See also

28.03.2025 09:19 AM

28.03.2025 09:19 AMIf you don't get it the first time, you will the second. The S&P 500 sell-off, led by U.S. and foreign automaker shares, continued a second day after the imposition of 25% tariffs. Donald Trump threatened the European Union and Canada with retaliation should they respond jointly to the import duties, and companies have begun tallying up losses. The broad stock index is confidently moving toward the lower boundary of its medium-term trading range of 5500–5790, but blaming only the White House occupant for all its troubles would be misguided.

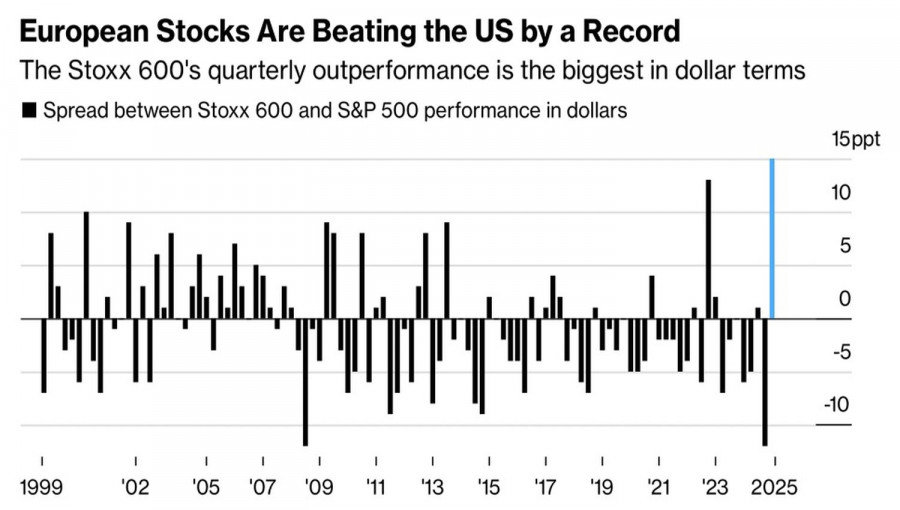

The sell-off of overvalued "Magnificent Seven" companies, slowing corporate profit growth, and a weakening U.S. economy contribute to a capital shift from North America to Europe. European indices are currently outperforming the S&P 500 by a wide margin. However, according to the world's largest asset manager, this advantage may not last long. BlackRock believes that Germany's fiscal stimulus will primarily benefit banks and defense companies — a very narrow group. Therefore, one shouldn't count on the EuroStoxx 50 and DAX 40 rally to continue at the same pace.

By contrast, the U.S. stock market will likely receive a fresh boost once the situation surrounding Donald Trump's protectionist policies becomes clearer. Many companies will adapt to the tariffs, enabling the S&P 500 to grow again.

But first, the broad stock index would do well to shed some dead weight. In 2025, that weight comes from the "Magnificent Seven" stocks. Back in February, they were trading at 45 times forward earnings. Only the sell-off has brought the P/E ratio down to 35 — still high, though the 11% drop in that figure is striking.

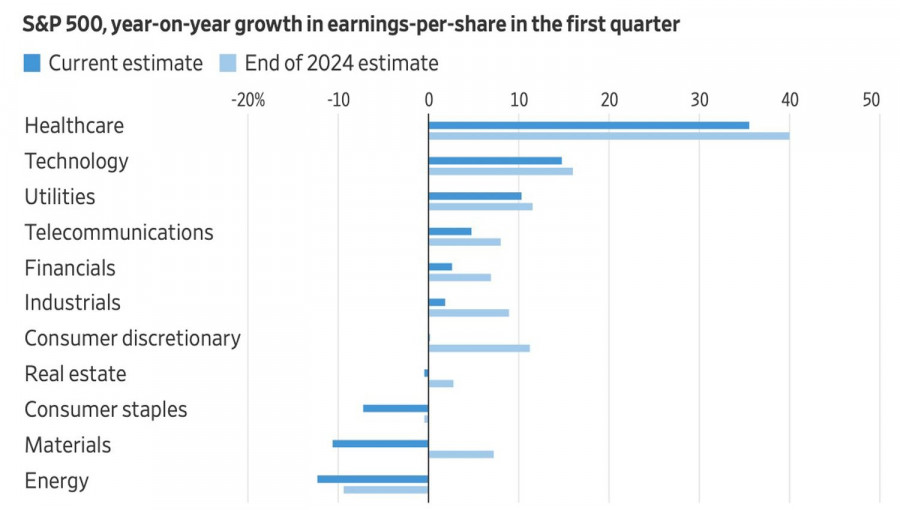

Q1 earnings season kicks off in a few weeks, and Wall Street's 7.1% earnings forecast is impressive. But that's four percentage points lower than what experts were projecting at the end of 2024. The discrepancy in estimates is above the historical average. Forecasts have been cut across all 11 S&P 500 sectors, and earnings growth is expected to slow in nine.

The stronger-than-expected Q4 GDP reading of 2.4% shouldn't be misleading. For January–March, Bloomberg analysts expect GDP growth to slow to 1–1.5%, and the Atlanta Fed's leading indicator signals an even weaker pace — just 0.2%. Inflation remains elevated, tying the Fed's hands and preventing the central bank from throwing markets a lifeline.

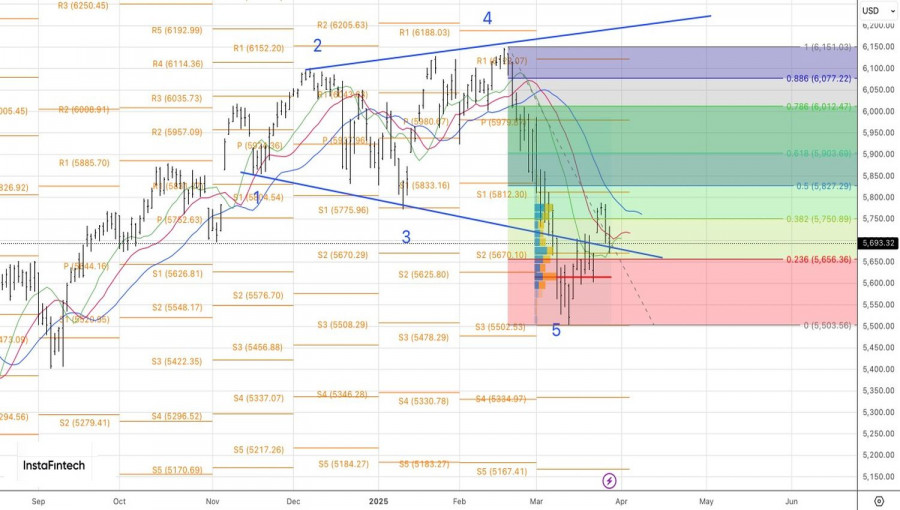

Technically, on the daily chart, the S&P 500 continues its previously forecasted move from the upper boundary of its consolidation range (5500–5790) toward the lower bound. It makes sense to hold and even build on short positions once support at 5670 is broken — especially since the Broadening Wedge pattern is playing out clearly.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Today is Good Friday, a day Christians observe worldwide across all denominations. Market activity has noticeably decreased ahead of the Easter holiday, but this isn't the main reason for market

There are no macroeconomic events scheduled for Friday—not in the US, the Eurozone, Germany, or the UK. Therefore, even if the market were paying any attention to the macroeconomic backdrop

The GBP/USD currency pair continued to trade relatively calmly on Thursday, showing only a minimal downward bias. We still can't classify the current movement as a "pullback" or "correction."

The EUR/USD currency pair spent most of the day moving sideways. When the European Central Bank meeting results were released, the market saw a small emotional reaction, but nothing fundamentally

Ferrari F8 TRIBUTO

from InstaTrade

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.