یہ بھی دیکھیں

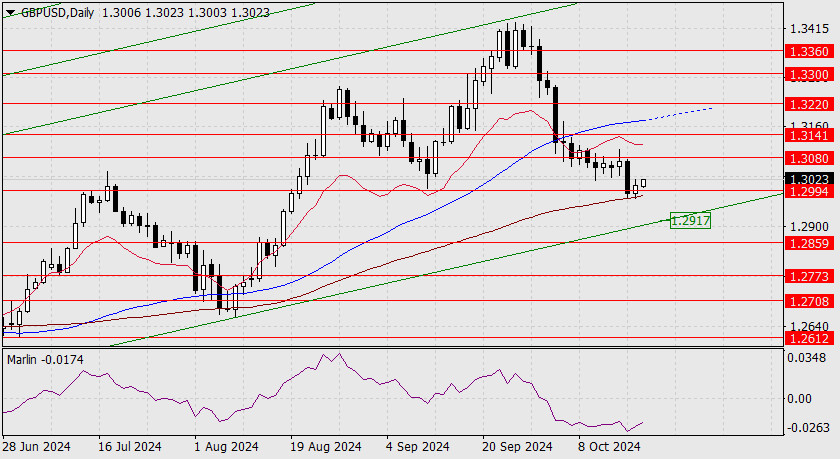

With the absence of strong news on Thursday (the ECB rate cut turned out to be a weak news event), the British pound climbed back above the target level of 1.2994, achieving a daily gain of 20 pips. Notably, the price rebound occurred precisely from the simple moving average with a period of 89 (brown line). This factor may slightly extend the corrective growth.

The Marlin oscillator has also turned upward and quite briskly. This reversal indicates its intention to relieve some tension before further decline. Indeed, for the price to move toward the lower boundary of the price channel (1.2917), it needs to gather some strength. If the price breaks above the resistance at 1.3080, the correction could become deeper and more complex, potentially reaching the MACD line (1.3220). This would suggest that the pound is trying to avoid falling before the BoE rate cut on November 7.

On the four-hour chart, the price is gathering momentum above the linear support, with a probable intention to move above the balance and MACD lines (1.3045). After that, a tough battle with the resistance at 1.3080 will follow, but by then, the Marlin oscillator will likely be firmly in bullish territory.

You have already liked this post today

*تعینات کیا مراد ہے مارکیٹ کے تجزیات یہاں ارسال کیے جاتے ہیں جس کا مقصد آپ کی بیداری بڑھانا ہے، لیکن تجارت کرنے کے لئے ہدایات دینا نہیں.