#NTLA (Intellia Therapeutics Inc.). Exchange rate and online charts.

See Also

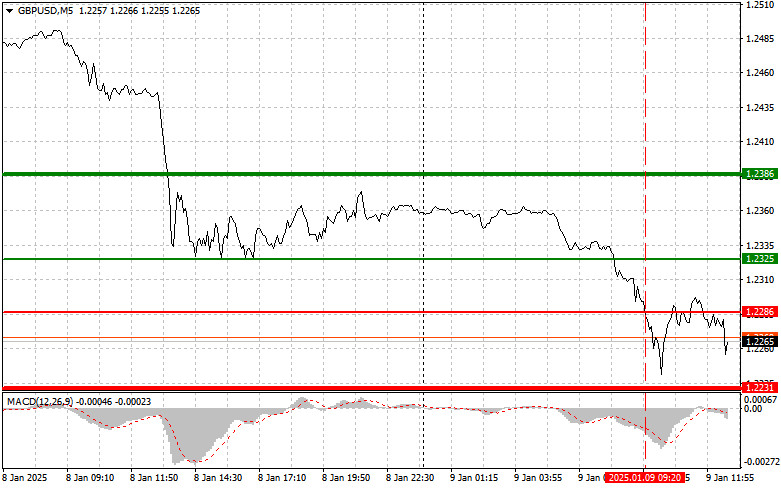

- The test of the 1.2286 price level in the first half of the day coincided with the MACD indicator being significantly below the zero mark

Author: Jakub Novak

14:21 2025-01-09 UTC+2

1393

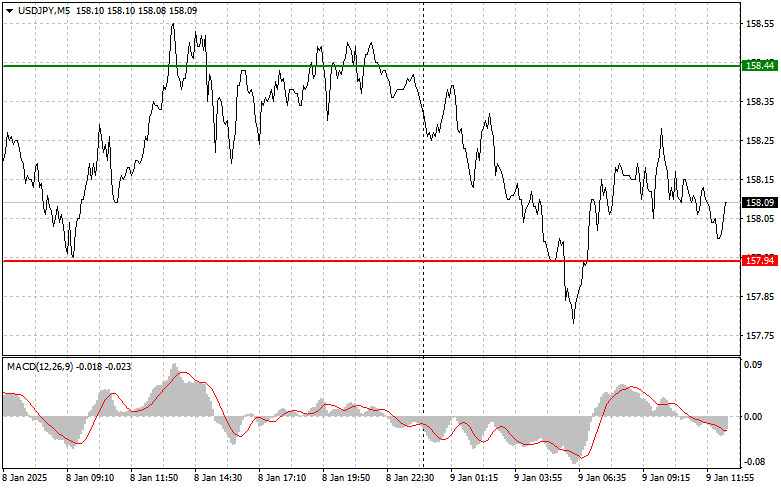

The designated levels were not tested in the first half of the day, so I did not make any trades.Author: Jakub Novak

14:24 2025-01-09 UTC+2

1393

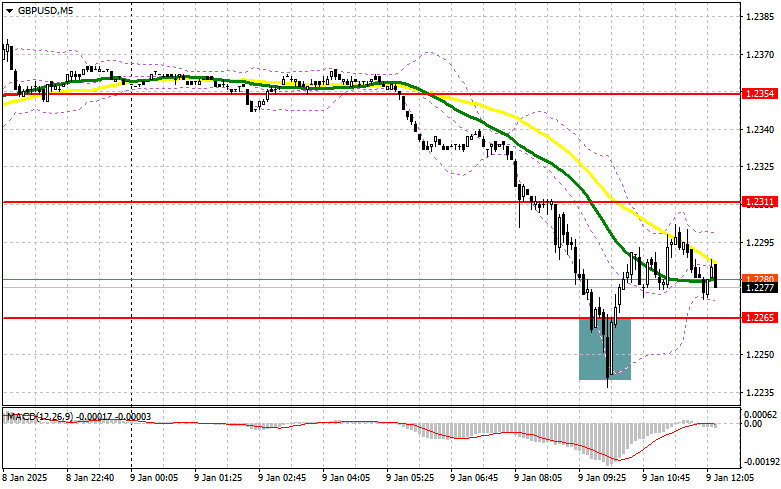

In my morning forecast, I highlighted the level of 1.2265 and planned to make trading decisions based on itAuthor: Miroslaw Bawulski

14:08 2025-01-09 UTC+2

1318

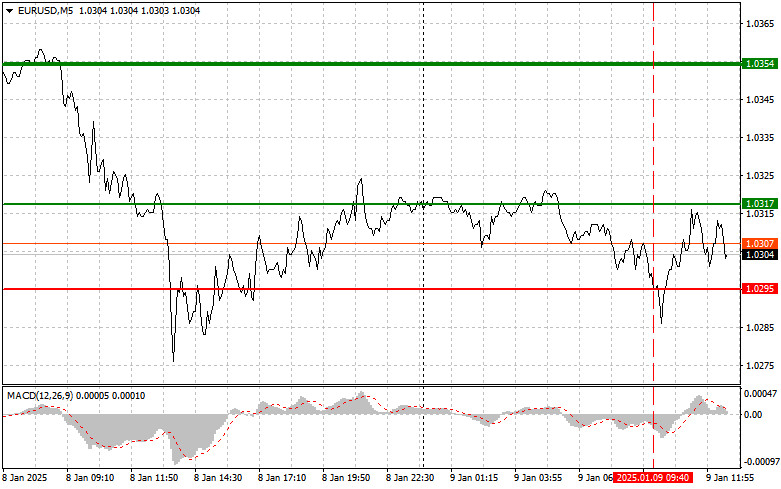

- The test of the 1.0295 price coincided with the moment when the MACD indicator had moved significantly downward from the zero level

Author: Jakub Novak

14:12 2025-01-09 UTC+2

1258

In my morning forecast, I highlighted the level of 1.0319 and planned to make trading decisions based on itAuthor: Miroslaw Bawulski

13:53 2025-01-09 UTC+2

1243

Technical analysisTrading Signals for GOLD (XAU/USD) for January 9-15, 2025: buy above, $2,629 or sell below $2,677 (21 SMA - 4/8 Murray)

If gold falls below 2,656, the bearish force could persist and the metal could reach the bottom of the bullish trend channel around 2,620.Author: Dimitrios Zappas

16:47 2025-01-09 UTC+2

1243

- The EUR/GBP pair continues its upward trajectory for the second session in a row, trading near 0.8400 during the European session.

Author: Irina Yanina

12:26 2025-01-09 UTC+2

1228

Technical analysisTrading Signals for EUR/USD for January 9-15, 2025: buy above 1.0253 (4/8 Murray - rebound)

On the contrary, the outlook could be negative below 4/8 Murray and EUR/USD could reach 1.01 and even continue its fall rapidly to 1.00.Author: Dimitrios Zappas

16:46 2025-01-09 UTC+2

928

ECB Rate Cut – A NecessityAuthor: Marek Petkovich

00:38 2025-01-10 UTC+2

898

- The test of the 1.2286 price level in the first half of the day coincided with the MACD indicator being significantly below the zero mark

Author: Jakub Novak

14:21 2025-01-09 UTC+2

1393

- The designated levels were not tested in the first half of the day, so I did not make any trades.

Author: Jakub Novak

14:24 2025-01-09 UTC+2

1393

- In my morning forecast, I highlighted the level of 1.2265 and planned to make trading decisions based on it

Author: Miroslaw Bawulski

14:08 2025-01-09 UTC+2

1318

- The test of the 1.0295 price coincided with the moment when the MACD indicator had moved significantly downward from the zero level

Author: Jakub Novak

14:12 2025-01-09 UTC+2

1258

- In my morning forecast, I highlighted the level of 1.0319 and planned to make trading decisions based on it

Author: Miroslaw Bawulski

13:53 2025-01-09 UTC+2

1243

- Technical analysis

Trading Signals for GOLD (XAU/USD) for January 9-15, 2025: buy above, $2,629 or sell below $2,677 (21 SMA - 4/8 Murray)

If gold falls below 2,656, the bearish force could persist and the metal could reach the bottom of the bullish trend channel around 2,620.Author: Dimitrios Zappas

16:47 2025-01-09 UTC+2

1243

- The EUR/GBP pair continues its upward trajectory for the second session in a row, trading near 0.8400 during the European session.

Author: Irina Yanina

12:26 2025-01-09 UTC+2

1228

- Technical analysis

Trading Signals for EUR/USD for January 9-15, 2025: buy above 1.0253 (4/8 Murray - rebound)

On the contrary, the outlook could be negative below 4/8 Murray and EUR/USD could reach 1.01 and even continue its fall rapidly to 1.00.Author: Dimitrios Zappas

16:46 2025-01-09 UTC+2

928

- ECB Rate Cut – A Necessity

Author: Marek Petkovich

00:38 2025-01-10 UTC+2

898