See also

19.02.2025 10:36 AM

19.02.2025 10:36 AMThe Reserve Bank of Australia (RBA), like the Reserve Bank of New Zealand (RBNZ), continues its monetary policy easing to create conditions for stimulating economic growth. For now, the pair is holding above the 0.6340 support level, but the strength of the US dollar is likely to increase further as the situation around Donald Trump's trade tariffs becomes clearer. The divergence in monetary policies between the Federal Reserve and the RBA will ultimately drive the long-term decline of the pair.

There may be short-term rebounds due to profit-taking on previous positions, but the overall downward trend in the pair is expected to continue.

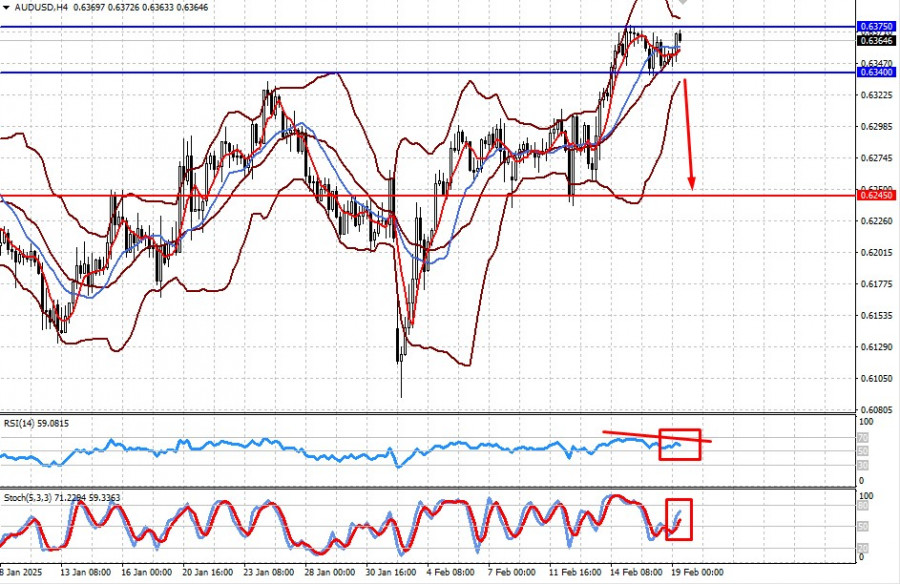

The price remains above the middle line of the Bollinger Bands, as well as above the SMA 5 and SMA 14. The RSI is below the overbought zone, indicating weakening bullish momentum. Meanwhile, the Stochastic indicator continues to rise actively.

If the pair fails to break above 0.6375 and hold above this level, a local reversal downward is likely, with the price falling toward 0.6245, once 0.6340 is breached.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Our trading plan for the coming hours is to sell gold below 3,224, with targets at 3,203 and 3,156. We should be alert to any technical rebound, as the outlook

On the 4-hour chart of the Crude Oil commodity instrument, the Inverted Head & Shoulders pattern and Bullish Pattern 123 and Divergence between the #CL price movement and the Stochastic

With the appearance of Divergence from the Stochastic Oscillator indicator with the XPD/USD price movement on its 4-hour chart and the appearance of a Bullish 123 pattern followed

During the European session, the euro reached a new high around +2/8 Murray, located at 1.1473. This movement in EUR/USD occurred after the announcement by China's Ministry of Finance that

Early in the American session, gold is undergoing a strong technical correction after reaching a new high around 3,237.69 for now. Economic data from the United States will be released

Forex Chart

Web-version

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.