Vea también

20.06.2023 01:00 AM

20.06.2023 01:00 AMReview & Forecast :

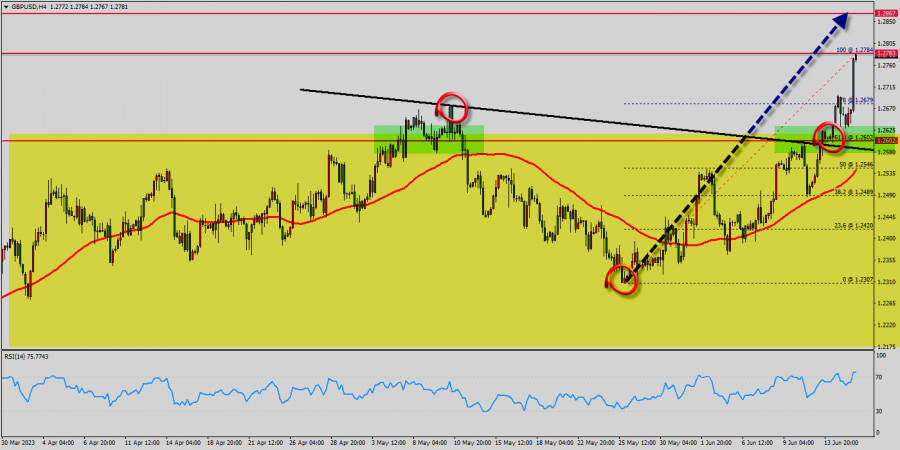

The GBP/USD pair will continue rising from the level of 1.2377 today. So, the support is found at the level of 1.2377, which represents the 23.6% Fibonacci retracement level in the H1 time frame. Since the trend is above the 23.6% Fibonacci level, the market is still in an uptrend. Therefore, the GBP/USD pair is continuing with a bullish trend from the new support of 1.2377. The current price is set at the level of 1.2423 that acts as a daily pivot point seen at 1.2434. Equally important, the price is in a bullish channel. According to the previous events, we expect the GBP/USD pair to move between 1.2495 and 1.2377.

This would suggest a bullish market because the RSI indicator is still in a positive area and does not show any trend-reversal signs. Therefore, strong support will be formed at the level of 1.2377 providing a clear signal to buy with the target seen at 1.2460. If the trend breaks the resistance at 1.2460 (first resistance), the pair will move upwards continuing the development of the bullish trend to the level 1.2495 in order to test the daily resistance 2. In the same time frame, resistance is seen at the levels of 1.2495 and 1.2500. The stop loss should always be taken into account for that it will be reasonable to set your stop loss at the level of 1.2326 (below the support 2).

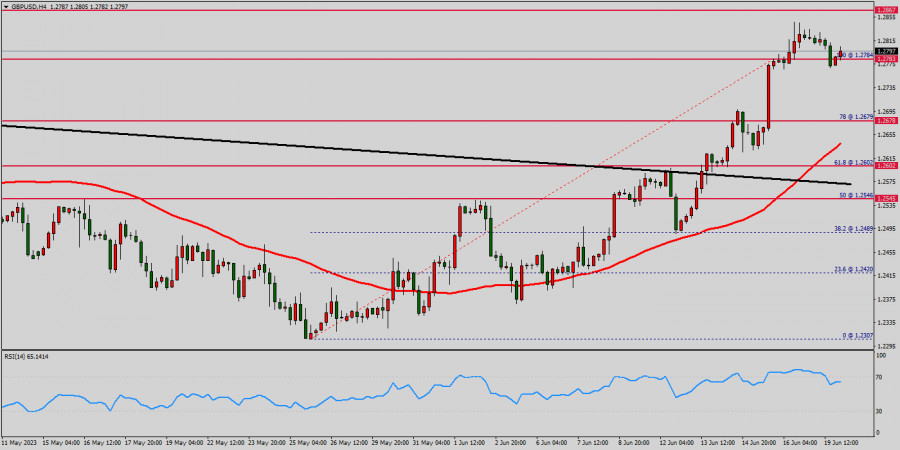

The GBP/USD pair retreats to 1.2580, looks to post some weekly gains. The GBP/USD pair gained its traction and rose to the 1.2580 area in the American session on Friday. In the absence of high-tier data releases, week-end flows seem to be impacting the pair's action heading into the weekend. The GBP/USD pair faced resistance at the level of 1.2545, while minor resistance is seen at 1.2545. Support levels found at the levels of 1.2493 and 1.2454.

The GBP/USD pair continued to move upwards from the levels of 1.2493 and 1.2454. The pair rose from the levels of 1.2493 or 1.2454 to the top around 1.2523. In consequence, the GBP/USD pair broke resistance, which turned strong support at the level of 1.2545. Moreover, the RSI starts signaling an upward trend, and the trend is still showing strength above the moving average (100). Hence, the market is indicating a bullish opportunity above the area of 1.2493 - 1.2454.

So, the market is likely to show signs of a bullish trend around 1.2493 and 1.2454. Today, the level of 1.2493 is expected to act as major support. Hence, we expect the GBP/USD pair to continue moving in the bullish trend from the support level of 1.2493 towards the target level of 1.2545. If the pair succeeds in passing through the level of 1.2545, the market will indicate the bullish opportunity above the level of 1.2545 in order to reach the second target at 1.0002 to test the double top in the H1 time frame. However, the price spot of 1.2593 remains a significant resistance zone. Thus, the trend will probably be rebounded again from the double top as long as the level of 1.2454 is not breached.

Overview : The GBP/USD pair managed to exceed 1.2602 level and close the last four hours' candlestick above it, reinforcing the expectations of continuing the bullish trend for the rest of the day, reminding you that our waited target is located at 1.2800, supported by RIS and the EMA50 positivity - last bearish wave 1.2602 (major support).

In case the GBP/USD pair manages to sette above the support 1.2602 level, it will have a good chance to climb above 1.2602, although it should be noted that the current move has already pushed the GBP/USD pair into the overbought territory. Holding above 1.2602 is important to continue the expected rise, as breaking it will push the price to decline and visit 1.2602 areas before any new positive attempt.

The expected trading range for today is between 1.2602 support and 1.2867 resistance. The expected trend for today: Bullish. The GBPUSD pair rallied upwards strongly to succeed achieving our second waited target at 1.2800, noticing that the price is affected by RIS positivity to show positive trades now, and it might test 1.2827 and might extend to 1.2703 before turning back to rise again. We expect the continuation of the main bullish trend domination in the upcoming period, supported by the EMA100 that carries the price from below, reminding you that our next target reaches 1.2910, while achieving it requires holding above 1.2602.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Puntos de entrada para el par EURUSD: Una ruptura del nivel de 1,0866 puede llevar al crecimiento del euro a la zona de 1,0893 y 1,0918 Una ruptura del nivel

Puntos de entrada en el par EURUSD: La superación de 1,0805 puede llevar al euro a crecer hasta la zona de 1,0832 y 1,0857. Una ruptura de 1,0778 puede llevar

Notificaciones

por correo electrónico y mensaje de texto

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.