CHFCZK (Swiss Franc vs Czech Koruna). Exchange rate and online charts.

Currency converter

24 Mar 2025 18:31

(-0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

CHF/CZK is not the most popular trading instrument in the forex market. However, this currency pair may well diversify the portfolio of any trader, as well as bring its holder a profit.

CHF/CZK is a cross rate against the US dollar. A cross rate is a forex market price made in two currencies that are both valued against a third currency – USD. In other words, the greenback is not included in the currency pair but its exchange rate is greatly affected by it. For example, if we compare USD/CHF and USD/CZK charts, they can predict a possible movement of CHF/CZK.

Features of CHF/CZK

Switzerland’s economy has been stable for years. For that reason, the Swiss franc is considered one of the world’s most reliable and trustworthy currencies.

The Swiss franc is the safe-haven asset investors turn to at the time of financial upheaval.

Therefore, at the time of crises, when investors rush to transfer their capital to Switzerland, CHF shows an exponential increase against the basket of currencies. Traders should always keep in mind this feature of the Swiss economy when trading the instrument.

The Czech Republic is one of the most developed industrial countries in Central Europe. Its residents enjoy high incomes thanks to the country’s buoyant economy.

The Czech Republic has achieved impressive results in sectors such as mechanical engineering, steel and cast iron production, chemical, electronics, brewing, and agriculture. However, its automotive industry is considered the most developed economic field (cars are mainly exported). Above all else, the Czech Republic is one of the leading exporters of beer and footwear.

Aspects of trading CHF/CZK

Speaking of CHF/CZK, the trading instrument is relatively illiquid compared to the major currency pairs (EUR/USD, USD/CHF, GBP/USD, and USD/JPY). For that reason, to make an accurate forecast for CHF/CZK, it is important to pay attention to the currency pairs where each currency of the instrument is traded against USD.

In addition, it is also essential to analyze the US economic indicators, like interest rates, GDP, unemployment, Nonfarm Payrolls, etc.

Importantly, when trading cross currency pairs, traders should carefully consider the broker’s trading conditions on the given financial instrument. The spread for cross currency pairs is usually higher.

See Also

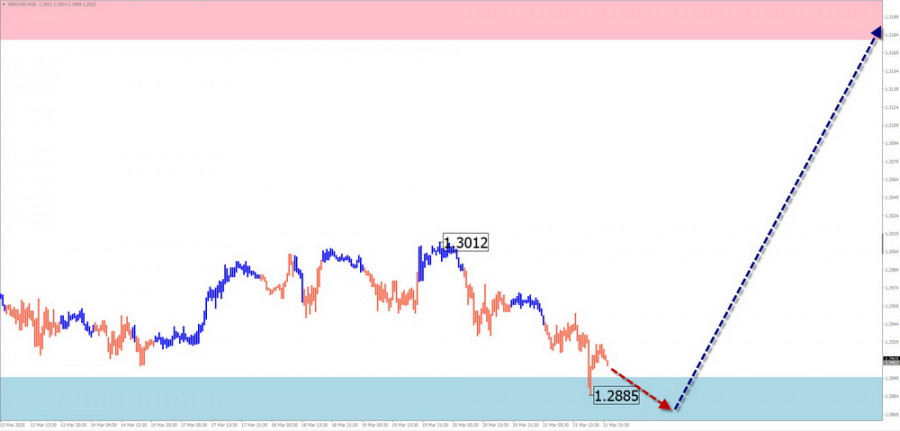

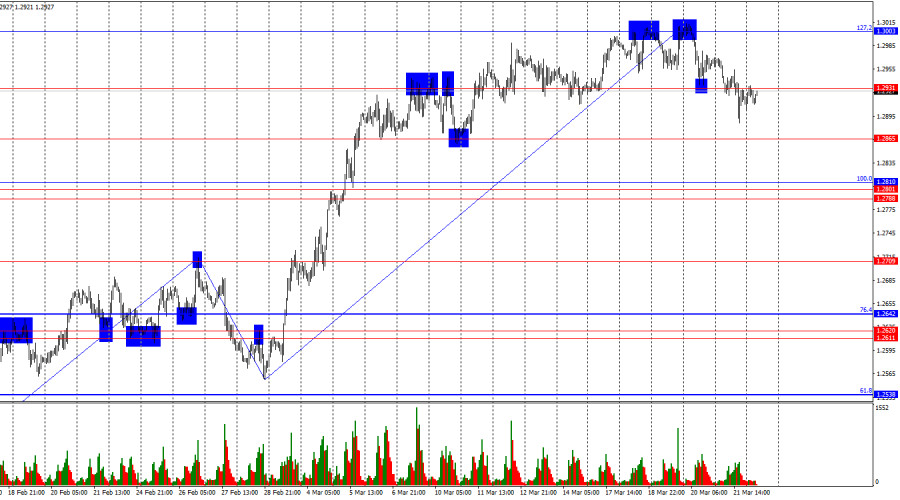

- Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:24 2025-03-24 UTC+2

1063

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

763

Technical analysis / Video analyticsForex forecast 24/03/2025: EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin.Author: Sebastian Seliga

15:34 2025-03-24 UTC+2

748

- The outcomes of the Bank of England and FOMC meetings contradicted each other.

Author: Samir Klishi

12:25 2025-03-24 UTC+2

733

Wave analysisWeekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

718

The bulls attacked for two weeks, but now it's time for a pause.Author: Samir Klishi

13:55 2025-03-24 UTC+2

688

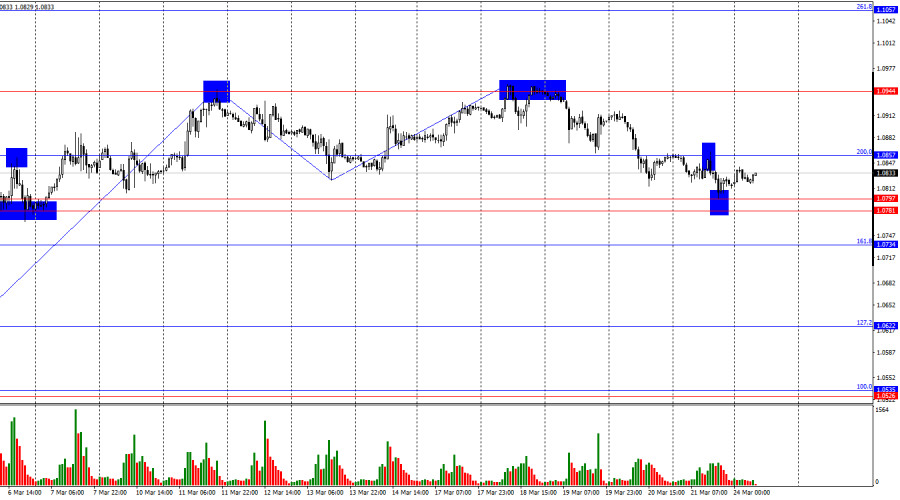

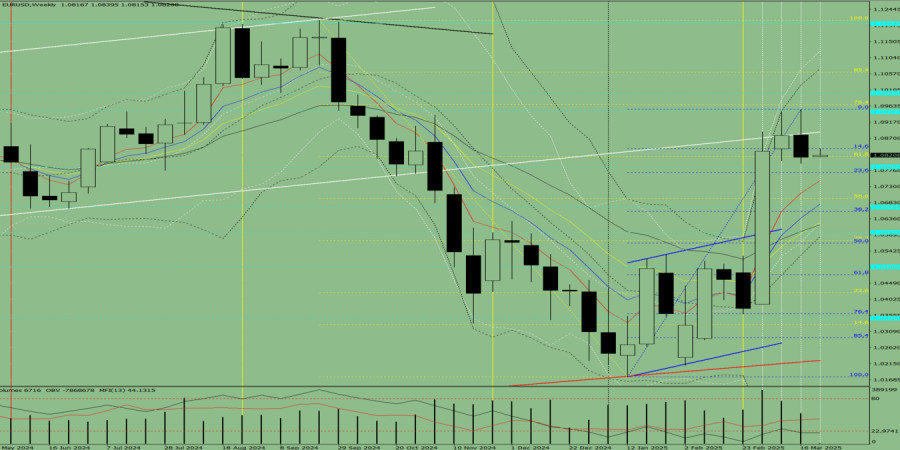

- Last week, the pair moved downward and tested the historical resistance level of 1.0948 (light blue dashed line), after which the price declined and closed the weekly candle at 1.0815. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:22 2025-03-24 UTC+2

643

Dow Transports down more than 17% from November high European stocks rise ahead of PMI surveys Consumer sentiment, inflation reports next weekAuthor: Thomas Frank

11:49 2025-03-24 UTC+2

613

Friday's US trading session brought a welcome surprise for those betting on natural gas futures, while oil traders were left somewhat disappointed.Author: Andreeva Natalya

13:39 2025-03-24 UTC+2

613

- Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:24 2025-03-24 UTC+2

1063

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

763

- Technical analysis / Video analytics

Forex forecast 24/03/2025: EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin.Author: Sebastian Seliga

15:34 2025-03-24 UTC+2

748

- The outcomes of the Bank of England and FOMC meetings contradicted each other.

Author: Samir Klishi

12:25 2025-03-24 UTC+2

733

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

718

- The bulls attacked for two weeks, but now it's time for a pause.

Author: Samir Klishi

13:55 2025-03-24 UTC+2

688

- Last week, the pair moved downward and tested the historical resistance level of 1.0948 (light blue dashed line), after which the price declined and closed the weekly candle at 1.0815. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:22 2025-03-24 UTC+2

643

- Dow Transports down more than 17% from November high European stocks rise ahead of PMI surveys Consumer sentiment, inflation reports next week

Author: Thomas Frank

11:49 2025-03-24 UTC+2

613

- Friday's US trading session brought a welcome surprise for those betting on natural gas futures, while oil traders were left somewhat disappointed.

Author: Andreeva Natalya

13:39 2025-03-24 UTC+2

613