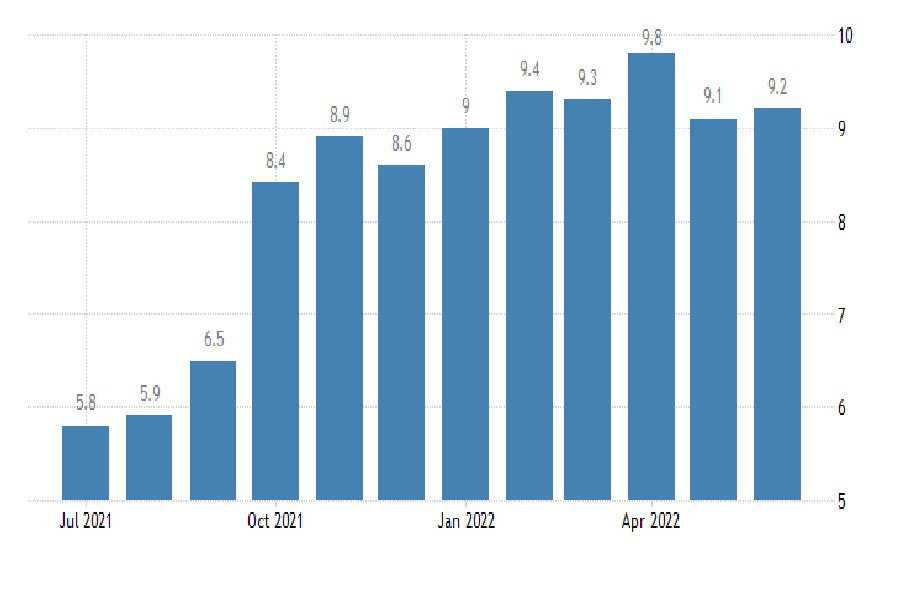

On an annualized basis, the PPI jumped to 9.2%. Moreover, the jump occurred mainly due to increased prices for raw materials and energy carriers, as well as an increase in import prices on the weak yen. The question "How will the increased production costs affect the price of the final product" looks rhetorical. It is clear that the business will shift part of its costs onto the shoulders of consumers.

Japanese Producer Price Change (Y/Y)

However, as the head of the BOJ, Haruhiko Kuroda, has repeatedly stated, the central bank intends to continue to adhere to the quantitative and qualitative easing (QQE) program with the control of the government bond yield curve. And the yen exchange rate, closely monitored by financial officials, may continue to fall for the time being. The fact that local inflation is somewhat above the target level of 2.0%, the BOJ explains the influence of external geopolitical and economic factors. So there will probably be no surprises and changes in the current dovish monetary policy. In turn, the Federal Open Market Committee (FOMC) is more willing to make hawkish decisions in the near future.

Since the key psychological level of 140 yen per dollar is already very close, analysts' views on the further path of the Japanese currency are beginning to diverge. Some of them (mainly in Japan) believe that the yen may still depreciate for some time, and that the BOJ still has some time to spare. Their arguments:

Bulls argue with the "bears" in Japan (mainly from abroad):

While analysts are breaking spears, the yen, which is indecisive today, is likely to dutifully go to new price highs against the US dollar. At the same time, short positions will prevail for the USD/JPY pair. And amid the strengthening of the dollar, the yen looks more and more undervalued.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The flagship cryptocurrency remains in a fragmented state, unable to establish a firm footing. Bitcoin is experiencing significant volatility and posted losses this week. Nevertheless, experts remain optimistic, anticipating

Trump's China tariffs spark recession fears US Treasuries and dollar hit by sell-off, yields soar European stocks fall as US retaliatory tariffs take effect World markets face crisis-era volatility, stocks

Gold forecasts are becoming increasingly dazzling in every sense, as analysts appear to be competing with one another over how high the precious metal could go. Rising geopolitical instability

InstaFutures

Make money with a new promising instrument!

InstaFutures

Make money with a new promising instrument!

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.