NZDSEK (New Zealand Dollar vs Swedish Krona). Exchange rate and online charts.

Currency converter

24 Mar 2025 20:46

(0.02%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

NZD/SEK (New Zealand Dollar vs Sweden Kronor)

The NZD/SEK is not very popular currency pair on the Forex market. The NZD/SEK does not involve the U.S. dollar and that is why called a cross currency pair. Despite this, the U.S. dollar still has a significant influence on it. This can be seen if you combine two charts: NZD/USD and USD/SEK. Thus, you will get an approximate NZD/SEK chart.

Since the U.S. dollar heavily influences both currencies, it is necessary to take into account the major U.S. economic indicators for the correct projection of this financial instrument’s price movement. Pay attention to the discount rate, GDP data, unemployment rate, new jobs figures, etc. It is worth noting that the currencies comprising the pair can respond differently to changes in the U.S. economy, therefore, the NZD/SEK can be considered as a specific indicator of these currencies.

When you trade the NZD/SEK currency pair, you should allow for many features of the New Zealand economy, including the GDP, discount rate, business activity, its foreign trade policy, etc. New Zealand is one of the world’s largest producers of wool and other wool-related products. It is worth noting that New Zealand's economy is highly dependent on its main partners - the U.S., Australia, and other Asian-Pacific nations. For this reason, you should also take into account a variety of economic indicators of major trade partners of New Zealand.

Swedish economy is one of the most leading in the world. In terms of industrial output it is far ahead of its nearest neighbors, including Denmark, Norway and Finland. The country has managed to achieve such high economic performance due to the fact that it is rich in mineral resources and has great experts in all sectors of economy. Sweden has large reserves of iron ore and nonferrous metals. In addition, it is rich in timber and has large hydropower resources.

Currently, Sweden is the biggest manufacturer of engineering products; it is also the largest supplier of iron ore, steel and paper. This trading instrument is relatively illiquid compared with major currency pairs such as: the EUR/USD, USD/CHF, GBP/USD, and USD/JPY. Therefore, when you forecast its further movement, you should primarily focus on the pairs quoted against the U.S. dollar.

If you want to trade cross currency pairs, it is necessary to bear in mind that brokers’ spread is often higher for cross rates than for majors. Thus, you’d better read and understand the trading terms offered by the broker before you start your cross rate trading.

See Also

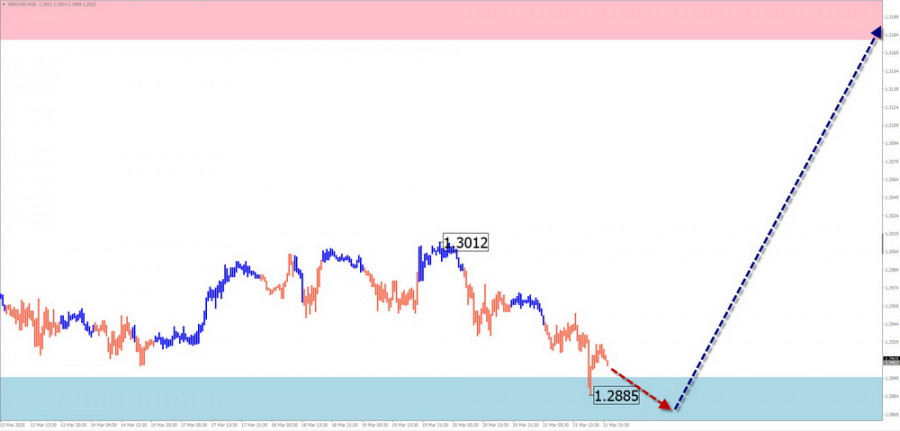

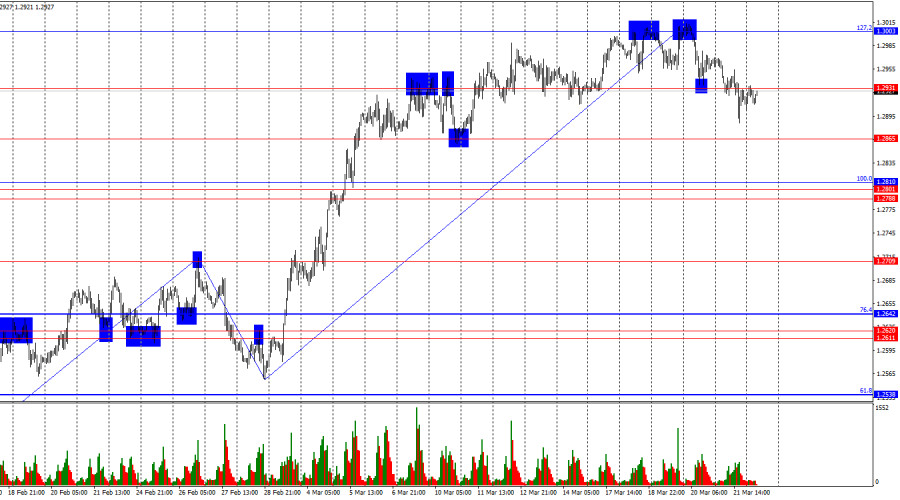

- Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:24 2025-03-24 UTC+2

1093

Technical analysis / Video analyticsForex forecast 24/03/2025: EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin.Author: Sebastian Seliga

15:34 2025-03-24 UTC+2

838

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

808

- The outcomes of the Bank of England and FOMC meetings contradicted each other.

Author: Samir Klishi

12:25 2025-03-24 UTC+2

778

Wave analysisWeekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

733

The bulls attacked for two weeks, but now it's time for a pause.Author: Samir Klishi

13:55 2025-03-24 UTC+2

718

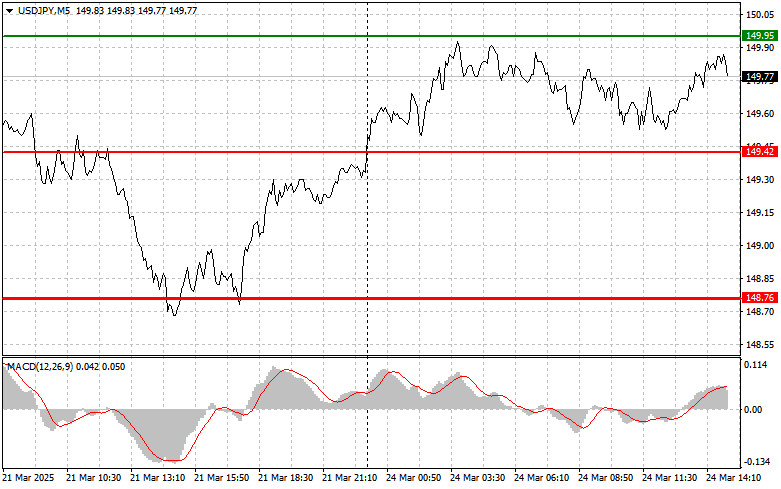

- USDJPY: Simple Trading Tips for Beginner Traders on March 24th (U.S. Session)

Author: Jakub Novak

17:13 2025-03-24 UTC+2

703

Technical analysisTrading Signals for GOLD (XAU/USD) for March 24-27, 2025: sell below $3,032 (21 SMA - overbought)

The eagle indicator is reaching overbought levels, so we believe a technical correction could occur in the coming days, before resuming its bullish cycle.Author: Dimitrios Zappas

17:44 2025-03-24 UTC+2

673

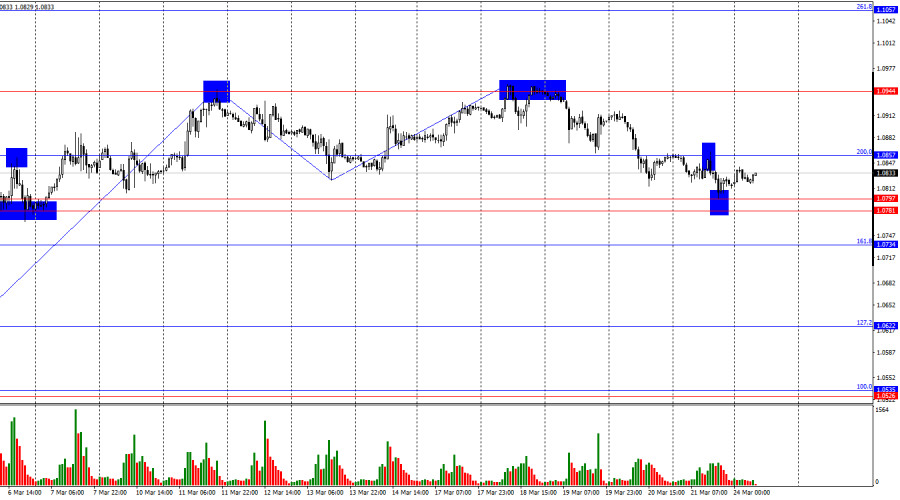

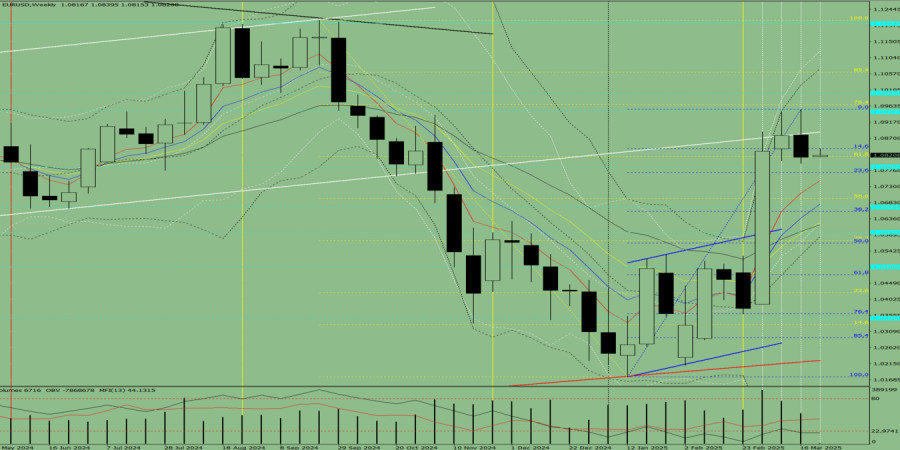

Last week, the pair moved downward and tested the historical resistance level of 1.0948 (light blue dashed line), after which the price declined and closed the weekly candle at 1.0815. In the upcoming week, the price may continue moving upward.Author: Stefan Doll

14:22 2025-03-24 UTC+2

658

- Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:24 2025-03-24 UTC+2

1093

- Technical analysis / Video analytics

Forex forecast 24/03/2025: EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin.Author: Sebastian Seliga

15:34 2025-03-24 UTC+2

838

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

808

- The outcomes of the Bank of England and FOMC meetings contradicted each other.

Author: Samir Klishi

12:25 2025-03-24 UTC+2

778

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

733

- The bulls attacked for two weeks, but now it's time for a pause.

Author: Samir Klishi

13:55 2025-03-24 UTC+2

718

- USDJPY: Simple Trading Tips for Beginner Traders on March 24th (U.S. Session)

Author: Jakub Novak

17:13 2025-03-24 UTC+2

703

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 24-27, 2025: sell below $3,032 (21 SMA - overbought)

The eagle indicator is reaching overbought levels, so we believe a technical correction could occur in the coming days, before resuming its bullish cycle.Author: Dimitrios Zappas

17:44 2025-03-24 UTC+2

673

- Last week, the pair moved downward and tested the historical resistance level of 1.0948 (light blue dashed line), after which the price declined and closed the weekly candle at 1.0815. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:22 2025-03-24 UTC+2

658