CADCZK (Canadian Dollar vs Czech Koruna). Exchange rate and online charts.

Currency converter

24 Mar 2025 18:46

(0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

CAD/CZK is one of the most popular currency pairs among traders. The US dollar has a significant impact on this pair. We can see this by combining the charts of CAD/USD and USD/CZK. As a result, the approximate chart of CAD/CZK will be shown.

Features of CAD/CZK

Canada is one of the leading global exporters of oil. Therefore, its national currency is affected by world oil prices. As a result, the Canadian dollar strengthens when the value of the commodity rises and weakens when oil falls. For this reason, the CAD/CZK pair is vulnerable to oil prices.

The Czech Republic is one of the most industrialized countries in Central Europe. Its economy is characterized by prosperity and sustainability. The population of the Czech Republic has a consistently high level of personal income. This could be explained by well-balanced economic development.

The main sectors of the country's economy are car manufacturing, iron and steel production, and agriculture. The Czech Republic is one of the world's leading car manufacturers. In addition, it is the main exporter of beer and shoes.

How to trade CAD/CZK

If you want to start trading cross-currency pairs, please be aware that the spread in such trades is often higher than for the main currency pairs. Before you start trading, read the trading conditions for each type of financial instrument carefully.

As mentioned above, the US dollar has a strong influence on each of the currencies of the CAD/CZK pair. Therefore, in order to make the most accurate forecast about the movement of this trading instrument, it is necessary to take into account such indicators of the US economy as interest rate changes, GDP, unemployment rate, new job creation, and so on. Notably, the Canadian dollar and the Czech Koruna react to any changes in the US economy. This is why the movement of the CAD/CZK pair is a specific indicator of the exchange rate fluctuations.

See Also

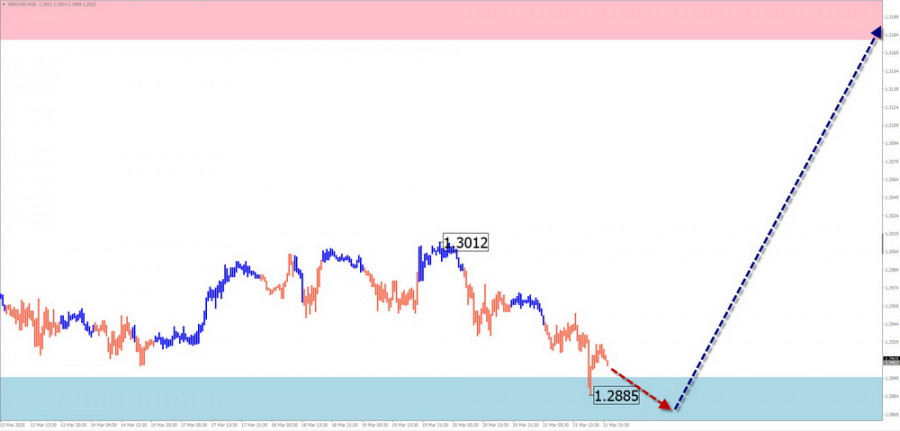

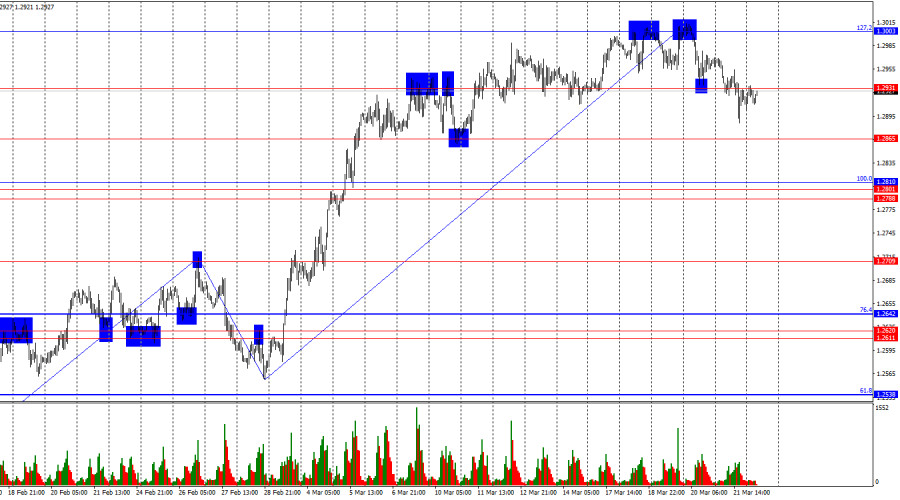

- Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:24 2025-03-24 UTC+2

1063

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

763

Technical analysis / Video analyticsForex forecast 24/03/2025: EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin.Author: Sebastian Seliga

15:34 2025-03-24 UTC+2

748

- The outcomes of the Bank of England and FOMC meetings contradicted each other.

Author: Samir Klishi

12:25 2025-03-24 UTC+2

733

Wave analysisWeekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

718

The bulls attacked for two weeks, but now it's time for a pause.Author: Samir Klishi

13:55 2025-03-24 UTC+2

688

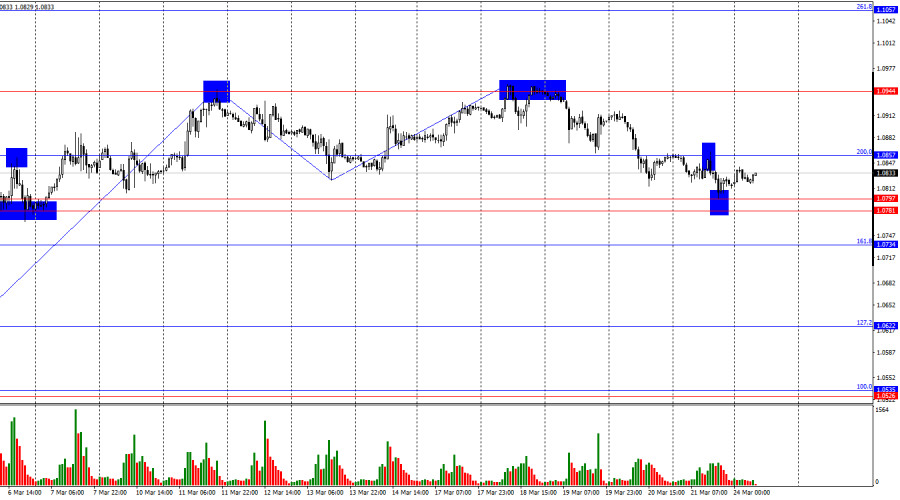

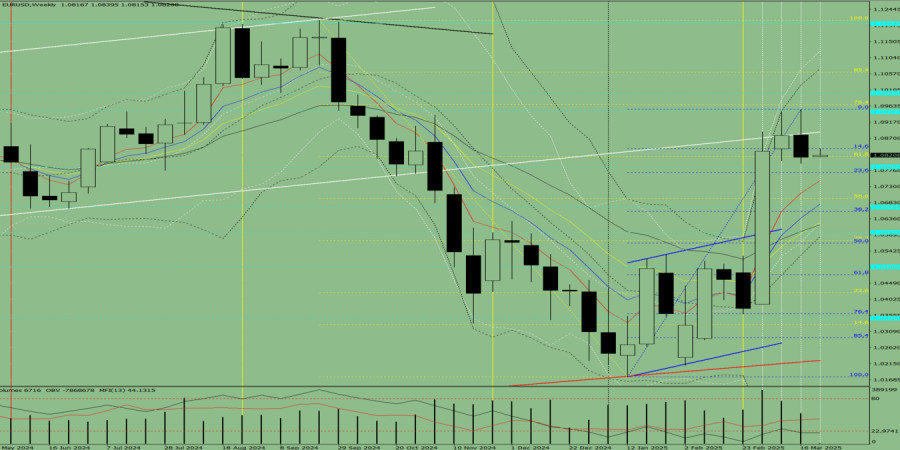

- Last week, the pair moved downward and tested the historical resistance level of 1.0948 (light blue dashed line), after which the price declined and closed the weekly candle at 1.0815. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:22 2025-03-24 UTC+2

643

Dow Transports down more than 17% from November high European stocks rise ahead of PMI surveys Consumer sentiment, inflation reports next weekAuthor: Thomas Frank

11:49 2025-03-24 UTC+2

613

Friday's US trading session brought a welcome surprise for those betting on natural gas futures, while oil traders were left somewhat disappointed.Author: Andreeva Natalya

13:39 2025-03-24 UTC+2

613

- Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:24 2025-03-24 UTC+2

1063

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

763

- Technical analysis / Video analytics

Forex forecast 24/03/2025: EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin.Author: Sebastian Seliga

15:34 2025-03-24 UTC+2

748

- The outcomes of the Bank of England and FOMC meetings contradicted each other.

Author: Samir Klishi

12:25 2025-03-24 UTC+2

733

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

718

- The bulls attacked for two weeks, but now it's time for a pause.

Author: Samir Klishi

13:55 2025-03-24 UTC+2

688

- Last week, the pair moved downward and tested the historical resistance level of 1.0948 (light blue dashed line), after which the price declined and closed the weekly candle at 1.0815. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:22 2025-03-24 UTC+2

643

- Dow Transports down more than 17% from November high European stocks rise ahead of PMI surveys Consumer sentiment, inflation reports next week

Author: Thomas Frank

11:49 2025-03-24 UTC+2

613

- Friday's US trading session brought a welcome surprise for those betting on natural gas futures, while oil traders were left somewhat disappointed.

Author: Andreeva Natalya

13:39 2025-03-24 UTC+2

613