Lihat juga

04.04.2025 12:50 AM

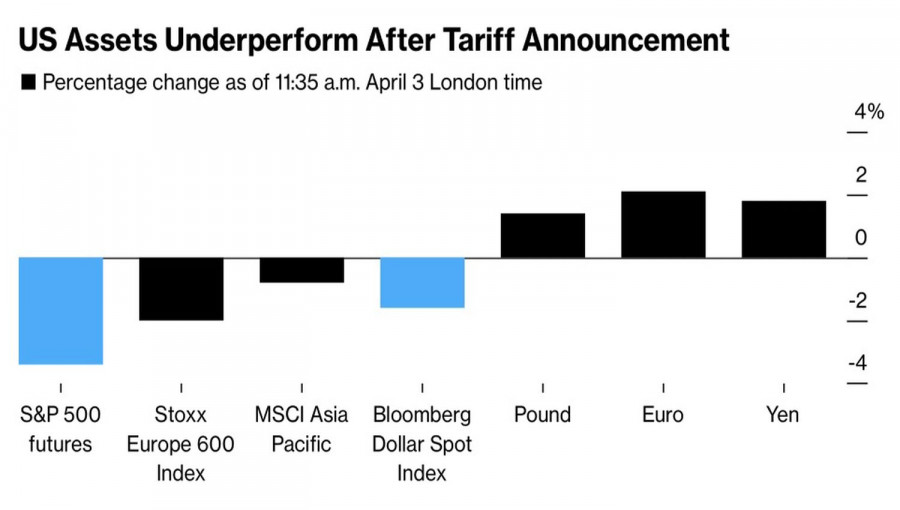

04.04.2025 12:50 AMDon't create a problem for someone else; you might get caught in it yourself. Donald Trump sought to leverage the United States' leading position in the global economy by announcing the highest tariffs in over a century. The White House resident claimed this would return America to its Golden Age. However, financial market reactions tell a different story: the U.S. is emerging as the biggest victim—sending the dollar plunging into the abyss.

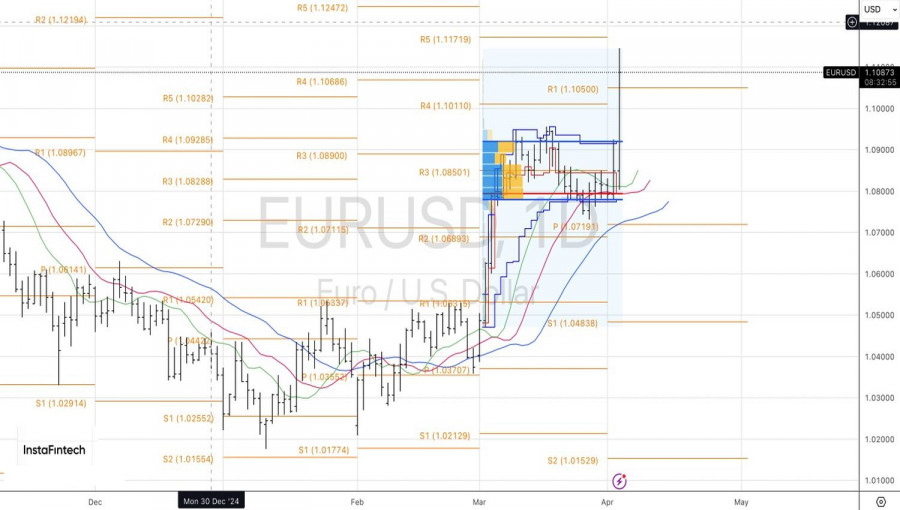

At the turn of 2024–2025, investors were confident that the eurozone and the EUR/USD pair would be the primary victims of Trump's protectionist policies. The logic was simple: the euro area is export-driven, and the euro is a pro-cyclical currency susceptible to the global economic outlook. But theory means little without practice. The main currency pair has soared to its highest levels since early October, which may be far from the ceiling.

Citi expects EUR/USD to reach 1.15, citing the disproportionate impact of tariffs on U.S. markets compared to European ones. According to their estimates, the S&P 500 could lose 11% of its market capitalization due to the broad scope of import tariffs, while European indexes would see only about a 5% drop.

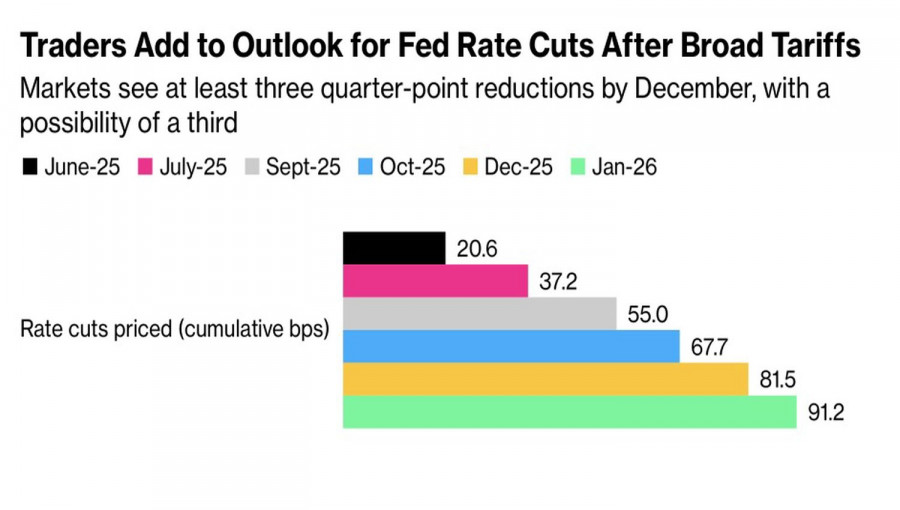

The tariffs have intensified recession risks in the U.S., pushed Treasury yields lower, and raised money market expectations for aggressive monetary easing by the Fed. Derivatives markets now predict 81.5 basis points will cut the federal funds rate by December—implying three rate cuts in 2025, with a possible fourth.

Thus, capital outflows from U.S. equities, falling Treasury yields, rising recession risks in the U.S. economy, and the expected resumption of the Federal Reserve's monetary easing cycle all contribute to an extremely unfavorable environment for EUR/USD bears. The pair's trajectory will depend mainly on how the European Union responds to the White House's tariffs.

The EU appears determined to strike back despite Treasury Secretary Scott Bessent advising other countries not to retaliate against the U.S. import tariffs and warning that rates could go even higher. France and Germany have been particularly vocal, calling for targeted measures against American tech firms and service providers. That would be a painful blow, given that the U.S. runs a services trade surplus with the EU.

However, there are other options. Europe could increase fiscal stimulus and pivot its economy from exports toward domestic consumption, both of which would be supportive of the euro.

On the daily chart, EUR/USD has broken out of consolidation or the "shelf" in the Spike and Ledge pattern. Long positions in the 1.0765–1.0800 zone should be held and increased on pullbacks. Target levels are 1.1220 and 1.1440.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Seperti yang diantisipasi, ECB memangkas semua suku bunga utama sebesar seperempat poin, menurunkan suku bunga deposito menjadi 2,25%. Pada pertemuan ini, tidak ada proyeksi staf baru yang dirilis, dan mengingat

Gelombang euforia baru telah melanda pasar. Banyak yang percaya ini bukan kebetulan: ambil semuanya dari seseorang dan kemudian berikan mereka sedikit saja, dan mereka akan merasakan kebahagiaan. Jadi, apa yang

Sejumlah besar peristiwa makroekonomi dijadwalkan pada hari Rabu. Semua peristiwa tersebut adalah laporan Indeks Manajer Pembelian (PMI) untuk bulan April di sektor jasa dan manufaktur. Indeks-indeks ini akan dipublikasikan

Pada hari Selasa, pasangan mata uang GBP/USD diperdagangkan dengan lebih tenang, sekali lagi menunjukkan tanda-tanda pola "maxed-out flat". Seperti yang telah disebutkan sebelumnya, dolar AS belakangan ini hanya memiliki

Pada hari Selasa, pasangan mata uang EUR/USD diperdagangkan lebih tenang dibandingkan hari Senin. Dolar AS berhasil menghindari penurunan lebih lanjut, tetapi masih terlalu dini untuk merayakannya. Dolar bisa saja jatuh

Ketakutan dapat melumpuhkan, tetapi tindakan tetap berlanjut. Para investor perlahan-lahan mengatasi kekhawatiran mereka terhadap serangan Donald Trump terhadap independensi Federal Reserve dan mulai mengunci keuntungan pada posisi panjang EUR/USD

Pelan tapi pasti memenangkan perlombaan! Bitcoin diam-diam menembus level tertingginya sejak awal Maret di tengah serangan Donald Trump terhadap Jerome Powell. Ketika independensi Federal Reserve dipertaruhkan dan kepercayaan terhadap dolar

Setelah mencapai rekor tertinggi baru di $3500 dalam kondisi overbought, harga emas mengalami penurunan. Namun, sentimen bullish tetap kuat karena kekhawatiran yang terus-menerus mengenai potensi dampak ekonomi dari kebijakan tarif

Pada hari ini, pasangan EUR/GBP mengalami penurunan setelah dua hari berturut-turut mengalami kenaikan, diperdagangkan mendekati level psikologis 0,8600. Pound mendapatkan dukungan dari optimisme seputar negosiasi perdagangan yang sedang berlangsung antara

Notifikasi

E-mail/SMS

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.