Lihat juga

28.01.2025 01:20 PM

28.01.2025 01:20 PMThe gas market has taken a significant nosedive following Donald Trump's recent comments regarding potential trade tariffs and economic barriers from the United States. He said that the US government plans to impose import tariffs on semiconductors and pharmaceuticals, and may also announce tariffs on steel and various other goods.

The gas market reacted swiftly to these statements, with prices falling significantly. Investors began to panic, fearing that these potential trade measures could trigger a chain reaction across other sectors of the economy. Experts note that this move could not only weaken the US position in international markets but also pose challenges for companies operating in the energy sector, especially in the context of the existing economic sanctions.

In an attempt to minimize losses, US gas producers have rushed to revise their strategic plans, considering possible cuts in production and exports. An increase in tariffs on steel and semiconductors could also have a negative impact on the construction of new gas extraction and transportation infrastructure, which would slow down the sector's growth in the long term. In this climate of uncertainty triggered by political statements, market participants are closely monitoring the situation, aware that any further steps taken by the administration could significantly affect the industry and the economy as a whole.

In addition, news emerged yesterday that EU countries have reached a compromise on extending anti-Russian sanctions. Hungary is expected to drop its objections to the decision in exchange for energy security guarantees. This compromise among EU member states highlights the dynamic response to the current challenges facing the region. Extending the sanctions has become an important step to ensure unity in foreign policy approaches, despite existing disagreements. Hungary, known for its pragmatic stance, managed to strike a balance between the need for economic cooperation and the commitment to adhere to common European principles.

The energy security guarantees, which are expected to be offered in exchange for supporting the sanctions, could include increased gas supplies from alternative sources and the development of infrastructure to diversify energy supplies. This move not only strengthens EU unity but also underscores the importance of flexibility in diplomatic relations. Certain policy changes could lay the groundwork for future dialogue and compromise, contributing to a more stable situation in the region.

Statements by Polish President Andrzej Duda have also been met with some pessimism. According to him, gas flows from Russia to Western Europe should never be restored, even if Russia and Ukraine reach a peace deal. Moreover, the Nord Stream and Nord Stream 2 gas pipelines "should be dismantled," Duda said in an interview with the BBC. This reflects Poland's principled stance on the future energy security of the country and the region, but it does not address or resolve the issue of dependence on cheap energy and raw materials provided by Russia.

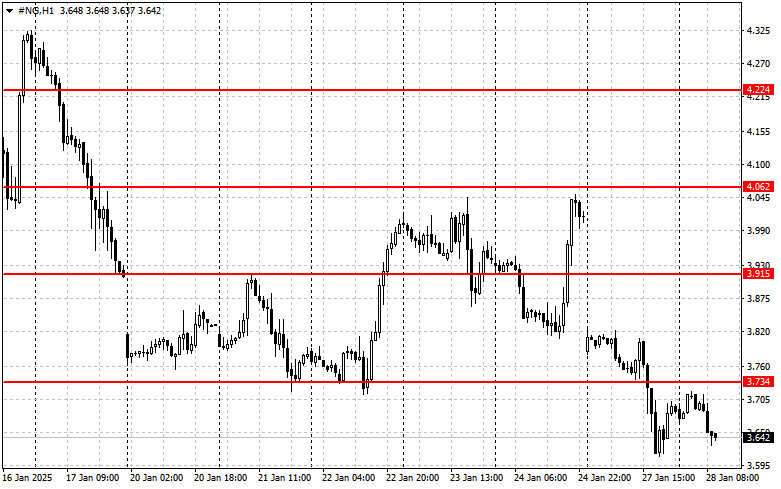

As for the technical outlook for NG, buyers need to focus on regaining control of the 3.915 level. A breakout of this range would open a direct path to 4.062 and 4.224, as well as the April 2023 level around 4.373. The most distant target would be the 4.800 area. In a scenario suggesting a correction, the first support level is at 3.734. A breakout of this support level would quickly drag the asset down to 3.567, with the ultimate target being the 3.422 area.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Lama-kelamaan, kita terbiasa dengan segalanya — yang baik mahupun yang buruk. Para pelabur akhirnya menerima kenyataan bahawa mereka perlu membangunkan perniagaan dalam keadaan ketidaktentuan dasar Rumah Putih yang berpanjangan untuk

Walaupun pasaran sebahagian besarnya telah berhenti memberi reaksi kepada data ekonomi yang masuk terutamanya dari A.S. dan lebih memberi tumpuan kepada langkah geopolitik dan ekonomi Donald Trump, yang mengendalikan semua

Walaupun Presiden Amerika Syarikat, Donald Trump berusaha untuk mendapatkan lebih banyak perjanjian perdagangan, dolar AS terus merosot dengan ketara berbanding beberapa aset lain kerana rundingan dengan China dan Eropah gagal

Analisis Laporan Makroekonomi: Terdapat hanya dua laporan makroekonomi yang dijadualkan untuk hari Selasa. Walaupun laporan pertama kelihatan penting secara sendirinya dan laporan kedua berkaitan secara langsung dengan pasaran buruh

Pasangan mata wang GBP/USD melonjak naik sekali lagi pada hari Isnin. Tepat ketika pound British memulakan pembetulan dan malah mengukuh di bawah garis purata bergerak, Trump sekali lagi mengumumkan kenaikan

Seperti yang telah kami ramalkan, pasangan mata wang EUR/USD menjunam pada hari Isnin. Namun begitu, kejatuhan itu bukan berlaku pada pasangan tersebut, sebaliknya pada dolar AS. Perlu diingat, pada hujung

Donald Trump bersedia untuk memperjuangkan "tarifnya" sehingga ke pengakhiran atau sehingga kemenangan. Penting untuk diingat bahawa pertarungan di mahkamah bukanlah sesuatu yang baru bagi presiden Amerika Syarikat ketika ini. Semasa

Kelab InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.