CHFNOK (Swiss Franc vs Norwegian Krone). Exchange rate and online charts.

Currency converter

24 Mar 2025 19:15

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

CHF/NOK is not such a popular currency pair on Forex. CHF/NOK is the cross rate against the US dollar. Although the US dollar obviously does not present in this currency pair, it still has a significant influence on it. This can be seen, if you combine two charts: USDCHF and USDNOK. Thus, you can get an approximate CHF/NOK chart.

The US dollar has a significant influence on both currencies. That is why it is necessary to take into account the major US economic indicators to forecast correctly the course of this financial instrument. These indicators are as follows: the discount rate, GDP, unemployment rate, Non-Farm Payrolls, etc. It is necessary to note that discussed currencies could respond with different speed on changes in the US economy, therefore the CHF/NOK currency pair may be a specific indicator of these currencies changes.

The economic situation in Switzerland has been high for several centuries. For this reason, the Swiss franc has a reputation for one of the world’s most reliable and stable currencies. The Swiss franc, or Swissie, is also a kind of safe haven currency for capital investment during the crisis. Therefore, in times of crisis, when capital is urgently forwarded to Switzerland, the Swiss franc rises sharply against the other currencies. Trading this currency pair, you have to take into account this feature of the Swiss economy.

Norway is one of a highly developed, stable democracies with a modern economy. The country occupies the first positions on such economic indicators as quality of life and personal income level. Norway is the third largest producer and exporter of oil and gas. The main source of income of this Scandinavian country is the export of energy resources. In addition, Norway is the leading country in electrometallurgy, electrical engineering, mechanical engineering, etc. In addition, the Norwegian industry is a leading manufacturer of offshore drilling platforms for oil and gas. Also, Norway is a leader in mining and processing of a great variety of seafood, which are in high demand worldwide, especially in the European countries.

If you trade with CHF/NOK, you should focus on economic indicators of Norway, as well as the oil world price and other minerals needed to support the Norway economy.

This trading instrument is relatively illiquid if we compare it with major currency pairs, such as: EUR/USD, USD/CHF, GBP/USD, and USD/JPY. Therefore, when you make a forecast for the financial instrument, you should focus on those currency pairs that include the US dollar together with each of the considered currencies.

If you trade cross rates, it is necessary to remember that brokers usually set a higher spread than for more popular currency pairs, so before you start working with the cross rates, you should carefully read the conditions offered by the broker to trade with specified trade instrument.

See Also

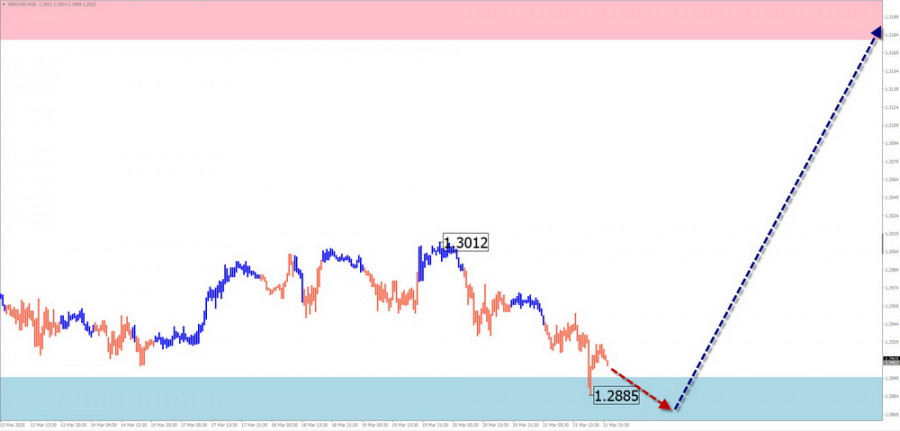

- Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:24 2025-03-24 UTC+2

1063

Technical analysis / Video analyticsForex forecast 24/03/2025: EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin.Author: Sebastian Seliga

15:34 2025-03-24 UTC+2

763

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

763

- The outcomes of the Bank of England and FOMC meetings contradicted each other.

Author: Samir Klishi

12:25 2025-03-24 UTC+2

733

Wave analysisWeekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

718

The bulls attacked for two weeks, but now it's time for a pause.Author: Samir Klishi

13:55 2025-03-24 UTC+2

688

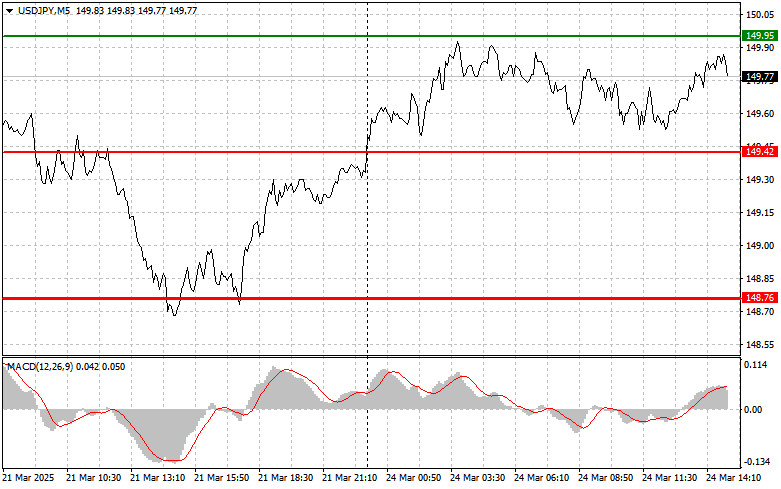

- USDJPY: Simple Trading Tips for Beginner Traders on March 24th (U.S. Session)

Author: Jakub Novak

17:13 2025-03-24 UTC+2

643

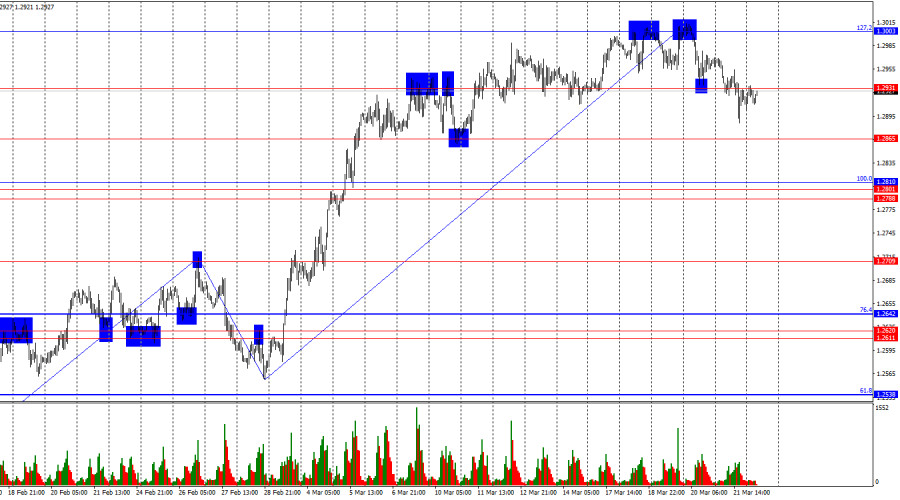

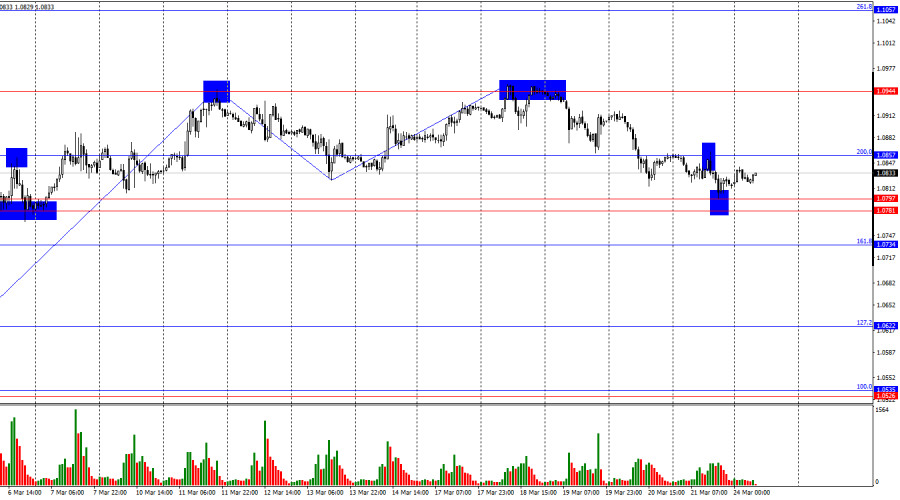

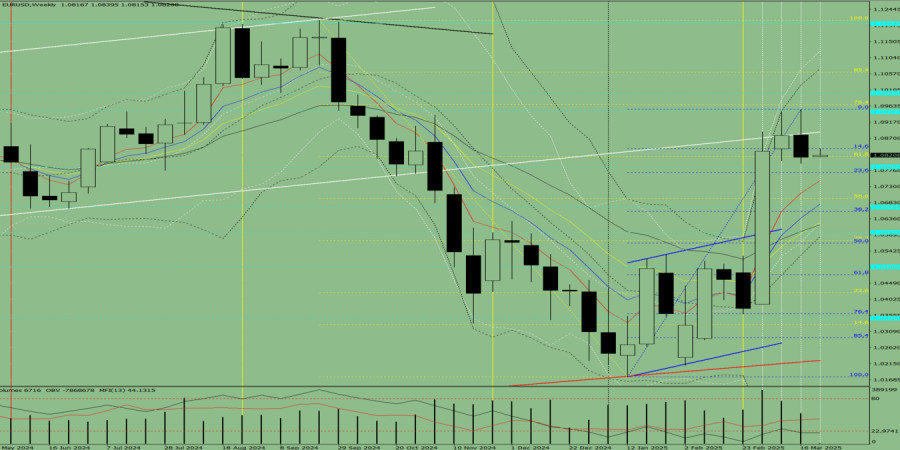

Last week, the pair moved downward and tested the historical resistance level of 1.0948 (light blue dashed line), after which the price declined and closed the weekly candle at 1.0815. In the upcoming week, the price may continue moving upward.Author: Stefan Doll

14:22 2025-03-24 UTC+2

643

Technical analysisTrading Signals for GOLD (XAU/USD) for March 24-27, 2025: sell below $3,032 (21 SMA - overbought)

The eagle indicator is reaching overbought levels, so we believe a technical correction could occur in the coming days, before resuming its bullish cycle.Author: Dimitrios Zappas

17:44 2025-03-24 UTC+2

613

- Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:24 2025-03-24 UTC+2

1063

- Technical analysis / Video analytics

Forex forecast 24/03/2025: EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin.Author: Sebastian Seliga

15:34 2025-03-24 UTC+2

763

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

763

- The outcomes of the Bank of England and FOMC meetings contradicted each other.

Author: Samir Klishi

12:25 2025-03-24 UTC+2

733

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

718

- The bulls attacked for two weeks, but now it's time for a pause.

Author: Samir Klishi

13:55 2025-03-24 UTC+2

688

- USDJPY: Simple Trading Tips for Beginner Traders on March 24th (U.S. Session)

Author: Jakub Novak

17:13 2025-03-24 UTC+2

643

- Last week, the pair moved downward and tested the historical resistance level of 1.0948 (light blue dashed line), after which the price declined and closed the weekly candle at 1.0815. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:22 2025-03-24 UTC+2

643

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 24-27, 2025: sell below $3,032 (21 SMA - overbought)

The eagle indicator is reaching overbought levels, so we believe a technical correction could occur in the coming days, before resuming its bullish cycle.Author: Dimitrios Zappas

17:44 2025-03-24 UTC+2

613