CHFPLN (Swiss Franc vs Polish Zloty). Exchange rate and online charts.

Currency converter

24 Mar 2025 22:40

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

CHF/PLN is not very popular currency pair on the Forex market. It the cross currency pair as it does not include the U.S. dollar. However, the U.S. currency has a significant influence on it. This can be seen if you combine two price charts: the USD/CHF and USD/PLN. Thus, you can get an approximate CHF/PLN chart.

The U.S. dollar has a significant influence on both currencies. So, a CHF/PLN trader should take into account the major U.S. economic indicators in order to make a correct prediction of a future trend of this financial asset. The indicators which are important to keep track of: the Federal Reserve discount rate, GDP, unemployment rate, new jobs, etc. It is also worth noting that the currencies comprising the pair can respond at a different rate on changes in the U.S. economy. Therefore, the CHF/PLN may be considered as a specific indicator reflecting changes of these currencies.

The Swiss economy remains strong for several centuries. For this reason, its national currency enjoys a great confidence all over the world as one of the most reliable and stable currencies. The Swiss franc is also a safe haven for capital investment during the crisis. Therefore, in times of crisis, when capital is urgently forwarded to Switzerland, the Swiss franc rises sharply against other currencies. This feature of Swiss economy should be taken into account when you trade this financial asset.

Poland plans to introduce the euro in the near future. At the same time, many of the domestic problems (the budget deficit, high public debt, etc.), as well as the global economic crisis prevented Poland from adopting the single European currency in the planned terms. The European Central Bank proposed to the country strict conditions to euro adoption. However, Poland will introduce the euro until 2014, having met all requirements.

Poland is a developed industrial country with high living standards. The main economic sectors are engineering, metallurgy, chemical and coal industry. Poland has robust automotive industry and shipbuilding yards on the Baltic Sea. The country is rich in mineral resources: coal, copper, lead, natural gas, etc. Due to the large number of hydrocarbons, Poland's economy is able to cover most of its electricity needs. International sovereign credit rating, the state of the leading sectors of the economy of Poland and the European Union are considered to be the factors that have a significant influence on the rate of the national currency.

This trading instrument is relatively illiquid compared with major currency pairs such as the EUR/USD, USD/CHF, GBP/USD, and USD/JPY. Therefore, when you forecast its further movement, you should primarily focus on the pairs with the Swiss franc and Polish zloty quoted against the U.S. dollar.

If you trade cross rates, it is necessary to remember that brokers usually set a higher spread for crosses than for more popular currency pairs, so you should carefully read the conditions the broker offers for trading this type of currency pairs.

See Also

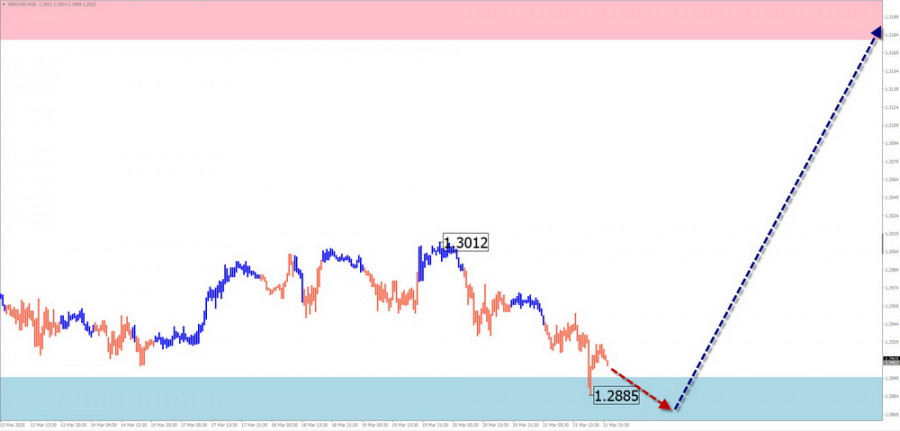

- Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:24 2025-03-24 UTC+2

1108

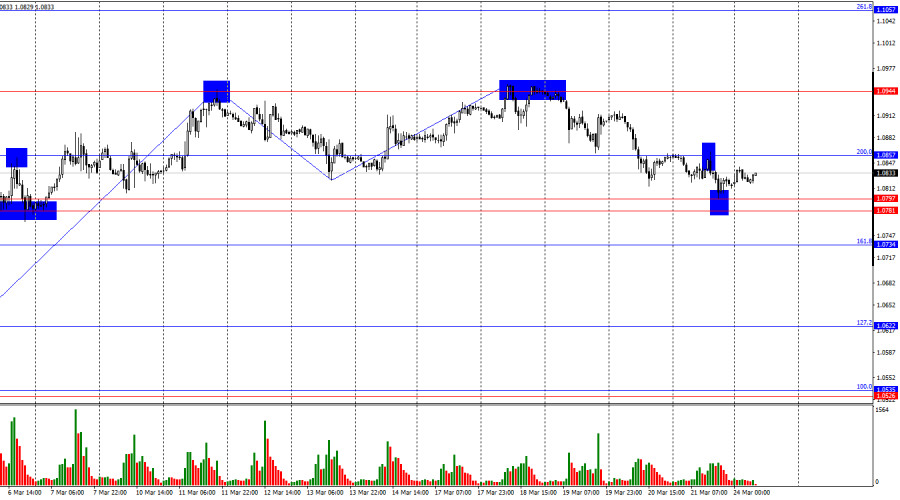

Technical analysis / Video analyticsForex forecast 24/03/2025: EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin.Author: Sebastian Seliga

15:34 2025-03-24 UTC+2

853

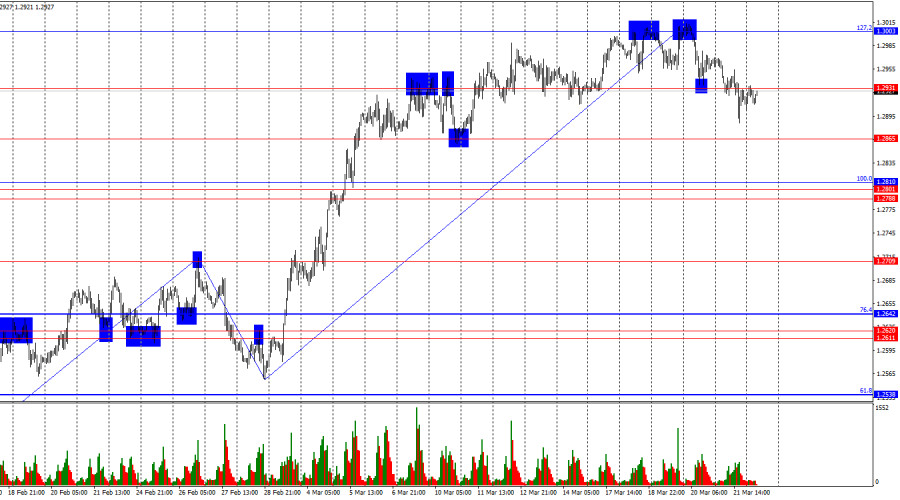

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

838

- The outcomes of the Bank of England and FOMC meetings contradicted each other.

Author: Samir Klishi

12:25 2025-03-24 UTC+2

793

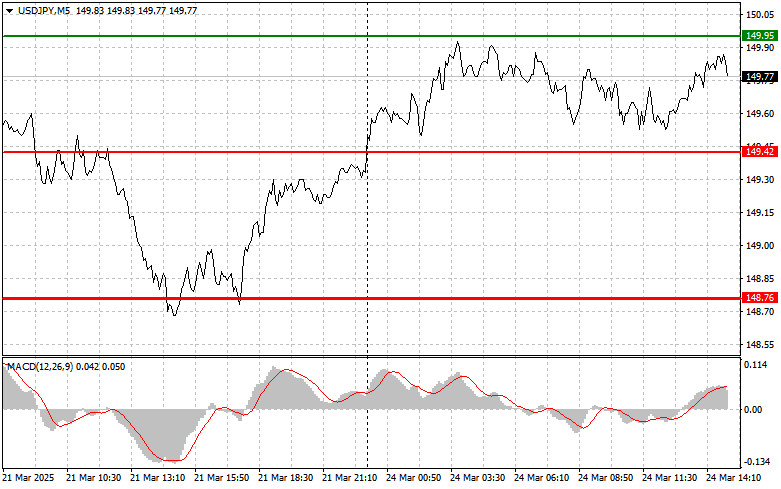

USDJPY: Simple Trading Tips for Beginner Traders on March 24th (U.S. Session)Author: Jakub Novak

17:13 2025-03-24 UTC+2

763

Wave analysisWeekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

733

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 24-27, 2025: sell below $3,032 (21 SMA - overbought)

The eagle indicator is reaching overbought levels, so we believe a technical correction could occur in the coming days, before resuming its bullish cycle.Author: Dimitrios Zappas

17:44 2025-03-24 UTC+2

718

The bulls attacked for two weeks, but now it's time for a pause.Author: Samir Klishi

13:55 2025-03-24 UTC+2

718

GBP/USD: Trading Plan for the U.S. Session on March 24th (Review of Morning Trades)Author: Miroslaw Bawulski

17:05 2025-03-24 UTC+2

688

- Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:24 2025-03-24 UTC+2

1108

- Technical analysis / Video analytics

Forex forecast 24/03/2025: EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin.Author: Sebastian Seliga

15:34 2025-03-24 UTC+2

853

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

838

- The outcomes of the Bank of England and FOMC meetings contradicted each other.

Author: Samir Klishi

12:25 2025-03-24 UTC+2

793

- USDJPY: Simple Trading Tips for Beginner Traders on March 24th (U.S. Session)

Author: Jakub Novak

17:13 2025-03-24 UTC+2

763

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

733

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 24-27, 2025: sell below $3,032 (21 SMA - overbought)

The eagle indicator is reaching overbought levels, so we believe a technical correction could occur in the coming days, before resuming its bullish cycle.Author: Dimitrios Zappas

17:44 2025-03-24 UTC+2

718

- The bulls attacked for two weeks, but now it's time for a pause.

Author: Samir Klishi

13:55 2025-03-24 UTC+2

718

- GBP/USD: Trading Plan for the U.S. Session on March 24th (Review of Morning Trades)

Author: Miroslaw Bawulski

17:05 2025-03-24 UTC+2

688