Veja também

25.03.2025 09:15 AM

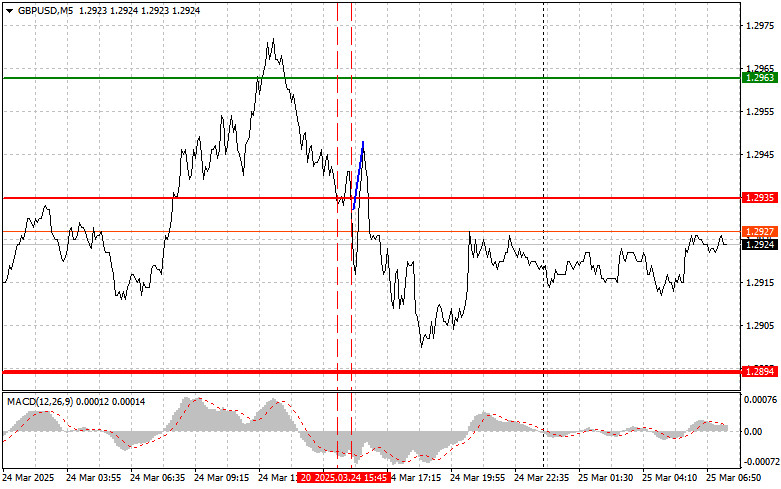

25.03.2025 09:15 AMThe test of the 1.2935 level occurred when the MACD indicator had already moved significantly below the zero mark, which limited the pair's downside potential. For this reason, I did not sell the pound. Shortly afterward, a second test of this level occurred while the MACD was in the oversold zone, which allowed Scenario #2 for buying to be realized. However, as you can see on the chart, after a 10-pip rise, selling pressure on the pair returned.

Yesterday's mixed UK and US PMI data maintained high volatility in the market and preserved the chances for the pound to continue rising against the US dollar. Today, the only notable data release is the retail sales report from the Confederation of British Industry, and positive numbers could trigger renewed buying, supporting the ongoing uptrend in the pair. Every report is scrutinized in the current environment of heightened uncertainty driven by geopolitical tensions and inflationary pressures. Even slight deviations from expectations can lead to volatility in the currency market. Despite the pound's recent resilience, any negative shock could quickly change the outlook.

For intraday strategy, I will focus primarily on implementing Scenarios #1 and #2.

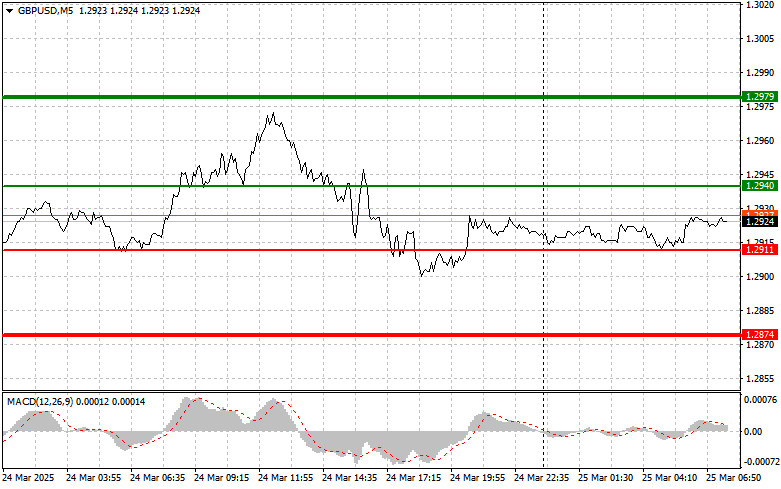

Scenario #1: I plan to buy the pound today upon reaching the entry point near 1.2940 (green line on the chart), targeting a rise to 1.2975 (thicker green line on the chart). Around the 1.2975 level, I plan to exit long positions and open shorts in the opposite direction, expecting a 30–35 pip move. A bullish outlook for the pound is only justified following strong economic data. Important: Before buying, ensure the MACD indicator is above the zero line and beginning to rise.

Scenario #2: I also plan to buy the pound today if there are two consecutive tests of the 1.2911 level while the MACD is in the oversold zone. This will limit the pair's downside potential and may lead to a market reversal to the upside. A move toward the opposite levels of 1.2940 and 1.2979 can be expected.

Scenario #1: I plan to sell the pound today after a break below the 1.2911 level (red line on the chart), which could lead to a rapid drop in the pair. The primary target for sellers will be 1.2874, where I plan to exit short positions and immediately open long positions in the opposite direction, expecting a 20–25 pip retracement. It's best to sell the pound at higher levels. Important: Before selling, ensure the MACD indicator is below the zero line and just beginning to decline.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of the 1.2940 level while the MACD is in the overbought zone. This will limit the pair's upside potential and could lead to a reversal to the downside. A move toward the opposite levels of 1.2911 and 1.2874 can be expected.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

Análise das transações e recomendações para o iene japonês O teste de preço em 143,49 ocorreu exatamente quando o indicador MACD começou a se mover para baixo a partir

Análise das transações e recomendações para a libra esterlina O teste de preço em 1,3292 ocorreu quando o indicador MACD começava a se mover para cima a partir da linha

Análise das operações e dicas para negociar a libra esterlina O teste do nível 1,3286 ocorreu quando o indicador MACD já havia se movido significativamente acima da linha zero

Análise das operações e dica para negociar o iene japonês O primeiro teste do nível 142,66 ocorreu quando o indicador MACD já havia recuado significativamente abaixo da linha zero

O euro e a libra esterlina continuaram em queda frente ao dólar dos EUA, pressionados por notícias positivas e desenvolvimentos fundamentais favoráveis à moeda norte-americana. Os fortes dados

Não houve testes dos níveis que marquei na primeira metade do dia. Na segunda metade do dia, investidores e traders estarão atentos aos principais indicadores macroeconômicos dos Estados Unidos

InstaFutures

Make money with a new promising instrument!

InstaFutures

Make money with a new promising instrument!

Clube InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.