AUDNOK (Australian Dollar vs Norwegian Krone). Exchange rate and online charts.

Currency converter

25 Mar 2025 16:41

(0.05%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

AUD/NOK is not a very popular currency pair in the Forex market. It is the cross rate against the U.S. dollar. Although the U.S. dollar obviously is not present in this currency pair, it still has a significant impact on it. This can be seen if you combine two charts ― AUD/USD and USD/NOK. By combining these two charts in the same price chart, you can get an approximate AUD/NOK chart.

The U.S. dollar has a significant influence on both currencies. For this reason, it is necessary to take into account the major U.S. economic indicators for the correct prediction of a future course of this financial instrument. These indicators include the discount rate, GDP, unemployment, new vacancies and many others. It is worth noting that the discussed currencies could respond to U.S. economic changes with different speed. Therefore, the AUD/NOK pair may be a specific indicator of changes in these currencies.

Norway is one of the leading industrial-agrarian countries. The country is number one in terms of quality of life and personal income level. This Scandinavian country is the third largest producer and exporter of oil and gas. The main source of Norway’s income is the export of energy resources. In addition, Norway is a leader in electrometallurgy, electrical engineering, mechanical engineering, mining as well as processing of seafood, which is in high demand worldwide, especially in European countries. In addition, it is the largest manufacturer of offshore drilling platforms for oil and gas.

This trading instrument is relatively illiquid in comparison with major currency pairs, such as EUR/USD, USD/CHF, GBP/USD, and USD/JPY. Therefore, when you make a forecast for the financial instrument, you should primarily focus on those currency pairs that include the U.S. dollar in tandem with each of the considered currencies.

If you trade cross rates, it is necessary to remember that brokers usually set a higher spread than more popular currency pairs, so before you start working with the cross rates, carefully learn the conditions offered by the broker to trade a preferred instrument.

See Also

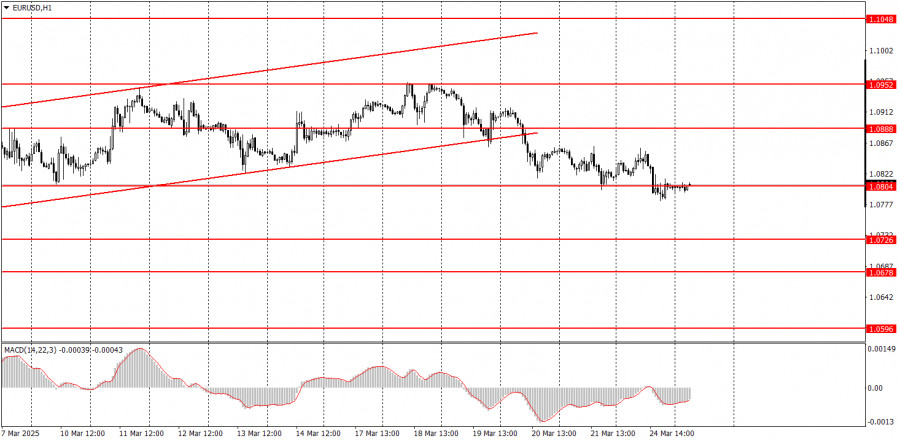

- The Euro is Searching for a Foothold for Reversal

Author: Laurie Bailey

05:59 2025-03-25 UTC+2

1153

Will money return to North America?Author: Marek Petkovich

09:18 2025-03-25 UTC+2

1123

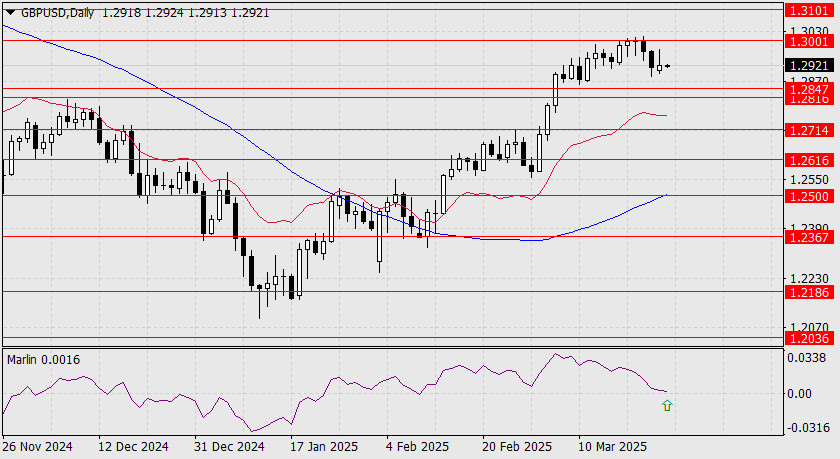

The Pound is Ready to Resume GrowthAuthor: Laurie Bailey

05:59 2025-03-25 UTC+2

1093

- Type of analysis

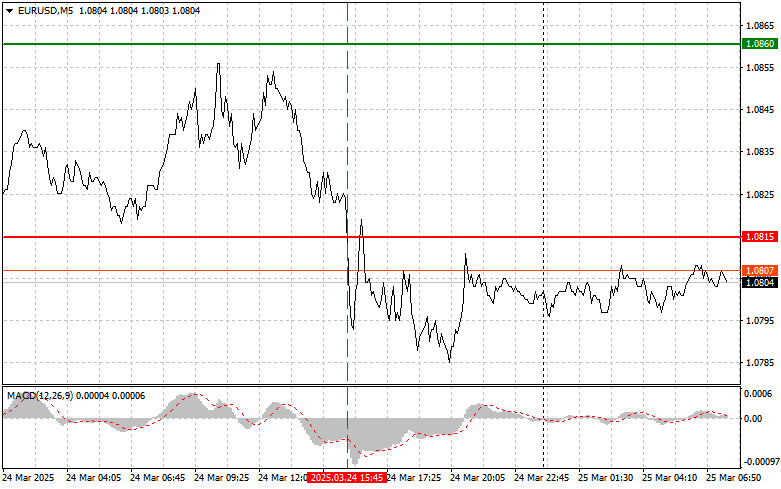

EUR/USD: Simple Trading Tips for Beginner Traders on March 25. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on March 25. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:12 2025-03-25 UTC+2

943

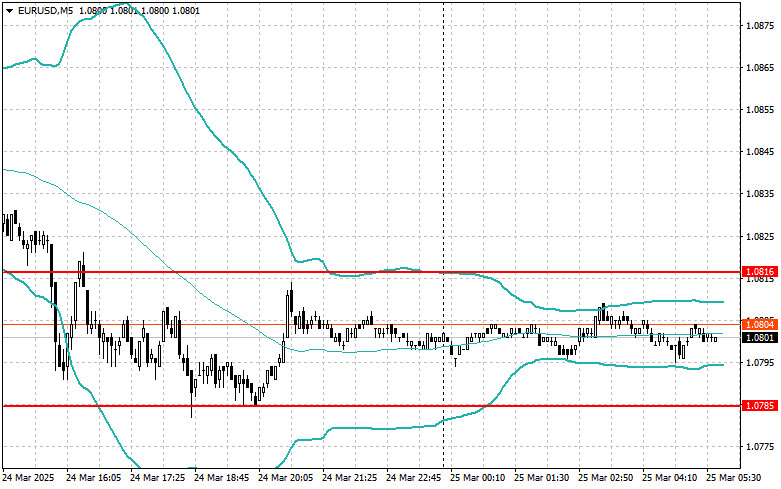

Intraday Strategies for Beginner Traders on March 25Author: Miroslaw Bawulski

08:49 2025-03-25 UTC+2

943

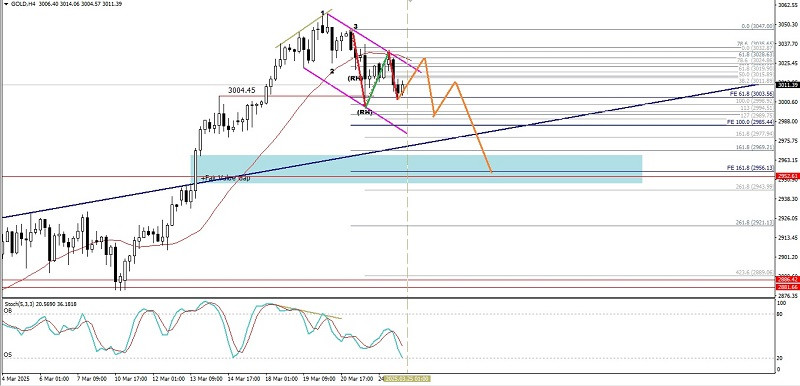

Technical analysisTechnical Analysis of Intraday Price Movement of Gold Commodity Instrument, Tuesday March 25,2025.

If we look at the 4-hour chart of the Gold commodity instrument, a Bearish 123 pattern appearsAuthor: Arief Makmur

08:19 2025-03-25 UTC+2

913

- AUD/USD Eyes the Upside Again

Author: Laurie Bailey

05:59 2025-03-25 UTC+2

898

Fundamental analysisWhat to Pay Attention to on March 25? A Breakdown of Fundamental Events for Beginners

Very few macroeconomic events are scheduled for Tuesday, and none are of significant importanceAuthor: Paolo Greco

07:30 2025-03-25 UTC+2

883

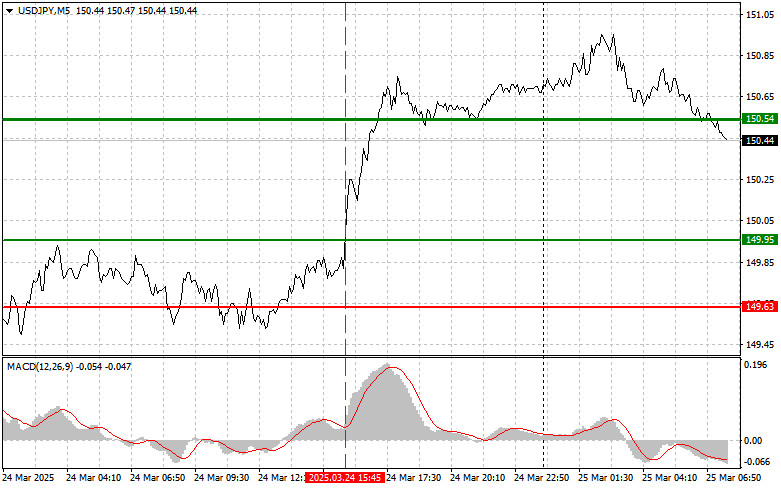

Type of analysisUSD/JPY: Simple Trading Tips for Beginner Traders on March 25. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on March 25. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:15 2025-03-25 UTC+2

838

- The Euro is Searching for a Foothold for Reversal

Author: Laurie Bailey

05:59 2025-03-25 UTC+2

1153

- Will money return to North America?

Author: Marek Petkovich

09:18 2025-03-25 UTC+2

1123

- The Pound is Ready to Resume Growth

Author: Laurie Bailey

05:59 2025-03-25 UTC+2

1093

- Type of analysis

EUR/USD: Simple Trading Tips for Beginner Traders on March 25. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on March 25. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:12 2025-03-25 UTC+2

943

- Intraday Strategies for Beginner Traders on March 25

Author: Miroslaw Bawulski

08:49 2025-03-25 UTC+2

943

- Technical analysis

Technical Analysis of Intraday Price Movement of Gold Commodity Instrument, Tuesday March 25,2025.

If we look at the 4-hour chart of the Gold commodity instrument, a Bearish 123 pattern appearsAuthor: Arief Makmur

08:19 2025-03-25 UTC+2

913

- AUD/USD Eyes the Upside Again

Author: Laurie Bailey

05:59 2025-03-25 UTC+2

898

- Fundamental analysis

What to Pay Attention to on March 25? A Breakdown of Fundamental Events for Beginners

Very few macroeconomic events are scheduled for Tuesday, and none are of significant importanceAuthor: Paolo Greco

07:30 2025-03-25 UTC+2

883

- Type of analysis

USD/JPY: Simple Trading Tips for Beginner Traders on March 25. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on March 25. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:15 2025-03-25 UTC+2

838