Vea también

19.02.2025 10:44 AM

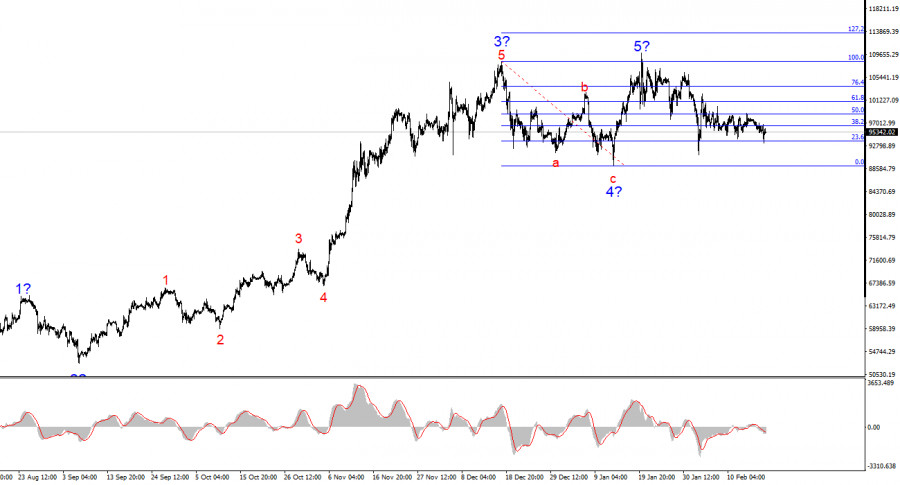

19.02.2025 10:44 AMThe 4-hour wave structure of BTC/USD appears clear and well-defined. Following a prolonged and complex corrective a-b-c-d-e wave, which formed between March 14 and August 5, Bitcoin initiated a new impulsive wave, which has already developed into a five-wave formation. Given the size of the first wave, the fifth wave is likely to be shortened, leading to the expectation that Bitcoin may not exceed $110,000–$115,000 in the coming months.

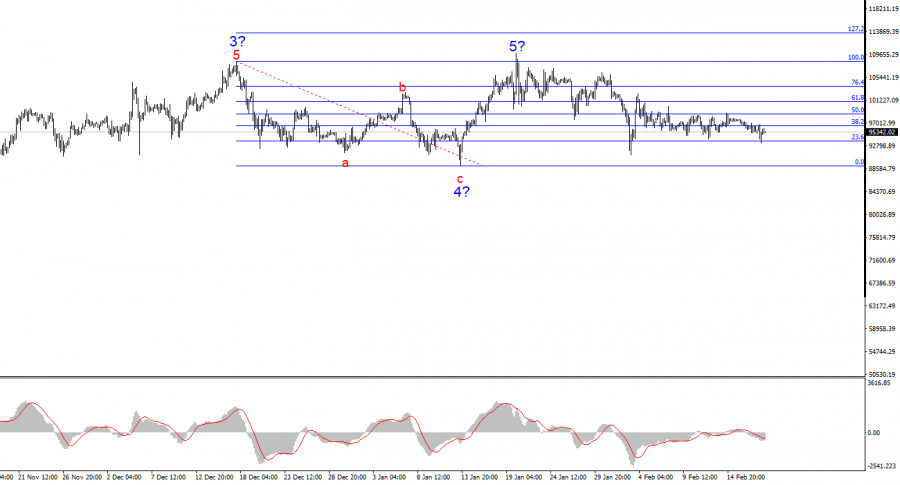

The three-wave formation of Wave 4 further validates the accuracy of the current wave structure. Bitcoin's previous growth was supported by institutional investments, government backing, and pension funds. However, Donald Trump's policies could drive investors away, as an uptrend cannot continue indefinitely. The current shape of Wave 2 within Wave 5 raises doubts about its validity, leading to the possibility that the bullish phase is already over.

Bitcoin has remained range-bound this week, with minor price fluctuations that fail to meet traders' expectations. The BTC/USD pair continues to slowly decline toward the Wave 4 low, reinforcing the idea that the bullish phase is complete.

Trump's presidency has not triggered a Bitcoin surge or led to the creation of a BTC reserve in the U.S. Consequently, there are no strong catalysts to drive demand for Bitcoin at the moment, especially after its significant price rally last year. The lack of strong news flow has further reduced market activity, and Trump's policies have predominantly contributed to Bitcoin's price decline.

Based on the BTC/USD analysis, Bitcoin's uptrend is either approaching its end or has already concluded. This may not be a popular view, but Wave 5 appears shortened. If this assumption is correct, Bitcoin may face either a sharp decline or an extended correction. Currently, a complex correction seems more likely.

At this stage, buying Bitcoin is not advisable. If BTC falls below the Wave 4 low, it would confirm the transition into a bearish trend phase.

On higher timeframes, the five-wave upward structure is visible, suggesting that a corrective or bearish trend phase may begin soon.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

El Ethereum apenas logró recuperarse hasta el FVG más cercano y durante dos semanas no pudo seguir subiendo. Sin embargo, el Bitcoin finalmente arrastró hacia arriba a su "hermano menor"

El Bitcoin continuó su movimiento ascendente el martes, lo que generó muchas preguntas. Sin embargo, recordemos que el análisis técnico no puede proporcionar señales con una precisión del 100% todo

El Bitcoin se activó durante el pasado fin de semana, sin que hubiera razones ni fundamentos concretos para ello. Simplemente el mercado volvió a lanzarse a comprar la primera criptomoneda

El Bitcoin y el Ethereum permanecen dentro de sus canales laterales y la incapacidad para salir de estos rangos podría poner en peligro las perspectivas de una recuperación más amplia

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.