spot.QIDRUB ( vs ). Exchange rate and online charts.

See Also

- Potential for the further drop on BTC/USD

Author: Petar Jacimovic

10:32 2024-12-27 UTC+2

3373

Technical analysis of EUR/USD, USD/JPY, Oil and Bitcoin.Author: Sebastian Seliga

10:21 2024-12-27 UTC+2

2233

The first test of the 157.90 level coincided with the MACD indicator moving significantly above the zero markAuthor: Jakub Novak

15:09 2024-12-27 UTC+2

1693

- Gold prices, after reaching a local high at the end of October due to widespread geopolitical risks in the Middle East and Ukraine

Author: Pati Gani

11:53 2024-12-27 UTC+2

1663

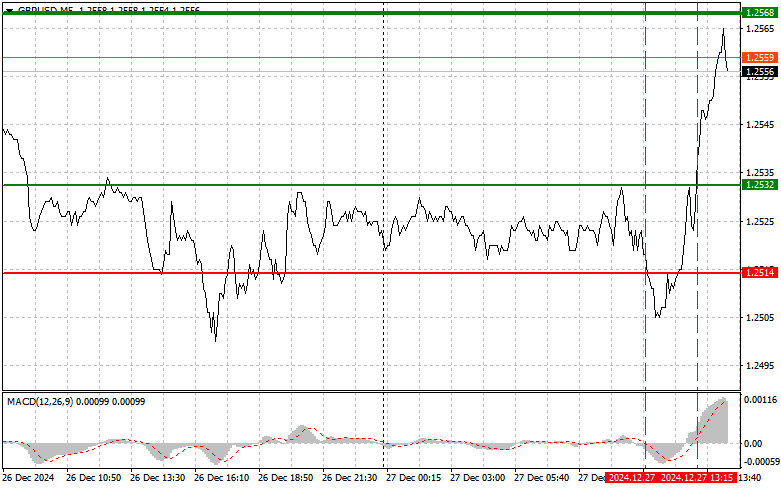

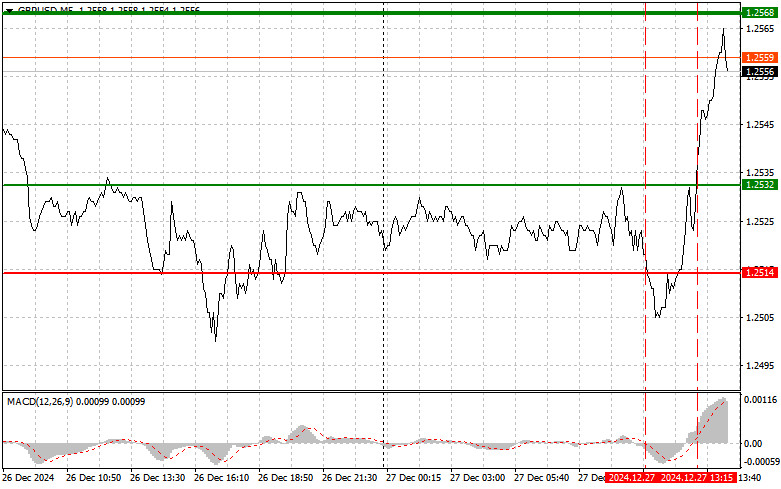

The test of the 1.2514 level coincided with the moment when the MACD indicator moved significantly below the zero markAuthor: Jakub Novak

15:06 2024-12-27 UTC+2

1573

Bearish traders postpone their plans to 2025Author: Samir Klishi

11:51 2024-12-27 UTC+2

1573

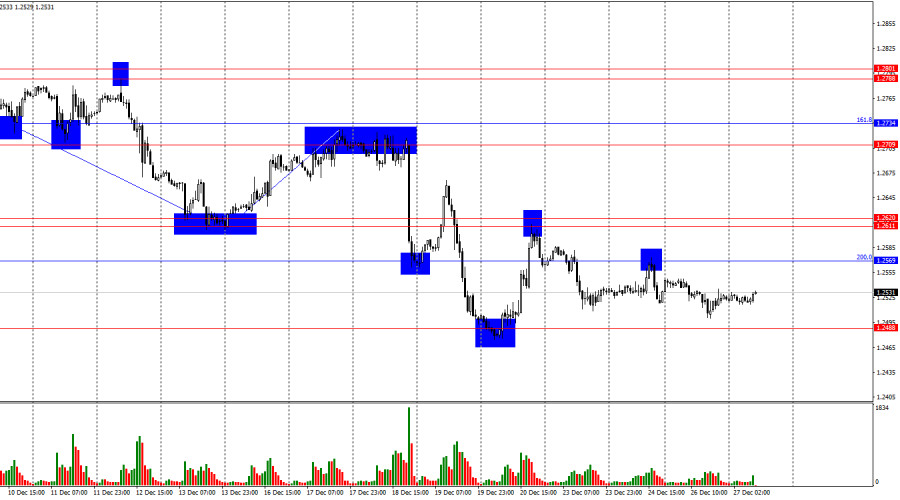

- Bullish traders retreat once again.

Author: Samir Klishi

11:17 2024-12-27 UTC+2

1468

Today, the Japanese yen is trying to counter the U.S. dollar, strengthening following the release of Tokyo CPI inflation data for the Consumer Price IndexAuthor: Irina Yanina

11:07 2024-12-27 UTC+2

1378

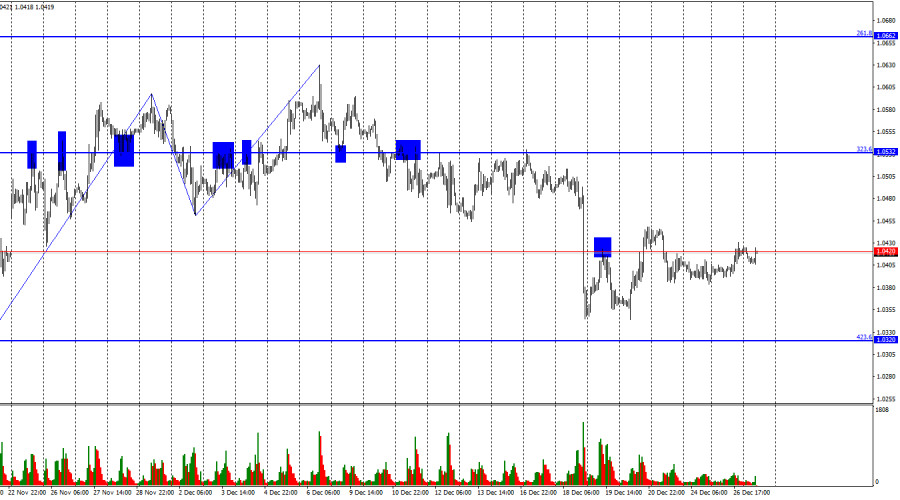

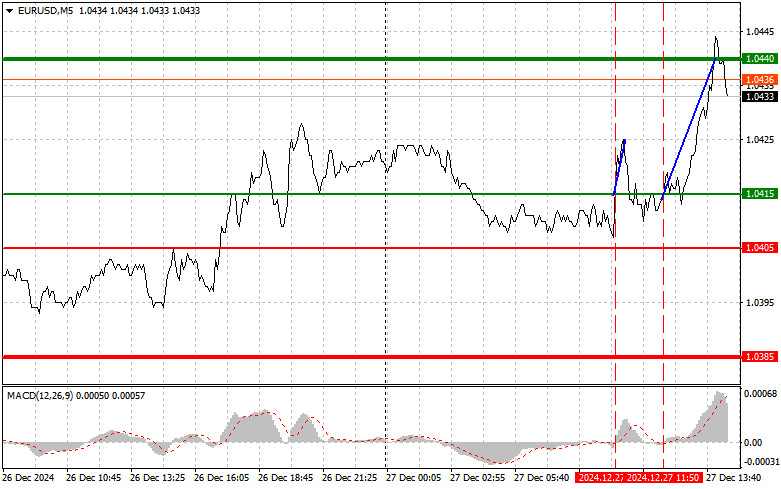

The test of the 1.0415 level in the first half of the day coincided with the moment when the MACD indicator started moving upward from the zero markAuthor: Jakub Novak

15:02 2024-12-27 UTC+2

1333

- Potential for the further drop on BTC/USD

Author: Petar Jacimovic

10:32 2024-12-27 UTC+2

3373

- Technical analysis of EUR/USD, USD/JPY, Oil and Bitcoin.

Author: Sebastian Seliga

10:21 2024-12-27 UTC+2

2233

- The first test of the 157.90 level coincided with the MACD indicator moving significantly above the zero mark

Author: Jakub Novak

15:09 2024-12-27 UTC+2

1693

- Gold prices, after reaching a local high at the end of October due to widespread geopolitical risks in the Middle East and Ukraine

Author: Pati Gani

11:53 2024-12-27 UTC+2

1663

- The test of the 1.2514 level coincided with the moment when the MACD indicator moved significantly below the zero mark

Author: Jakub Novak

15:06 2024-12-27 UTC+2

1573

- Bearish traders postpone their plans to 2025

Author: Samir Klishi

11:51 2024-12-27 UTC+2

1573

- Bullish traders retreat once again.

Author: Samir Klishi

11:17 2024-12-27 UTC+2

1468

- Today, the Japanese yen is trying to counter the U.S. dollar, strengthening following the release of Tokyo CPI inflation data for the Consumer Price Index

Author: Irina Yanina

11:07 2024-12-27 UTC+2

1378

- The test of the 1.0415 level in the first half of the day coincided with the moment when the MACD indicator started moving upward from the zero mark

Author: Jakub Novak

15:02 2024-12-27 UTC+2

1333