#HSI (Hang Seng Index). Exchange rate and online charts.

Currency converter

11 Apr 2025 05:37

(-0.02%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The Hang Seng Index (abbreviated HSI) is a benchmark stock market index of the Hong Kong Stock Exchange. It comprises 34 largest companies in Hong Kong which account for almost 65% of capitalization of the Hong Kong financial hub. HSI was introduced in 1969 by HSI Services Limited which is still dealing with analysis of information and compilation of ratings. The index records and monitors daily changes of stock prices of these companies. So, HSI is the main barometer of the overall market performance in Hong Kong. HSI embraces four sectors of the economy such as commerce and industry, finance, utilities, and land properties.

Besides, Hang Seng Index is a convenient instrument to invest in Hong Kong’s stock market which is one of major financial hubs not only in Asia, but on the global scale. Importantly, the economies of Hong Kong and China are closely connected as Hong Kong has the status of the special administrative region of the People’s Republic of China. So this indicator of Hong Kong’s stock market enables investors to put up capital for China’s economy which is considered to be one of the booming economies in the world. Last but not least, high liquidity of HSI makes it possible to use it for speculative trading.

Trading Hang Seng Index is available through different financial instruments including Exchange-Traded Funds (ETF), contracts for differences (CFDs), and futures contracts. Futures are the most convenient and liquid means of implementing medium- and long-term strategies as well as speculative trading.

See Also

- Markets remain in shock because of Trump

Author: Samir Klishi

12:19 2025-04-10 UTC+2

838

Technical analysisTrading Signals for GOLD (XAU/USD) for April 10-12, 2025: sell below $3,145 (21 SMA - 8/8 Murray)

The Eagle indicator is reaching oversold levels and is giving a negative signal, so we will look for opportunities to sell below 3,145 or below 3,131 with a target at 3,036.Author: Dimitrios Zappas

15:37 2025-04-10 UTC+2

763

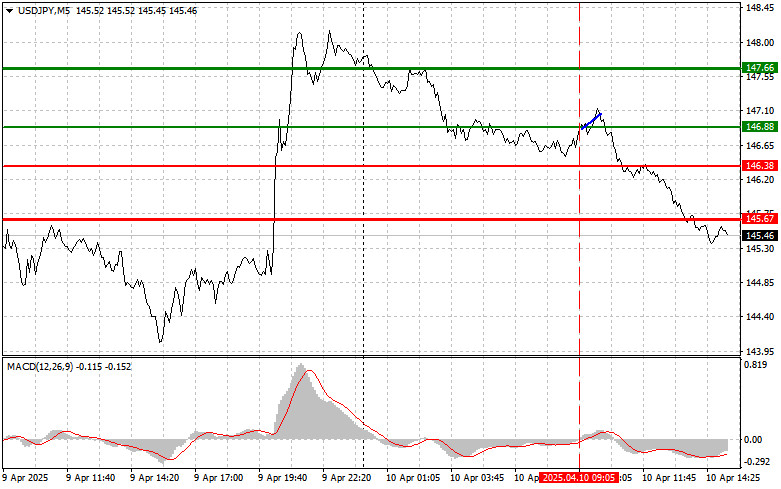

USDJPY: Simple Trading Tips for Beginner Traders – April 10th (U.S. Session)Author: Jakub Novak

20:19 2025-04-10 UTC+2

733

- The flagship cryptocurrency remains in a fragmented state, unable to establish a firm footing.

Author: Larisa Kolesnikova

14:38 2025-04-10 UTC+2

718

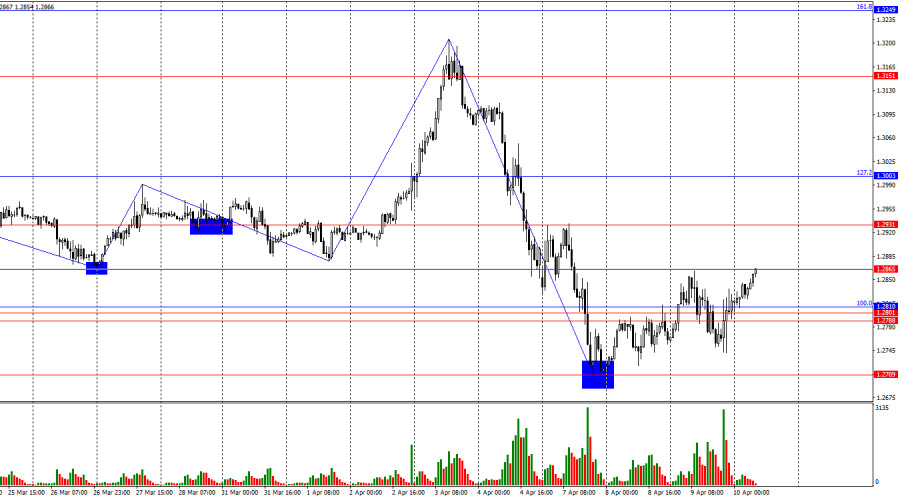

Forecast for GBP/USD on April 10, 2025Author: Samir Klishi

12:12 2025-04-10 UTC+2

718

U.S. Inflation Data: What to Know and What to ExpectAuthor: Jakub Novak

12:09 2025-04-10 UTC+2

703

- Today, gold maintains a positive tone, trading above the $3100 level.

Author: Irina Yanina

20:05 2025-04-10 UTC+2

688

S&P 500 posts historic rally, but 5,669 remains key barrier. Temporary tariff suspension fuels gains: S&P 500 and Nasdaq close higherAuthor: Irina Maksimova

12:58 2025-04-10 UTC+2

673

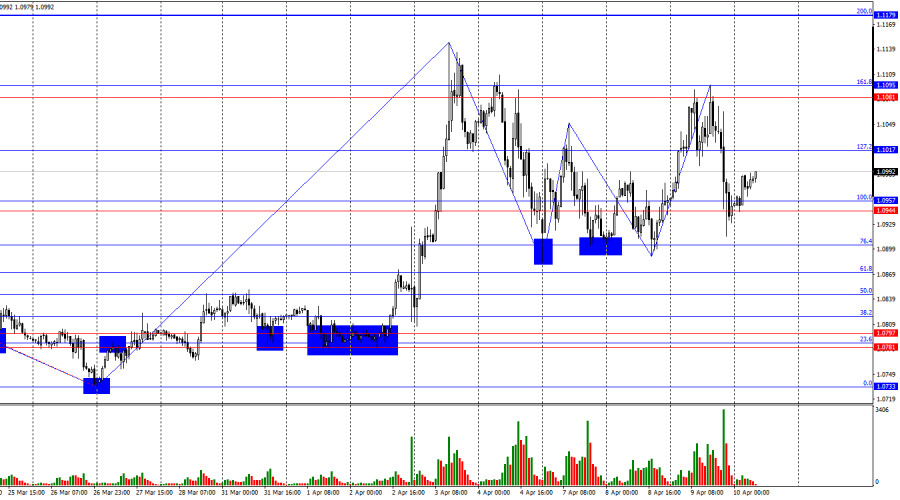

On Thursday, the EUR/USD rate rose by 120 basis points.Author: Chin Zhao

20:24 2025-04-10 UTC+2

658

- Markets remain in shock because of Trump

Author: Samir Klishi

12:19 2025-04-10 UTC+2

838

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 10-12, 2025: sell below $3,145 (21 SMA - 8/8 Murray)

The Eagle indicator is reaching oversold levels and is giving a negative signal, so we will look for opportunities to sell below 3,145 or below 3,131 with a target at 3,036.Author: Dimitrios Zappas

15:37 2025-04-10 UTC+2

763

- USDJPY: Simple Trading Tips for Beginner Traders – April 10th (U.S. Session)

Author: Jakub Novak

20:19 2025-04-10 UTC+2

733

- The flagship cryptocurrency remains in a fragmented state, unable to establish a firm footing.

Author: Larisa Kolesnikova

14:38 2025-04-10 UTC+2

718

- Forecast for GBP/USD on April 10, 2025

Author: Samir Klishi

12:12 2025-04-10 UTC+2

718

- U.S. Inflation Data: What to Know and What to Expect

Author: Jakub Novak

12:09 2025-04-10 UTC+2

703

- Today, gold maintains a positive tone, trading above the $3100 level.

Author: Irina Yanina

20:05 2025-04-10 UTC+2

688

- S&P 500 posts historic rally, but 5,669 remains key barrier. Temporary tariff suspension fuels gains: S&P 500 and Nasdaq close higher

Author: Irina Maksimova

12:58 2025-04-10 UTC+2

673

- On Thursday, the EUR/USD rate rose by 120 basis points.

Author: Chin Zhao

20:24 2025-04-10 UTC+2

658