Lihat juga

21.08.2023 08:32 PM

21.08.2023 08:32 PMPower lies in truth. And the truth is that the stronger the U.S. economy appears, the worse for the dollar in the medium term. Americans will absorb European and Chinese exports and help the world economy get back on its feet. This is excellent news for pro-cyclical currencies, including the euro. EUR/USD will rise. It just needs to give the main currency pair some time.

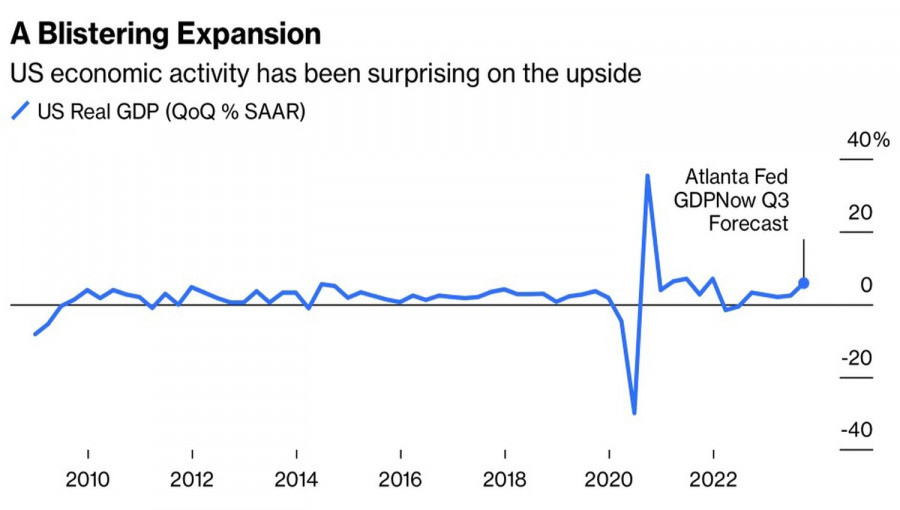

At first glance, dollar enthusiasts have nothing to worry about. The leading indicator from the Atlanta Fed is projecting a 5.8% growth in U.S. GDP in the third quarter, the best economic growth in the last 20 years if we exclude the post-pandemic recovery period. Most likely, such figures mean that nothing terrible will happen to the U.S. in 2024. However, this should not mislead the 'bears' in the EUR/USD market.

Dynamics of the American economy

In August, the U.S. dollar proved to be more resilient than one might have assumed, given the weaknesses of its main competitors. The Eurozone continues to teeter on the brink of recession, and rising gas prices bring back the specter of an energy crisis in the Old World. China is probably the biggest disappointment of 2023. Its economy is recovering from COVID-19 much slower than expected. The rate cut by the People's Bank of China leads to a weakening of the yuan and is perceived as panic within chinese officials.

However, this won't last forever. Thanks to the strength of the U.S., both the currency bloc and China will rise again. Moreover, the emerging Goldilocks regime will lead to an increase in American stock indices and improve the global risk appetite.

According to nearly 70% of those surveyed by the National Association for Business Economics, the Federal Reserve will be able to bring inflation down to the 2% target without causing a recession. In March, only 30% thought so. Three out of four respondents see PCE at around 3% by year-end. Inflation slowdown amid rapid economic growth creates a favorable backdrop for American stocks. The resumption of the upward trend in the S&P 500 is key to the rise of EUR/USD.

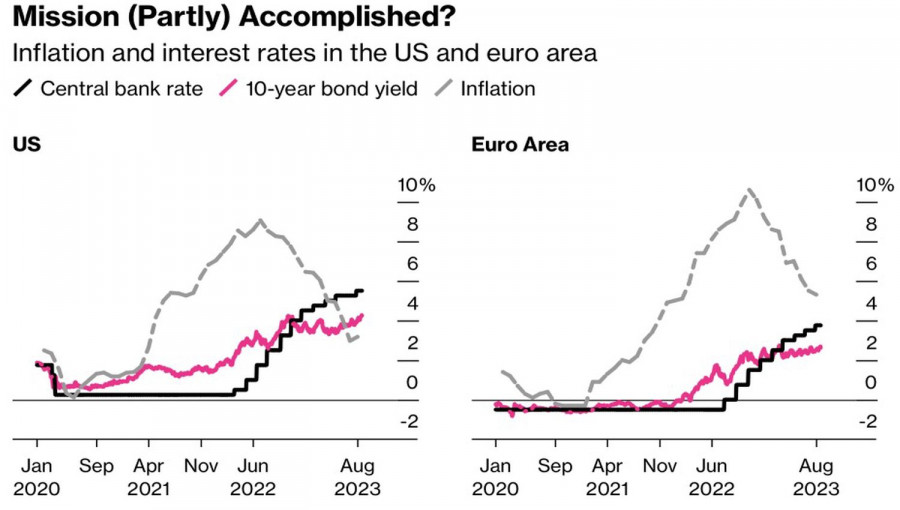

According to BNY Mellon Investment Management, the ECB will raise the deposit rate to 4% in September and probably bring it to 4.25% amid sticky inflation in the services sector and high wage growth rates, contradicting market consensus. Investors believe that the cycle of monetary policy tightening is over. If the company is right, EUR/USD should rise.

Dynamics of rates, yields, and inflation in the U.S. and the Eurozone

Thus, the risks of restoring an upward trend in the primary currency pair are quite significant. The question is how much time it will take. How soon will the euro find its bottom? Fed Chairman Jerome Powell's speech at Jackson Hole may provide a clue.

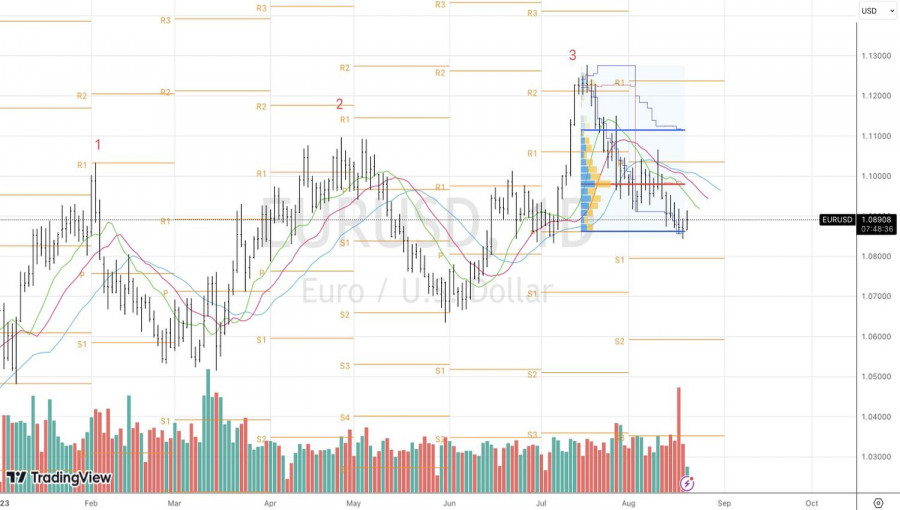

Technically, the 'bulls' in the EUR/USD are trying to play a doji bar at the lower boundary of the fair value range of 1.086-1.111 and switch to counterattack. Meanwhile, the pair's rise above 1.091 may serve as a basis for short-term long positions.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Seperti yang diantisipasi, ECB memangkas semua suku bunga utama sebesar seperempat poin, menurunkan suku bunga deposito menjadi 2,25%. Pada pertemuan ini, tidak ada proyeksi staf baru yang dirilis, dan mengingat

Gelombang euforia baru telah melanda pasar. Banyak yang percaya ini bukan kebetulan: ambil semuanya dari seseorang dan kemudian berikan mereka sedikit saja, dan mereka akan merasakan kebahagiaan. Jadi, apa yang

Sejumlah besar peristiwa makroekonomi dijadwalkan pada hari Rabu. Semua peristiwa tersebut adalah laporan Indeks Manajer Pembelian (PMI) untuk bulan April di sektor jasa dan manufaktur. Indeks-indeks ini akan dipublikasikan

Pada hari Selasa, pasangan mata uang GBP/USD diperdagangkan dengan lebih tenang, sekali lagi menunjukkan tanda-tanda pola "maxed-out flat". Seperti yang telah disebutkan sebelumnya, dolar AS belakangan ini hanya memiliki

Pada hari Selasa, pasangan mata uang EUR/USD diperdagangkan lebih tenang dibandingkan hari Senin. Dolar AS berhasil menghindari penurunan lebih lanjut, tetapi masih terlalu dini untuk merayakannya. Dolar bisa saja jatuh

Ketakutan dapat melumpuhkan, tetapi tindakan tetap berlanjut. Para investor perlahan-lahan mengatasi kekhawatiran mereka terhadap serangan Donald Trump terhadap independensi Federal Reserve dan mulai mengunci keuntungan pada posisi panjang EUR/USD

Pelan tapi pasti memenangkan perlombaan! Bitcoin diam-diam menembus level tertingginya sejak awal Maret di tengah serangan Donald Trump terhadap Jerome Powell. Ketika independensi Federal Reserve dipertaruhkan dan kepercayaan terhadap dolar

Setelah mencapai rekor tertinggi baru di $3500 dalam kondisi overbought, harga emas mengalami penurunan. Namun, sentimen bullish tetap kuat karena kekhawatiran yang terus-menerus mengenai potensi dampak ekonomi dari kebijakan tarif

Pada hari ini, pasangan EUR/GBP mengalami penurunan setelah dua hari berturut-turut mengalami kenaikan, diperdagangkan mendekati level psikologis 0,8600. Pound mendapatkan dukungan dari optimisme seputar negosiasi perdagangan yang sedang berlangsung antara

Chart Forex

versi web

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.